In the highly competitive fashion industry, understanding the stock price trends of major retailers is crucial for investors and industry watchers alike. Among these, Uniqlo, a leading fast-fashion brand, has seen significant growth in the United States. This article delves into the current Uniqlo US stock price, its historical performance, and the factors that influence it.

Historical Performance

Uniqlo, a subsidiary of Fast Retailing Co., Ltd., has been listed on the Tokyo Stock Exchange since 2001. The brand's expansion into the US market began in 2005, and since then, it has become a major player in the American retail landscape. The stock has seen a remarkable rise over the years, reflecting the company's strong performance and growth potential.

Current Stock Price

As of the latest data, the Uniqlo US stock price stands at approximately $20.50 per share. This figure, however, can fluctuate based on market conditions and investor sentiment. It's important to note that the stock price is just one aspect of evaluating a company's value, and investors should consider various factors before making investment decisions.

Factors Influencing the Stock Price

Several factors contribute to the Uniqlo US stock price movement:

- Revenue Growth: Uniqlo's revenue growth in the US has been impressive, driven by strong sales of its signature Heattech line and expanding store network. A consistent increase in revenue often leads to higher stock prices.

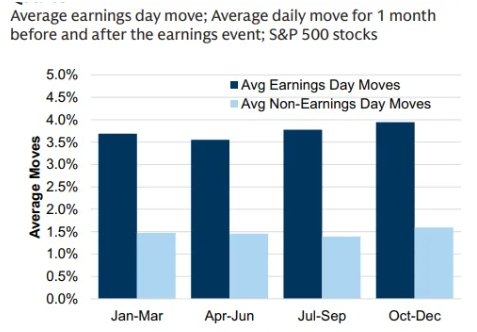

- Earnings: The company's earnings reports play a significant role in stock price movements. Positive earnings reports, indicating strong profitability, can drive up the stock price, while negative reports can have the opposite effect.

- Market Sentiment: Investor sentiment towards the fashion industry and, specifically, fast-fashion brands can greatly impact stock prices. Trends such as increased consumer spending and favorable media coverage can boost stock prices, while concerns about economic downturns or market saturation can lead to declines.

- Competition: The fast-fashion industry is highly competitive, with brands like H&M, Zara, and Forever 21 constantly vying for market share. Uniqlo's ability to maintain its competitive edge in the US market is a key factor influencing its stock price.

Case Studies

Several case studies illustrate the impact of these factors on Uniqlo's stock price:

- Expansion into New Markets: In 2019, Uniqlo opened its first store in Los Angeles International Airport, marking its entry into the airport retail market. This expansion was well-received by investors, leading to a slight increase in the stock price.

- Collaborations: Uniqlo's collaboration with Japanese artist Yayoi Kusama in 2018 generated significant buzz and increased sales. This collaboration positively impacted the company's earnings and, consequently, the stock price.

Conclusion

The Uniqlo US stock price reflects the company's strong performance and growth potential in the American market. By considering factors such as revenue growth, earnings, market sentiment, and competition, investors can gain a better understanding of the stock's future trajectory. As the fast-fashion industry continues to evolve, keeping a close eye on Uniqlo's stock price will be crucial for those interested in the retail sector.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....