As we approach the midpoint of 2025, the US stock market continues to evolve, influenced by a myriad of economic and geopolitical factors. In this article, we delve into the current state of the market and provide an outlook for July 2025.

Market Performance So Far

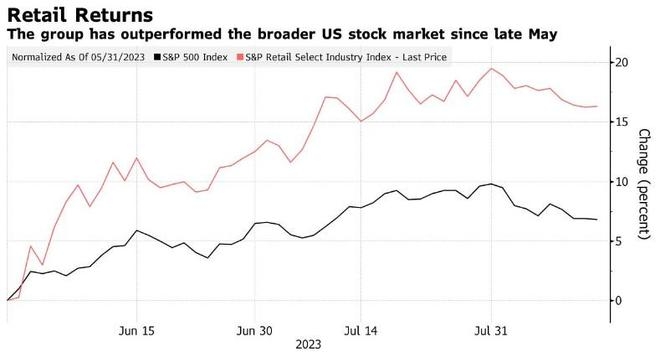

The US stock market has experienced a rollercoaster ride in the past few years. Despite the challenges posed by the COVID-19 pandemic, the market has managed to recover and achieve impressive gains. The S&P 500, a widely followed index, has surged over 20% in the past year alone.

Several factors have contributed to this growth. Economic stimulus measures from the government, low interest rates, and robust corporate earnings have all played a role. Additionally, the rise of technology stocks has been a significant driver of market performance.

Outlook for July 2025

Looking ahead to July 2025, several key factors could impact the US stock market. Here's a breakdown of the key considerations:

1. Economic Growth

Economic growth remains a critical factor in determining market performance. The Federal Reserve has been closely monitoring economic indicators such as GDP growth, inflation, and unemployment rates. With the economy recovering from the pandemic, these indicators are expected to remain positive.

2. Corporate Earnings

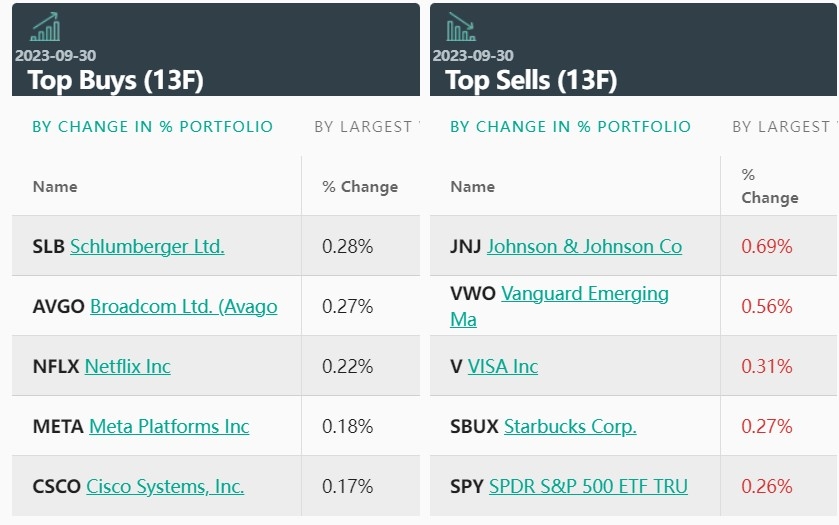

Corporate earnings have been a major driver of stock market gains. Companies are expected to continue reporting strong earnings, driven by factors such as cost-cutting measures and increased productivity. This trend is likely to continue, providing support for the stock market.

3. Geopolitical Factors

Geopolitical tensions remain a significant concern for investors. The ongoing conflict in Eastern Europe and other geopolitical issues could lead to volatility in the market. However, the market has shown resilience in the face of such challenges, and investors are likely to remain cautious but optimistic.

4. Technology Stocks

Technology stocks have been a major force in the market, and this trend is expected to continue. Companies in this sector are known for their strong growth potential and innovative business models. As a result, they are likely to remain a key driver of market performance.

5. Sector Performance

Sector performance has been mixed in recent years. Technology, healthcare, and consumer discretionary sectors have outperformed, while financials and real estate sectors have lagged behind. This trend is expected to continue, with technology and healthcare sectors likely to lead the way.

Case Study: Apple Inc.

To illustrate the potential of the stock market, let's consider the case of Apple Inc. Over the past few years, Apple has experienced significant growth, driven by factors such as strong product launches and innovative technology. As a result, the company's stock price has surged, making it one of the most valuable companies in the world.

Apple's success highlights the importance of innovation and strong fundamentals in the stock market. By focusing on these factors, investors can identify companies with strong growth potential and achieve impressive returns.

In conclusion, the US stock market is expected to remain strong in July 2025, driven by factors such as economic growth, corporate earnings, and technological advancements. However, investors should remain cautious and monitor geopolitical developments closely. By staying informed and making informed decisions, investors can navigate the market and achieve their financial goals.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....