In the dynamic world of US stocks, the bid ask spread is a critical factor that investors and traders closely monitor. It represents the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). This article delves into the concept of the average bid ask spread in US stocks, its significance, and how it impacts the trading process.

What is the Average Bid Ask Spread?

The average bid ask spread is a metric that reflects the level of liquidity and volatility in a stock. It is calculated by taking the average of the bid and ask prices over a specific period, typically a day or a week. A narrow spread suggests high liquidity and less volatility, while a wide spread indicates lower liquidity and higher volatility.

Significance of the Average Bid Ask Spread

Liquidity Indicators: A narrow bid ask spread is a sign of high liquidity, which is beneficial for investors looking to buy or sell stocks without significantly impacting the price. High liquidity reduces transaction costs and minimizes the risk of slippage, where the executed trade price differs from the expected price.

Volatility Indicators: Conversely, a wide bid ask spread suggests lower liquidity and higher volatility. High volatility can lead to wider price swings and increased risk for traders. However, some traders may see this as an opportunity to exploit price discrepancies.

Market Sentiment: The bid ask spread can also provide insights into market sentiment. A narrow spread may indicate strong market confidence, while a wide spread may reflect uncertainty or skepticism.

Factors Influencing the Average Bid Ask Spread

Several factors contribute to the average bid ask spread in US stocks:

