In the ever-growing global economy, investors from across the world are seeking opportunities to diversify their portfolios. For Indian citizens, investing in US stocks can be a strategic move to access some of the most lucrative and well-established markets in the world. But can Indian citizens buy US stocks? The answer is yes, with a few key considerations.

Understanding the Process

The process of buying US stocks for Indian citizens is relatively straightforward. Here's a step-by-step guide:

Open a Foreign Brokerage Account: Indian citizens need to open a brokerage account with a foreign brokerage firm that allows them to trade US stocks. Many brokerage firms, such as TD Ameritrade, E*TRADE, and Fidelity, offer accounts specifically tailored for international investors.

Fund Your Account: Once the brokerage account is set up, the next step is to fund it. This can be done through wire transfers, bank drafts, or other payment methods supported by the brokerage firm.

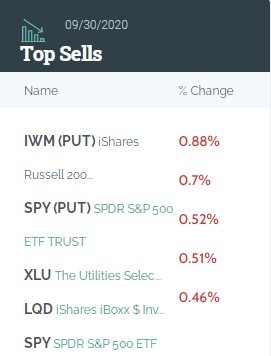

Choose Your Stocks: After the account is funded, you can start researching and selecting the US stocks you want to invest in. This could include large-cap companies, small-cap startups, or even ETFs (Exchange-Traded Funds) that track specific indices or sectors.

Place Your Order: Once you've chosen your stocks, you can place your order through your brokerage account. You can opt for market orders, limit orders, or stop orders, depending on your investment strategy.

Considerations for Indian Investors

While the process is straightforward, there are several considerations Indian citizens should keep in mind:

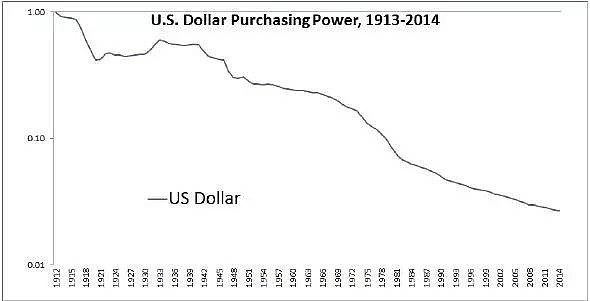

Currency Conversion: Since US stocks are priced in USD, Indian citizens need to convert their currency (INR) to USD for buying and selling stocks. This can impact the overall returns, especially if the USD/INR exchange rate fluctuates significantly.

Tax Implications: Indian citizens are required to pay taxes on their investment income in India. This means they need to keep track of their investment income and file tax returns accordingly. Additionally, if they hold US stocks for less than a year, they may be subject to short-term capital gains tax in India.

Trading Hours: It's important to note that the trading hours for US stocks are different from those in India. US stock markets operate from 9:30 AM to 4:00 PM EST on weekdays, while the Indian stock market operates from 9:15 AM to 3:30 PM IST on weekdays.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where an Indian citizen wants to invest in Apple (AAPL), one of the largest and most well-known companies in the world.

The investor opens a brokerage account with a foreign brokerage firm that supports US stock trading.

The investor funds their account with INR, which is converted to USD.

The investor researches Apple and decides to invest in 10 shares of AAPL.

The investor places a market order to buy 10 shares of AAPL at the current market price.

The order is executed, and the investor becomes a shareholder of Apple.

The investor keeps track of their investment and the associated currency conversion.

The investor files their tax returns in India, including their investment income from Apple.

By following these steps and considerations, Indian citizens can successfully buy and invest in US stocks. It's important to do thorough research and seek professional advice before making any investment decisions. With the right approach, investing in US stocks can be a rewarding experience for Indian citizens.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....