The stock market has undergone significant transformations since 2016, reflecting broader economic trends and global events. This article delves into the key developments, trends, and factors that have shaped the stock market landscape over the past five years. From technological advancements to geopolitical shifts, we explore the various elements that have influenced stock market performance.

Rising Technology Stocks

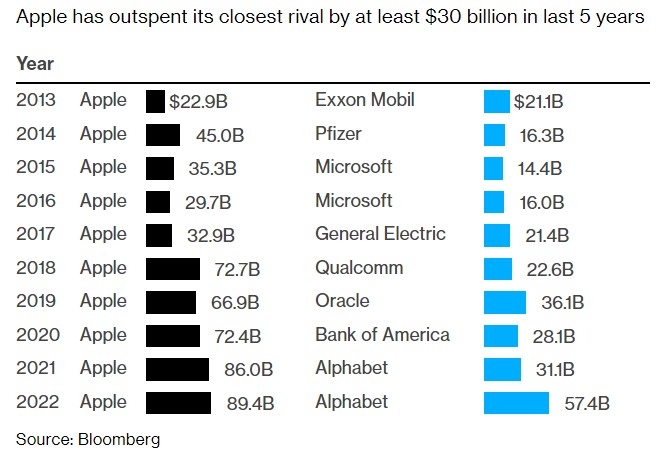

One of the most prominent trends since 2016 has been the surge in technology stocks. Companies like Apple, Amazon, and Google have seen their market capitalization soar, driven by their innovative products and services. The rise of cloud computing, artificial intelligence, and mobile technology has played a crucial role in this growth. For instance, Amazon's stock price has nearly doubled since 2016, reflecting its expansion into various sectors, including cloud computing and e-commerce.

Impact of Geopolitical Events

Geopolitical events have had a significant impact on the stock market since 2016. The Brexit vote in the UK, the election of Donald Trump as the US President, and the ongoing trade tensions between the US and China have all contributed to market volatility. The stock market's reaction to these events has been mixed, with some sectors benefiting while others suffered. For example, financial and energy stocks were hit hard during the initial stages of the trade war, while technology and healthcare stocks saw increased demand.

Interest Rate Changes

Interest rate changes by the Federal Reserve have also played a crucial role in shaping the stock market since 2016. The Fed has raised interest rates gradually over the past few years, reflecting a stronger economy. Higher interest rates can have a negative impact on stocks, particularly in sectors like real estate and utilities, as borrowing costs increase. However, the stock market has generally remained resilient, driven by strong corporate earnings and economic growth.

Emerging Markets and Dividends

Emerging markets have also become an important component of the stock market since 2016. As these economies grow, they offer opportunities for investors seeking higher returns. Stocks from emerging markets like China and India have seen significant growth, driven by factors like increased consumption and infrastructure development. Additionally, dividend yields have become a key focus for investors, as they seek stable income sources in a low-interest-rate environment.

Case Study: Tesla

A notable case study of the stock market's performance since 2016 is Tesla. The electric vehicle manufacturer has seen its stock price skyrocket, reflecting its innovative approach to the automotive industry. Tesla's stock price has more than tripled since 2016, driven by factors like its expansion into new markets and the growing demand for electric vehicles. This case study highlights the potential for high-risk, high-reward investments in emerging sectors.

In conclusion, the stock market since 2016 has been shaped by a combination of technological advancements, geopolitical events, and economic factors. While volatility has been a constant presence, the market has generally remained resilient, driven by strong corporate earnings and economic growth. As investors continue to navigate this dynamic landscape, it is crucial to stay informed and adapt to changing trends and conditions.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....