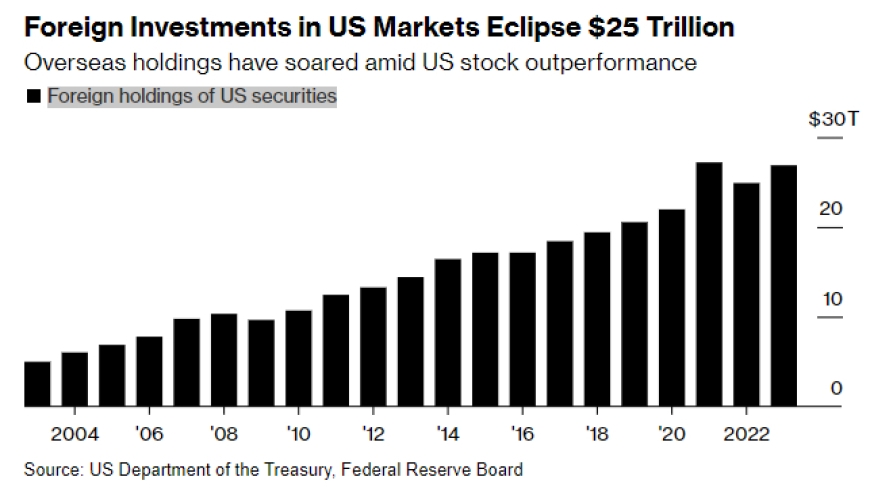

Investing in U.S. stocks can be a lucrative venture, especially for Canadians looking to diversify their portfolios. However, navigating the process of buying U.S. stocks from a Canadian account can sometimes be confusing. This comprehensive guide will walk you through the steps, benefits, and considerations involved in purchasing U.S. stocks from a Canadian account.

Understanding the Basics

Before diving into the details, it's essential to understand the basics. A Canadian account refers to a brokerage account held in Canada, while U.S. stocks are shares of companies listed on American stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Benefits of Buying U.S. Stocks from a Canadian Account

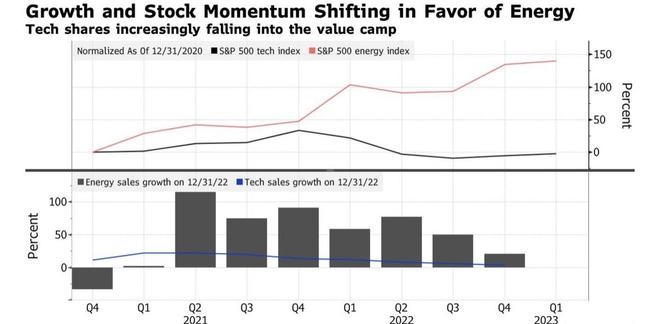

- Diversification: Investing in U.S. stocks allows you to diversify your portfolio beyond Canadian markets, potentially reducing risk and increasing returns.

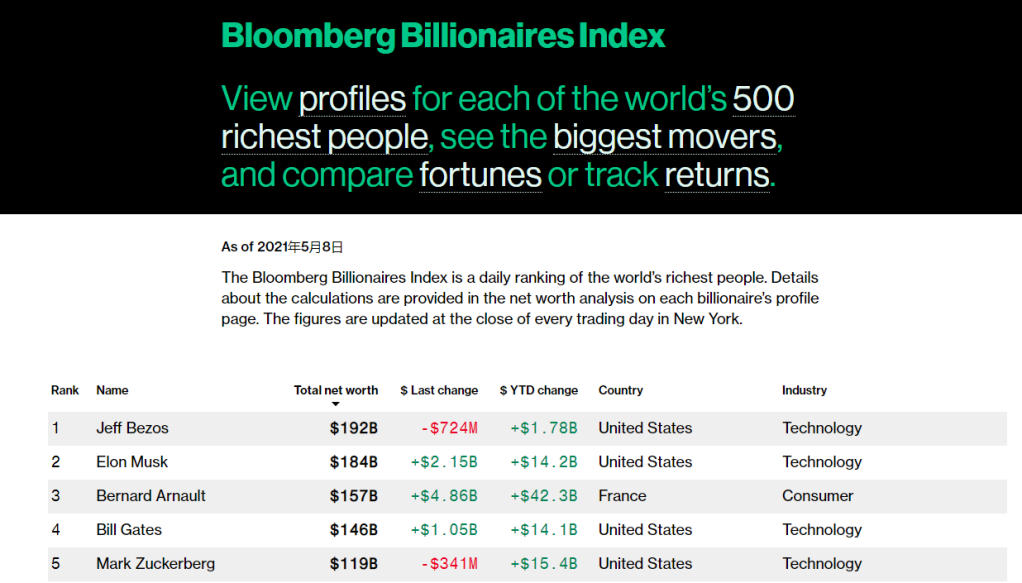

- Access to Top Companies: The U.S. stock market is home to some of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon.

