In the ever-evolving world of finance, the question of whether stock investing in the US is reliable is a topic of great interest for both seasoned investors and newcomers alike. With the US stock market being one of the largest and most dynamic in the world, it’s crucial to understand the factors that contribute to its reliability and the potential risks involved. In this article, we will delve into the key aspects of stock investing in the US, highlighting its reliability and providing insights to help you make informed decisions.

Understanding the US Stock Market

The US stock market, also known as the stock exchange, is a platform where investors can buy and sell shares of publicly-traded companies. The two primary stock exchanges in the US are the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a wide range of investment opportunities, from blue-chip companies with a long history of profitability to emerging growth stocks with high potential.

Factors Contributing to Reliability

Several factors contribute to the reliability of stock investing in the US:

- Regulatory Framework: The US has one of the most stringent regulatory frameworks in the world, ensuring transparency and fairness in the stock market. The Securities and Exchange Commission (SEC) plays a crucial role in regulating the market and protecting investors.

- Diverse Market Cap: The US stock market is home to companies across various industries and market caps, providing investors with a wide range of investment options and reducing the risk of being exposed to a single sector or industry.

- Economic Stability: The US economy has historically shown resilience, with periods of growth and stability. This economic stability contributes to the reliability of stock investing in the US.

- Access to Information: The US stock market is known for its transparency and access to information. Investors can easily access financial reports, company news, and market trends, enabling them to make informed decisions.

Potential Risks

While investing in the US stock market can be reliable, it’s important to be aware of the potential risks involved:

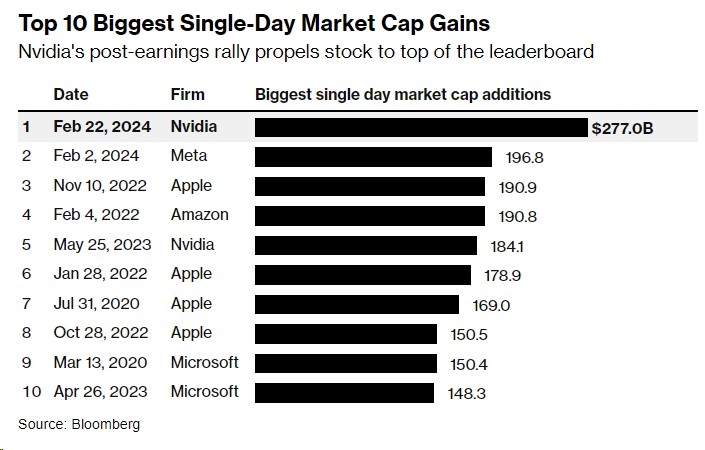

- Market Volatility: The stock market can be volatile, with prices fluctuating significantly over short periods. This volatility can lead to significant gains or losses for investors.

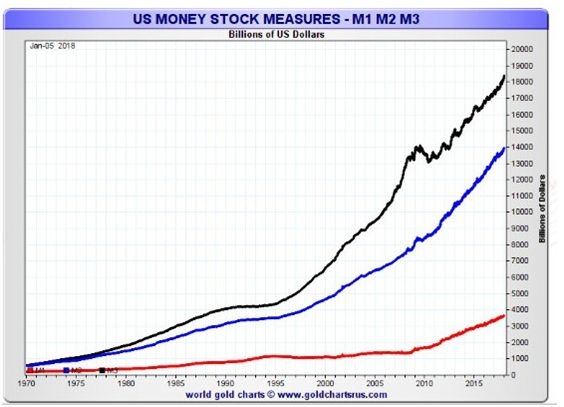

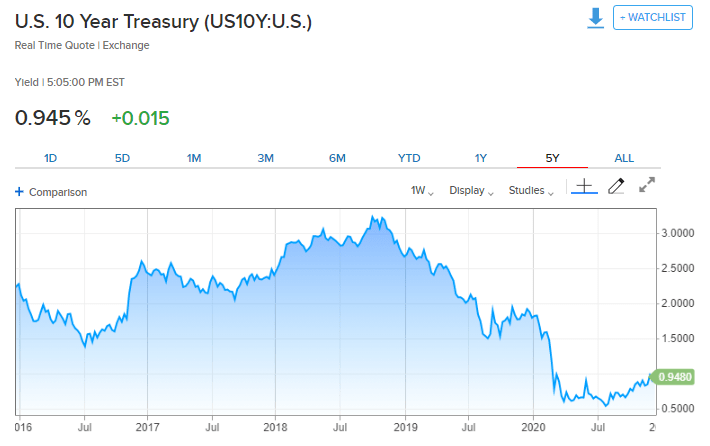

- Economic Factors: Economic factors such as inflation, interest rates, and political events can impact the stock market and individual stocks.

- Company-Specific Risks: Investing in individual stocks carries the risk of company-specific factors, such as poor management, product failures, or legal issues.

Case Studies: Successful Stock Investments

Several case studies demonstrate the potential for successful stock investments in the US:

- Apple Inc.: Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world’s most valuable companies. Investors who bought Apple shares at its IPO and held onto them have seen significant returns.

- Amazon.com Inc.: Amazon, founded in 1994, has become a dominant player in the e-commerce industry. Investors who bought Amazon shares early on have seen substantial gains.

- Tesla, Inc.: Tesla, founded in 2003, has revolutionized the electric vehicle industry. Investors who bought Tesla shares early on have seen significant returns, despite the company’s high volatility.

Conclusion

In conclusion, stock investing in the US can be reliable, provided investors understand the risks involved and conduct thorough research. The US stock market offers a diverse range of investment opportunities, supported by a robust regulatory framework and access to information. By staying informed and making informed decisions, investors can maximize their chances of success in the US stock market.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....