The rise of artificial intelligence (AI) has been nothing short of revolutionary, transforming industries across the globe. As a result, AI stocks in the US have become a hot topic among investors. This article delves into the world of AI stocks, highlighting key players, growth potential, and factors to consider when investing.

Understanding AI Stocks

AI stocks refer to shares of companies that are actively involved in the development, implementation, or sale of AI technologies. These companies range from giants like Google and IBM to smaller startups making waves in niche markets. Investing in AI stocks can offer exposure to a rapidly growing sector with immense potential.

Key Players in the AI Space

Several companies have emerged as leaders in the AI industry. Here are some notable examples:

Google's Alphabet (GOOGL) : As one of the world's largest tech companies, Alphabet's Google division has made significant strides in AI. From search algorithms to self-driving cars, Google's AI advancements are well-documented.

IBM (IBM) : IBM has been a pioneer in AI, offering a range of AI-powered solutions for businesses. Their Watson AI platform has been applied in various industries, from healthcare to finance.

Amazon (AMZN) : Amazon's AI capabilities are evident in their recommendation engine, which drives a significant portion of their sales. The company is also investing heavily in AI for logistics and supply chain management.

Intel (INTC) : Intel has been a key player in AI hardware, providing the processors and other components necessary for AI applications.

Growth Potential of AI Stocks

The growth potential of AI stocks is substantial, driven by several factors:

Expanding AI Applications: AI is being integrated into various industries, from healthcare to transportation, creating new opportunities for companies in the AI space.

Increasing Investment: Governments and private entities are investing heavily in AI research and development, fueling innovation and growth in the industry.

Mergers and Acquisitions: The AI industry is witnessing a surge in mergers and acquisitions, as companies seek to expand their capabilities and market share.

Factors to Consider When Investing in AI Stocks

Investing in AI stocks requires careful consideration of several factors:

Market Research: Conduct thorough research to understand the company's AI capabilities, market position, and growth potential.

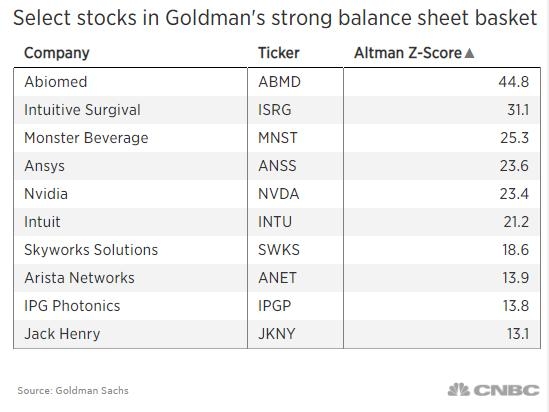

Financial Health: Evaluate the company's financial health, including revenue growth, profitability, and debt levels.

Regulatory Environment: Be aware of the regulatory landscape, as AI technologies may face scrutiny and potential restrictions.

Case Study: OpenAI

OpenAI, a non-profit AI research company, is a prime example of the potential in the AI space. Founded by a group of tech industry leaders, including Elon Musk and Sam Altman, OpenAI's mission is to ensure that AI benefits all of humanity. The company has made significant advancements in AI research, including the development of GPT-3, a powerful language model.

By investing in companies like OpenAI, investors can gain exposure to cutting-edge AI research and development, potentially leading to significant returns.

In conclusion, AI stocks in the US present a compelling opportunity for investors looking to capitalize on the rapidly growing AI industry. By understanding key players, growth potential, and factors to consider, investors can make informed decisions and potentially reap the rewards of this transformative sector.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....