In the ever-evolving world of finance, understanding American share market futures is crucial for investors and traders alike. These futures represent contracts that allow investors to buy or sell shares of a stock at a predetermined price on a specific future date. This guide will delve into the basics of American share market futures, highlighting their importance, how they work, and key factors to consider.

What are American Share Market Futures?

American share market futures are agreements between two parties to buy or sell an asset at a future date at a price agreed upon today. These contracts are commonly used by investors to hedge against potential losses or to speculate on the direction of a stock's price. Unlike options, futures are binding contracts, meaning both parties are obligated to fulfill their end of the deal.

Key Features of American Share Market Futures

- Standardized Terms: Futures contracts have standardized terms, including the size of the contract, the delivery date, and the settlement method. This standardization ensures liquidity and ease of trading.

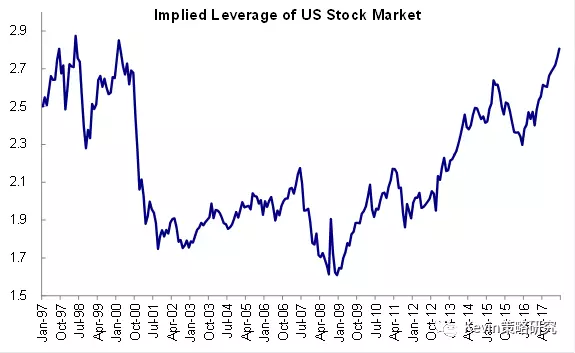

- Leverage: Futures contracts allow investors to control a large amount of stock with a relatively small amount of capital. This leverage can amplify gains but also increase risk.

- Daily Settlement: Unlike traditional stocks, which are settled at the end of the trading day, futures are settled daily. This means that gains and losses are realized immediately, and investors are required to maintain sufficient margin to cover potential losses.

How Do American Share Market Futures Work?

The process of trading American share market futures is similar to trading stocks. Investors can buy or sell futures contracts through a futures exchange, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX).

- Select a Broker: Before trading futures, investors need to open an account with a broker that offers futures trading.

- Choose a Contract: Investors must select the futures contract that corresponds to the stock they want to trade. This includes determining the size of the contract and the expiration date.

- Place an Order: Once a contract is chosen, investors can place a buy or sell order through their broker. The order will be executed based on market conditions at the time of trade.

- Manage Margin Requirements: Investors are required to maintain sufficient margin in their accounts to cover potential losses. This margin is a percentage of the total contract value and is used to ensure that both parties can fulfill their obligations.

Key Factors to Consider When Trading American Share Market Futures

- Market Volatility: Futures can be highly volatile, especially during periods of economic uncertainty. It's important to stay informed about market trends and news that could impact the price of a stock.

- Leverage Risk: While leverage can amplify gains, it can also lead to significant losses. Investors should carefully consider their risk tolerance and never risk more than they can afford to lose.

- Technical and Fundamental Analysis: Successful futures trading requires a combination of technical and fundamental analysis. Technical analysis involves studying price charts and patterns, while fundamental analysis involves analyzing economic indicators, corporate earnings, and other factors that could affect the price of a stock.

Case Studies

To illustrate the importance of understanding American share market futures, consider the following case study:

Company A is a leading technology firm. An investor believes that the stock will rise significantly in the next six months. Instead of buying the stock directly, the investor decides to purchase a futures contract on the stock. By doing so, the investor gains exposure to the stock's price movement without having to invest the full amount required to purchase the stock outright. If the investor's prediction is correct, they can sell the futures contract at a higher price and realize a profit. Conversely, if the stock's price falls, the investor's loss is limited to the amount of margin they put up.

In conclusion, American share market futures offer investors a powerful tool for hedging risk and speculating on stock price movements. By understanding the basics and key factors to consider, investors can make informed decisions and potentially benefit from the opportunities offered by the futures market.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....