Are the markets crashing? This question has been on the minds of investors and financial analysts worldwide. In this article, we'll delve into the current market situation, examine potential causes of crashes, and discuss strategies for managing risks during uncertain times.

Understanding the Current Market Situation

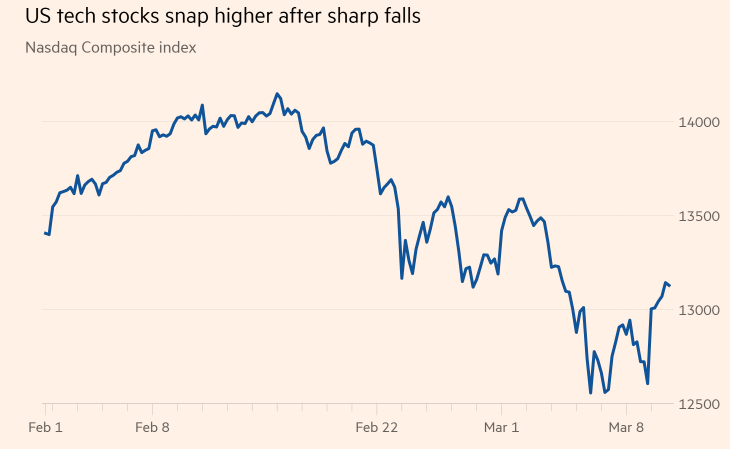

The stock market has been experiencing volatility lately, with some sectors facing significant declines. This volatility can be attributed to various factors, including geopolitical tensions, economic uncertainties, and corporate earnings warnings. However, it is crucial to differentiate between market corrections and full-blown crashes.

Geopolitical Tensions

Geopolitical tensions have been a significant driver of market volatility. For instance, the tensions between the United States and China have caused investors to worry about trade wars and supply chain disruptions. In addition, the situation in Eastern Europe and the Middle East has also added to the uncertainty.

Economic Uncertainties

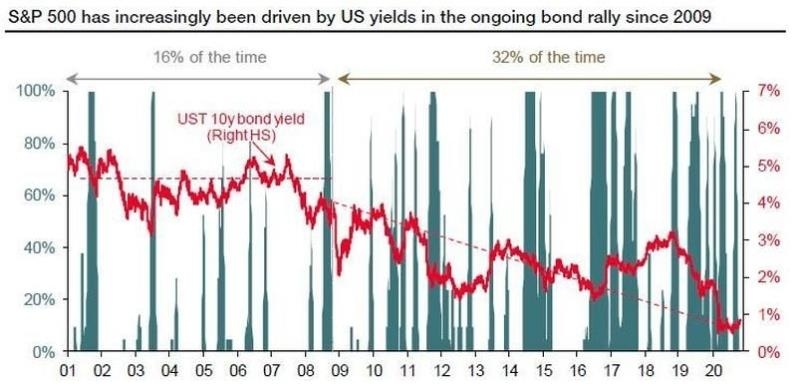

Economic uncertainties, such as slowing global growth and rising inflation, have also contributed to market volatility. Central banks, including the Federal Reserve, are struggling to balance inflation and economic growth, which has created uncertainty among investors.

Corporate Earnings Warnings

Many companies have issued earnings warnings, citing factors such as higher input costs, supply chain disruptions, and slowing consumer demand. These warnings have caused investors to reassess their investment strategies and adjust their expectations.

Potential Causes of Market Crashes

Several factors can lead to a market crash, including:

- Excessive Speculation: When investors excessively speculate on assets, it can lead to inflated prices and increased volatility.

- Economic Downturns: Economic downturns, such as recessions, can lead to a decrease in consumer spending and corporate earnings, causing the market to crash.

- Financial Instability: Financial crises, such as the 2008 financial crisis, can cause widespread panic and a sharp decline in the market.

Strategies for Managing Risks During Uncertain Times

To navigate uncertain market conditions, investors should consider the following strategies:

- Diversification: Diversifying your investment portfolio can help mitigate risks and reduce the impact of market volatility.

- Staying Informed: Keeping up with the latest news and developments can help you make informed decisions and avoid making emotional decisions during times of uncertainty.

- Long-term Investing: Investing for the long term can help you ride out market volatility and avoid making impulsive decisions based on short-term fluctuations.

Case Study: The 2008 Financial Crisis

One of the most significant market crashes in history was the 2008 financial crisis. The crisis was triggered by a combination of factors, including excessive speculation in the housing market, subprime mortgage loans, and financial institutions' excessive risk-taking. The crisis resulted in a sharp decline in the stock market, leading to widespread panic and economic hardship.

In conclusion, while the markets may be experiencing volatility, it is essential to differentiate between market corrections and crashes. By understanding the potential causes of market crashes and adopting sound investment strategies, investors can navigate uncertain market conditions and protect their portfolios.

Keywords: markets crashing, stock market volatility, economic uncertainties, corporate earnings warnings, market corrections, financial crises, diversification, long-term investing, 2008 financial crisis.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....