The stock market is a crucial component of any economy, reflecting the overall health and potential growth of a nation. When comparing the stock markets of the United States and China, it's essential to consider various factors such as market size, performance, and regulatory environment. This article aims to provide a comprehensive comparison of the two markets, highlighting their strengths and weaknesses.

Market Size and Composition

The United States boasts the world's largest stock market, with a market capitalization of over

Performance

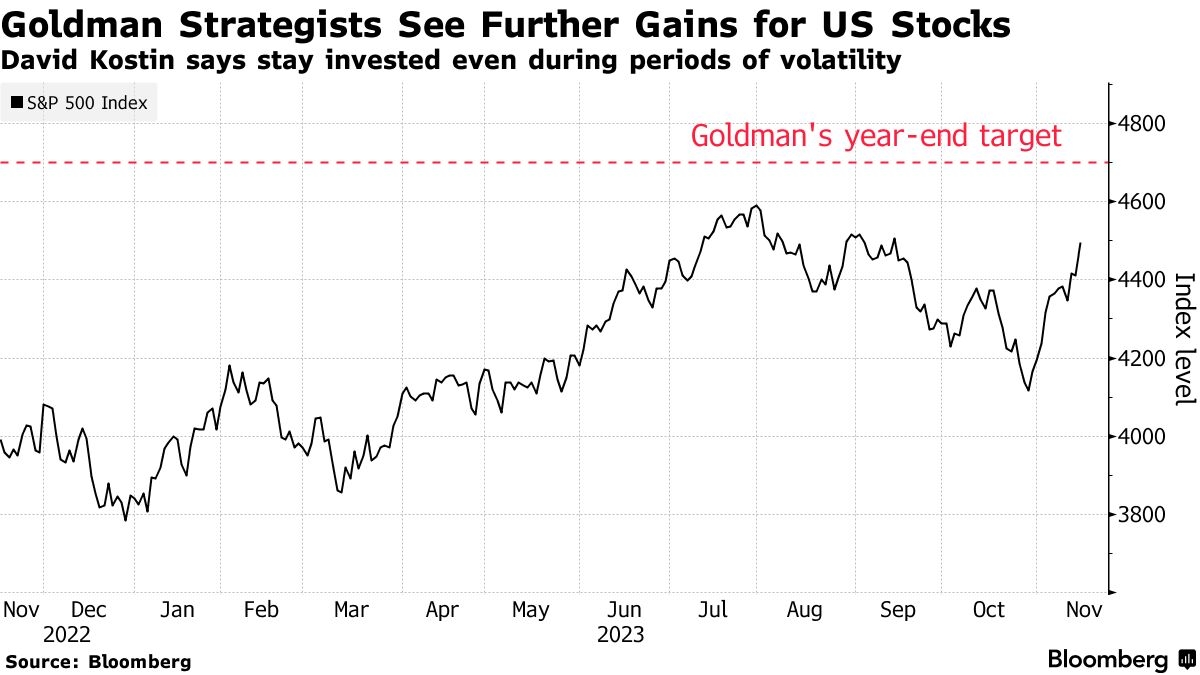

In terms of performance, the U.S. stock market has historically outperformed its Chinese counterpart. The S&P 500 has delivered an average annual return of around 10% over the past century, while the Shanghai Composite Index has returned an average of around 7%. However, it's important to note that these figures can fluctuate significantly over different time periods.

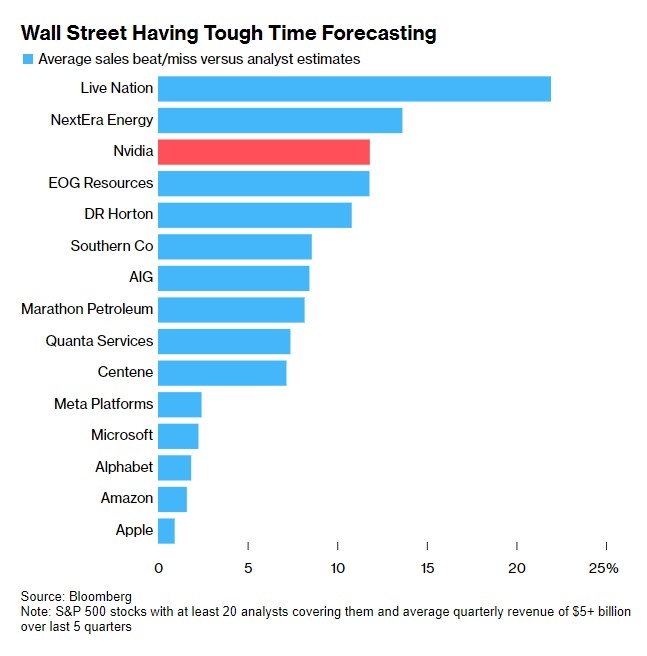

One reason for the U.S. market's outperformance is the higher level of innovation and technological advancements in the U.S. This has led to the creation of numerous successful companies, such as Apple, Microsoft, and Google, which have contributed significantly to the growth of the U.S. stock market.

Regulatory Environment

The regulatory environment in the U.S. and China differs significantly, which can impact market performance and investor confidence. The U.S. has a well-established regulatory framework, with the Securities and Exchange Commission (SEC) overseeing the stock market. This framework ensures transparency, fairness, and investor protection.

In contrast, China's regulatory environment is more government-controlled, with the China Securities Regulatory Commission (CSRC) overseeing the market. While this has led to rapid growth and development, it also raises concerns about market manipulation and transparency.

Case Study: Alibaba vs. Tencent

To better understand the differences between the U.S. and Chinese stock markets, let's compare two of the largest tech companies in the world: Alibaba and Tencent.

Alibaba is a Chinese e-commerce giant, listed on the New York Stock Exchange (NYSE) under the ticker symbol BABA. Since its IPO in 2014, Alibaba has delivered strong growth, with its stock price increasing by over 100%. This performance can be attributed to the company's strong market position in China and its expansion into new industries, such as cloud computing and digital media.

Tencent, on the other hand, is a Chinese tech company primarily focused on social media, gaming, and payments. It is listed on the Hong Kong Stock Exchange (HKEX) under the ticker symbol 0700.HK. While Tencent has also delivered impressive growth, its stock performance has been less robust compared to Alibaba. This can be attributed to the regulatory challenges faced by the company in China, particularly in the gaming industry.

Conclusion

In conclusion, the U.S. and Chinese stock markets have distinct characteristics that influence their performance and growth. While the U.S. market has historically outperformed its Chinese counterpart, the Chinese market offers significant potential for growth, particularly in the technology and manufacturing sectors. Understanding the differences between these markets is crucial for investors looking to diversify their portfolios.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....