In the dynamic world of finance, the stock market plays a crucial role in shaping economic trends and investment opportunities. At the heart of this market lie the major indices, which serve as key indicators of market performance. This article delves into the significance of major indices, their impact on the stock market, and how investors can leverage this knowledge to make informed decisions.

What are Major Indices?

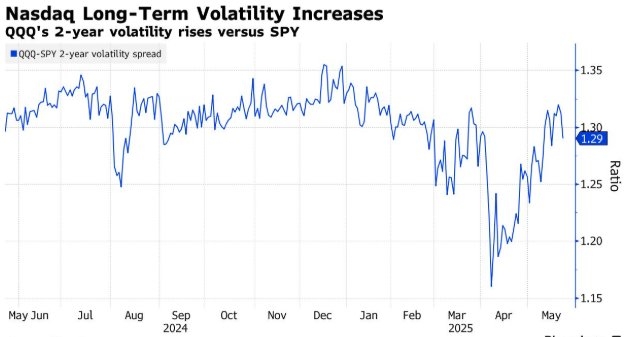

Major indices are composite indicators that reflect the overall performance of a stock market. They are typically calculated by taking the average or weighted average of the prices of selected stocks from a specific market. The most well-known major indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

The S&P 500 is a benchmark index that tracks the performance of 500 large companies listed on stock exchanges in the United States. It is widely regarded as a proxy for the overall U.S. stock market. The Dow Jones Industrial Average (DJIA), on the other hand, consists of 30 large, publicly-owned companies and is often used as a gauge of the U.S. economy. The Nasdaq Composite is a broader index that includes all Nasdaq-listed companies, making it a popular indicator of the technology sector.

The Impact of Major Indices on the Stock Market

Major indices have a profound impact on the stock market and are closely watched by investors, traders, and analysts. Here's how:

Market Sentiment: When major indices rise, it generally indicates positive market sentiment. Investors tend to feel optimistic about the market, leading to increased buying activity. Conversely, when major indices fall, it often suggests negative sentiment, resulting in selling pressure.

Investor Decisions: Major indices serve as a guide for investors when making decisions about their portfolios. Investors often compare the performance of their investments to the major indices to gauge their performance relative to the market.

Economic Indicators: Major indices are often used as economic indicators to gauge the overall health of the economy. For example, a rising S&P 500 can indicate strong economic growth, while a falling index may suggest economic challenges.

Leveraging Major Indices for Investment

Understanding major indices can help investors make informed decisions about their investments. Here are some strategies:

Index Funds: Investors can invest in index funds, which are mutual funds or exchange-traded funds (ETFs) designed to track the performance of a specific index. This allows investors to gain exposure to the overall market or a specific sector without having to select individual stocks.

Sector Rotation: Investors can use major indices to identify sectors that are performing well. For example, if the technology sector is outperforming the overall market, investors might consider allocating more of their portfolio to technology stocks.

Market Timing: While market timing is generally considered a risky strategy, some investors use major indices to make short-term trading decisions. For example, if the S&P 500 is showing strong momentum, an investor might look for opportunities to buy stocks that are part of the index.

Case Study: The 2020 Stock Market Crash

One notable example of the impact of major indices is the 2020 stock market crash, triggered by the COVID-19 pandemic. The S&P 500 experienced a historic drop of over 30% in a matter of weeks. However, the index quickly recovered, showing the resilience of the market. This event highlights the importance of understanding major indices in the context of market volatility.

In conclusion, major indices are vital tools for understanding the stock market and making informed investment decisions. By understanding their significance and impact, investors can better navigate the complexities of the financial markets and achieve their investment goals.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....