- Currency Conversion: By purchasing U.S. stocks from a Canadian account, you can avoid the complexities of currency conversion and potential currency fluctuations.

Steps to Buy U.S. Stocks from a Canadian Account

- Open a Canadian Brokerage Account: The first step is to open a brokerage account in Canada. This account will allow you to buy and sell stocks, including U.S. stocks.

- Choose a Broker: When selecting a broker, consider factors such as fees, customer service, and the availability of U.S. stocks. Some popular Canadian brokers that offer access to U.S. stocks include TD Ameritrade, Questrade, and BMO InvestorLine.

- Complete the Application: Fill out the application form and provide the necessary documentation, such as identification and proof of address.

- Fund Your Account: Transfer funds from your Canadian bank account to your brokerage account. This can typically be done through an electronic transfer or a wire transfer.

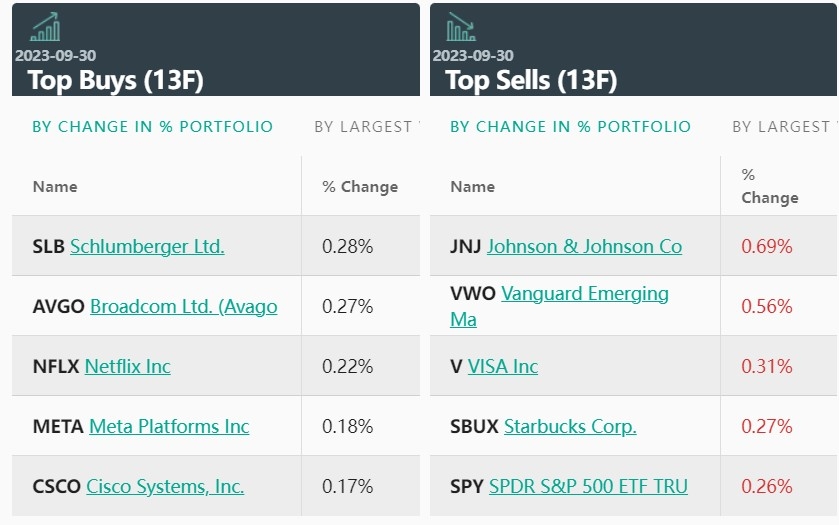

- Research and Select Stocks: Research U.S. stocks that align with your investment goals and risk tolerance. Utilize tools and resources provided by your broker to analyze and compare stocks.

- Place an Order: Once you've selected a stock, place an order to buy shares. You can choose to buy a specific number of shares or a fraction of a share, depending on your investment amount.

- Monitor Your Investment: After purchasing U.S. stocks, it's crucial to monitor your investment and stay informed about market trends and company news.

Considerations and Risks

- Currency Fluctuations: While buying U.S. stocks from a Canadian account can help avoid currency conversion fees, it's important to be aware of currency fluctuations, which can impact your investment returns.

- Tax Implications: U.S. stocks purchased from a Canadian account may be subject to U.S. taxes, depending on your residency status. Consult with a tax professional to understand the potential tax implications.

- Brokerage Fees: Be mindful of brokerage fees associated with buying and selling U.S. stocks, as these can impact your investment returns.

Case Study: Investing in Apple from a Canadian Account

Let's consider a hypothetical scenario where a Canadian investor wants to buy shares of Apple (AAPL) from their Canadian brokerage account. After researching the company and analyzing its financials, the investor decides to purchase 100 shares of Apple at

Conclusion

Buying U.S. stocks from a Canadian account can be a valuable strategy for diversifying your portfolio and accessing top companies. By understanding the process, benefits, and considerations, you can make informed decisions and potentially achieve significant returns.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....