Are you a foreign investor curious about the possibility of purchasing US stocks? If so, you've come to the right place. In this article, we'll delve into the ins and outs of buying US stocks as a foreigner, providing you with a comprehensive guide to help you navigate this exciting investment opportunity.

Understanding the Basics

What are US Stocks?

US stocks represent ownership in a company that is publicly traded on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. By purchasing stocks, you become a shareholder and have the potential to earn dividends and profit from the company's growth.

Why Invest in US Stocks?

There are several reasons why foreign investors might be interested in purchasing US stocks:

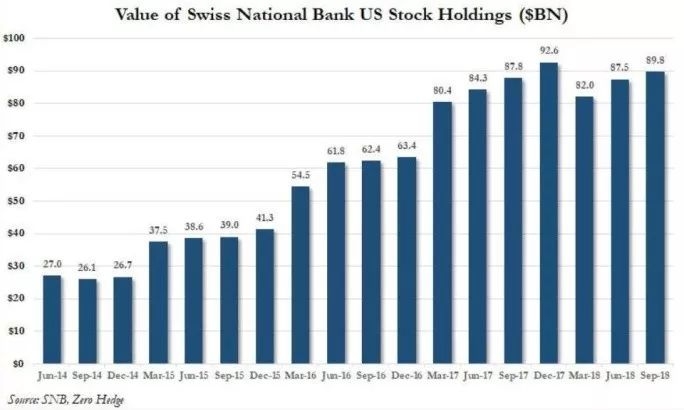

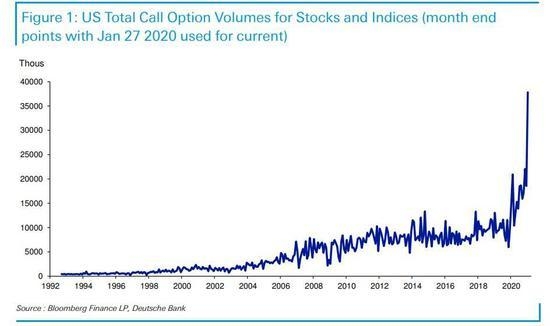

- Strong Market Performance: The US stock market has historically offered strong returns, making it an attractive investment destination.

- Diverse Range of Companies: The US stock market features a wide variety of companies across various industries, allowing investors to diversify their portfolios.

- Innovative Companies: The US is home to many innovative and successful companies, offering foreign investors the chance to invest in cutting-edge industries.

Eligibility and Restrictions

Can Foreigners Buy US Stocks?

Yes, foreign investors can buy US stocks. However, there are certain restrictions and requirements that must be met:

- Regulatory Compliance: Foreign investors must comply with the regulations of both their home country and the United States. This may include filling out additional paperwork and providing proof of identity.

- Account Requirements: To buy US stocks, you'll need a brokerage account. Many brokerage firms offer accounts specifically designed for foreign investors.

- Currency Exchange: You'll need to exchange your local currency for US dollars to purchase stocks. Be aware of exchange rates and fees associated with currency conversion.

How to Buy US Stocks as a Foreigner

1. Choose a Brokerage Firm

Select a reputable brokerage firm that caters to foreign investors. Some popular options include Charles Schwab, TD Ameritrade, and E*TRADE.

2. Open a Brokerage Account

Complete the account opening process, which typically involves providing personal information, proof of identity, and financial information.

3. Fund Your Account

Deposit funds into your brokerage account using your preferred method, such as a bank transfer or wire transfer.

4. Research and Select Stocks

Research companies that interest you and determine how much you want to invest in each stock. Consider factors such as the company's financial health, industry outlook, and market trends.

5. Place Your Order

Use your brokerage platform to place your stock orders. You can choose to buy shares of a company's stock, sell shares you already own, or sell short a stock (which involves borrowing shares and selling them with the expectation of buying them back at a lower price).

Conclusion

Buying US stocks as a foreigner is a viable and potentially lucrative investment opportunity. By understanding the basics, meeting the necessary requirements, and carefully selecting stocks, you can build a diversified and profitable portfolio. Remember to do your research, stay informed, and consult with a financial advisor if needed. Happy investing!

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....