In recent years, the US stock market has experienced unprecedented growth, raising concerns about a potential valuation bubble. This article delves into the analysis of the current stock market valuation bubble, exploring the factors contributing to its formation and the potential risks it poses to investors.

Market Dynamics and Valuation Metrics

The stock market valuation is a measure of the overall price level of the stocks in a particular market. Several key metrics are used to assess whether a stock market is overvalued or undervalued. The price-to-earnings (P/E) ratio is a common metric, comparing the current stock prices to the company's earnings. Another metric is the Shiller P/E ratio, which adjusts the P/E ratio for the average inflation-adjusted earnings over the past 10 years. Additionally, the Cyclically Adjusted Price-to-Earnings (CAPE) ratio considers the cyclicality of earnings, providing a more accurate picture of stock market valuation.

Bubble Formation and Factors

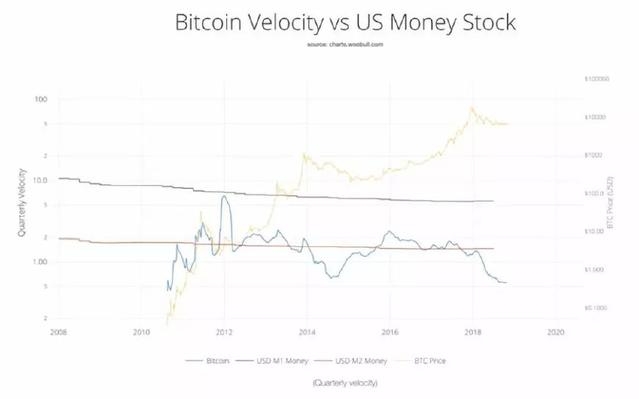

Several factors have contributed to the formation of the current stock market valuation bubble. Low interest rates have encouraged investors to seek higher returns in the stock market, driving up stock prices. The COVID-19 pandemic has also played a role, as investors sought refuge in the stock market amidst economic uncertainty. Economic stimulus from governments around the world has also supported stock prices.

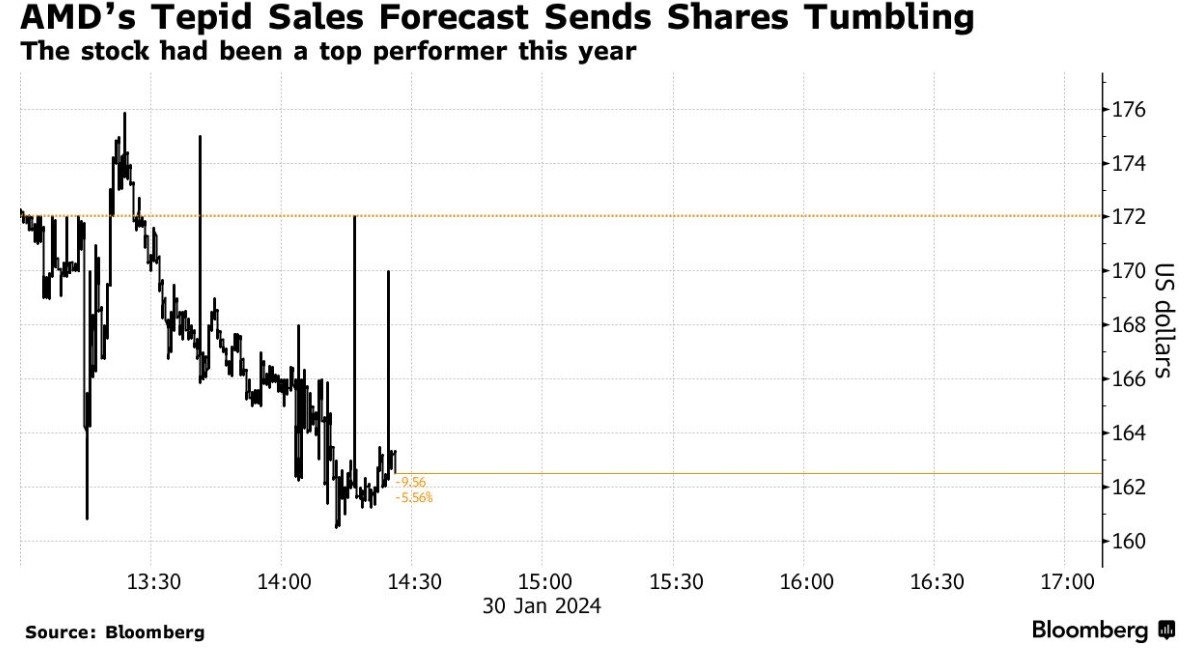

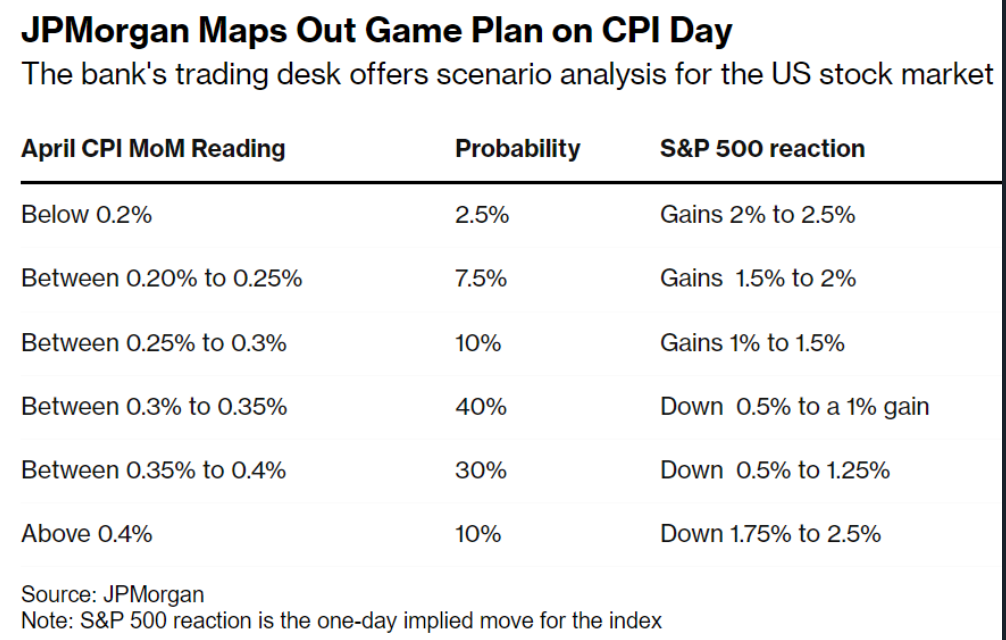

Risks and Potential Impacts

The formation of a stock market valuation bubble poses several risks. If the bubble bursts, it could lead to a market correction, with significant declines in stock prices. This could have a negative impact on investor wealth, and could also lead to reduced consumer spending and economic downturn.

Case Studies

A notable example of a stock market bubble is the dot-com bubble of the late 1990s. This bubble was characterized by an irrational exuberance in technology stocks, which eventually led to a significant market correction. Another example is the real estate bubble of the early 2000s, which contributed to the 2008 financial crisis.

Conclusion

In conclusion, the current US stock market valuation bubble presents several risks and challenges. It is crucial for investors to be aware of these risks and to take appropriate measures to protect their investments. As always, it is important to consult with a financial advisor before making any investment decisions.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....