The Dow Jones Industrial Average (DJIA) has reached new heights, marking another all-time high in its storied history. This milestone is not just a numerical achievement but a reflection of the broader economic landscape and investor sentiment. In this article, we delve into the implications and impact of this record-breaking figure.

Historical Context

To appreciate the significance of this all-time Dow high, it's crucial to understand the historical context. The DJIA, which was first published in 1896, has been a benchmark for the U.S. stock market for over a century. Over the years, it has weathered numerous economic crises, wars, and recessions, yet it has consistently grown, reflecting the resilience and adaptability of the American economy.

What Drives the Dow

Several factors have contributed to the all-time high of the DJIA. One of the primary drivers is the strong performance of its constituent companies. Many of these companies, such as Apple, Microsoft, and Johnson & Johnson, have seen substantial growth in their revenues and earnings, driving up their stock prices.

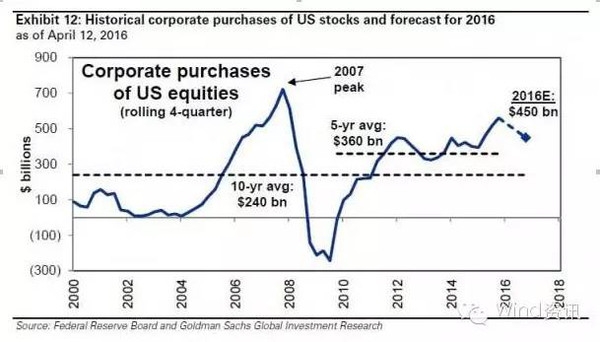

Moreover, the Federal Reserve's monetary policy has played a crucial role. The central bank's decision to keep interest rates low and implement quantitative easing measures has injected liquidity into the market, fueling investor confidence and driving stock prices higher.

Investor Sentiment

The current all-time high of the DJIA is also a testament to the positive sentiment among investors. The market's resilience in the face of global challenges, such as the COVID-19 pandemic, has bolstered investor confidence. This sentiment is further reinforced by the expectation of continued economic growth and the rollout of vaccines.

Implications for the Economy

The all-time high of the DJIA has several implications for the broader economy. Firstly, it suggests a strong and stable economic environment, which can encourage consumer spending and business investment. Secondly, it reflects the potential for higher corporate earnings, which can lead to increased job creation and economic growth.

Case Studies

Several companies within the DJIA have played a pivotal role in driving the index to new heights. For instance, Apple has seen a remarkable growth trajectory over the past few years, with its products becoming increasingly popular worldwide. Similarly, Microsoft has diversified its revenue streams, expanding into cloud computing and artificial intelligence, contributing to its robust performance.

Conclusion

The all-time high of the DJIA is a significant milestone, reflecting the resilience and adaptability of the American economy. While it is a testament to the strong performance of constituent companies and favorable investor sentiment, it also has broader implications for the economy. As the market continues to evolve, it will be interesting to see how these factors continue to shape the future of the DJIA and the broader economy.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....