In the ever-evolving global financial landscape, the stock markets of Europe and the United States have long been key players. Investors often find themselves weighing the pros and cons of investing in either market. This article delves into a comprehensive comparison of the European and US stock markets, highlighting their unique characteristics, performance, and future prospects.

Market Size and Composition

The US stock market is the largest in the world, with a market capitalization of over $35 trillion. It boasts a diverse range of companies across various sectors, including technology, healthcare, finance, and consumer goods. The S&P 500, the most widely followed index, represents the top 500 companies listed on US exchanges.

In contrast, the European stock market is much smaller, with a market capitalization of around $15 trillion. It is composed of several major exchanges, including the London Stock Exchange, the Frankfurt Stock Exchange, and the Paris Stock Exchange. The MSCI Europe index tracks the performance of the largest companies in the region.

Performance

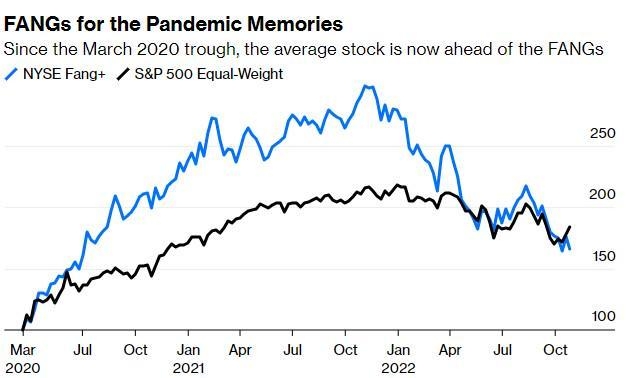

Over the past decade, the US stock market has generally outperformed its European counterpart. This can be attributed to several factors, including stronger economic growth, higher corporate profits, and technological advancements. However, Europe has shown resilience, particularly in sectors like healthcare and consumer goods.

Sector Performance

The US stock market has a strong presence in technology, with giants like Apple, Microsoft, and Google leading the charge. This sector has been a significant driver of growth, with companies benefiting from rapid technological innovation and global expansion.

In contrast, the European stock market has a more diversified sector composition, with notable strengths in healthcare, consumer goods, and automotive. Companies like Roche, L'Oréal, and Volkswagen have been key performers in these sectors.

Dividends and Yield

Dividends play a crucial role in the attractiveness of stock markets for investors. The US stock market offers higher dividend yields compared to the European market. This is due to the higher profitability of US companies and their commitment to returning value to shareholders.

Regulation and Taxation

Regulation and taxation are critical factors that can impact the performance of stock markets. The US stock market is known for its relatively friendly regulatory environment and low corporate tax rates. This has encouraged companies to invest and expand, leading to higher stock prices.

In contrast, the European stock market faces stricter regulations and higher corporate tax rates. This can make it less attractive for certain companies, particularly those in highly regulated sectors like banking and energy.

Future Prospects

The future of the European and US stock markets remains uncertain. However, several factors suggest that both markets have the potential for growth. The US stock market is expected to benefit from continued technological innovation and strong economic growth. The European stock market may see opportunities in sectors like healthcare and consumer goods, as well as from the potential for European Union integration and economic recovery.

In conclusion, the European and US stock markets offer unique opportunities and challenges for investors. Understanding their differences and similarities can help investors make informed decisions about where to allocate their capital. Whether you prefer the diversification of the European market or the technological strength of the US market, both offer compelling opportunities for growth and investment.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....