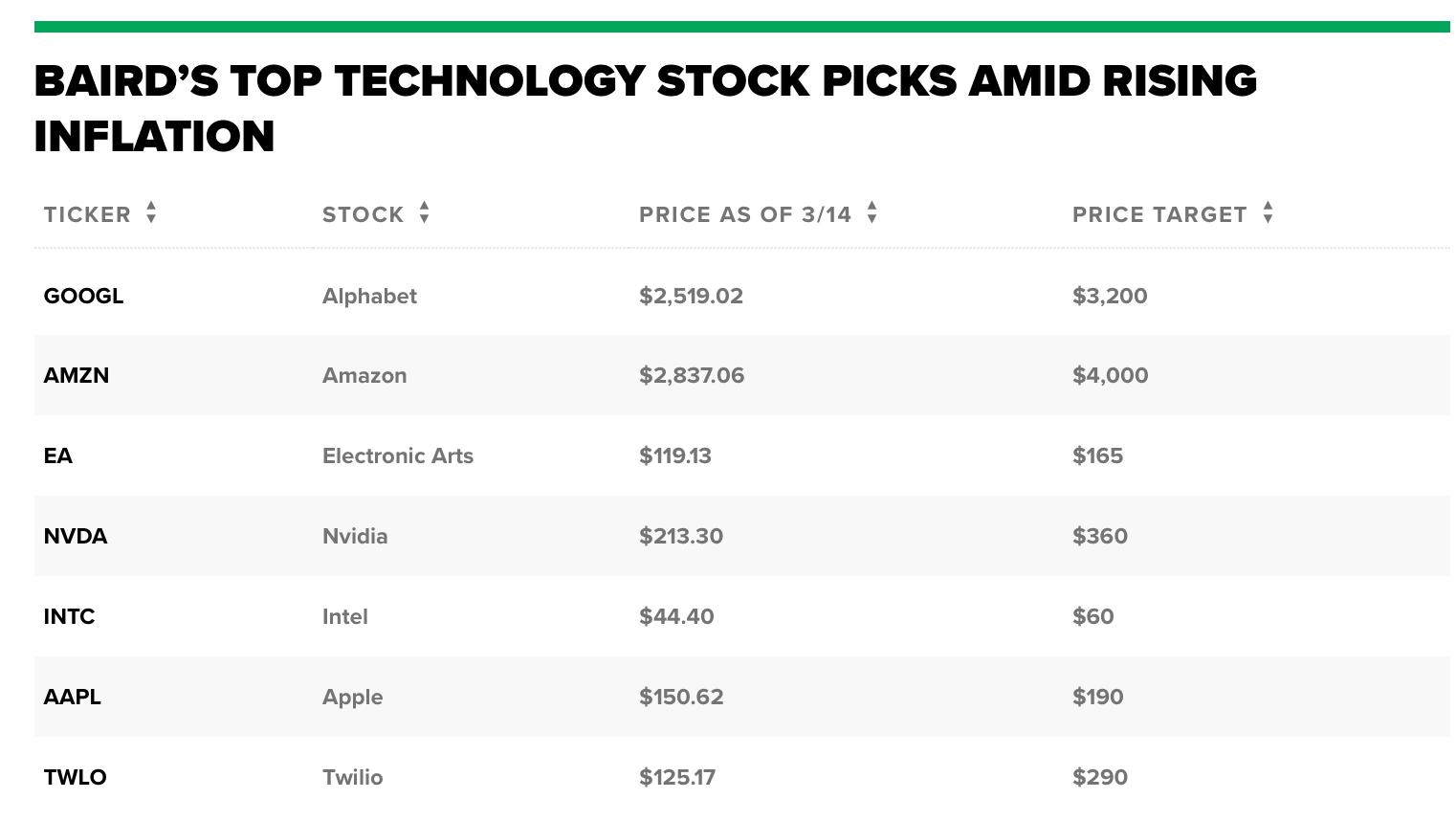

Market Capitalization: Larger companies with higher market capitalization tend to have narrower spreads due to their higher liquidity.

Trading Volume: Stocks with high trading volume typically exhibit lower bid ask spreads.

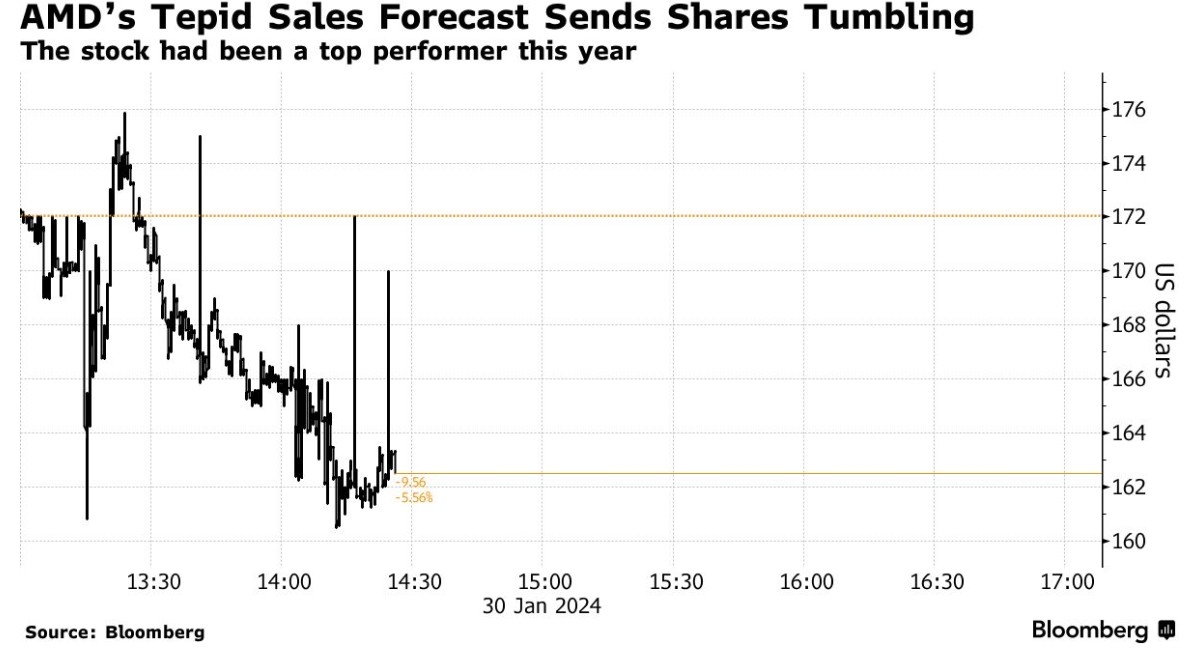

Market Conditions: During periods of high market volatility, bid ask spreads tend to widen as liquidity dries up.

News and Events: Significant news or events related to a company can cause bid ask spreads to widen temporarily.

Case Study: Apple Inc. (AAPL)

Consider the case of Apple Inc. (AAPL), a highly liquid and widely traded stock. As of a recent trading day, the average bid ask spread for AAPL was just

Conclusion

The average bid ask spread in US stocks is a crucial metric that provides insights into liquidity, volatility, and market sentiment. By understanding this concept, investors and traders can make more informed decisions and better navigate the complex world of stock trading.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....