In the ever-evolving landscape of the financial world, staying informed about the U.S. markets is crucial for investors and traders. Today, we delve into the latest trends, market analysis, and key developments shaping the U.S. markets. From stocks and bonds to commodities and currencies, this article provides a comprehensive overview of the U.S. markets today.

Stock Market Performance

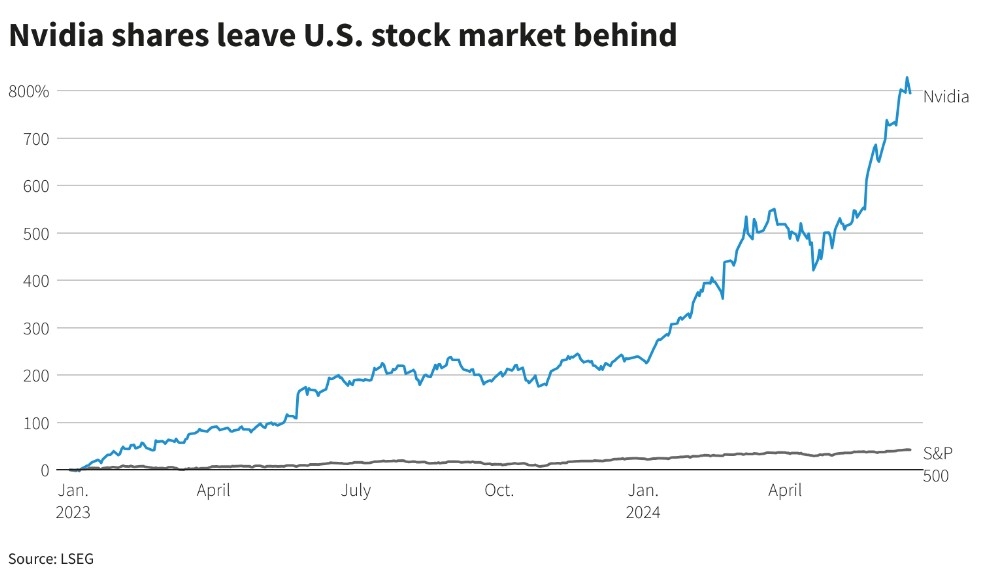

The stock market remains a primary focus for investors, and recent trends indicate a mix of optimism and caution. The S&P 500 has seen significant growth over the past year, driven by strong corporate earnings and economic recovery. However, some sectors, such as technology and energy, have experienced volatility due to changing market dynamics.

Key Sectors to Watch

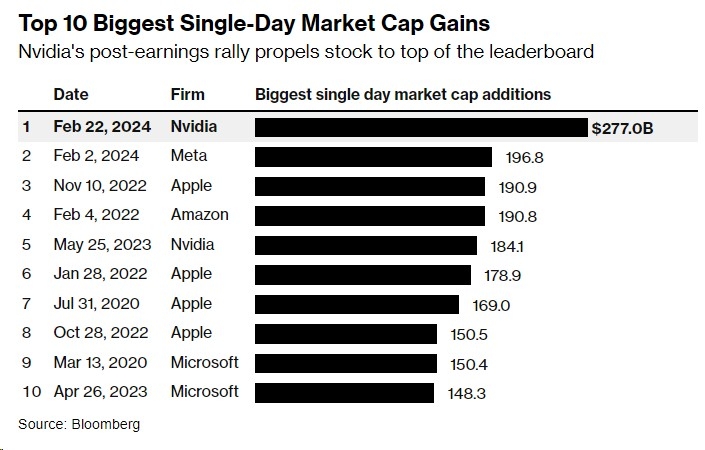

Technology: The tech sector has been a major driver of the stock market's growth. Companies like Apple, Microsoft, and Amazon have seen substantial gains, but investors should remain cautious due to increasing regulatory scrutiny and potential market saturation.

Energy: The energy sector has experienced a significant turnaround, with oil prices stabilizing and natural gas production increasing. Companies like ExxonMobil and Chevron have seen their shares rise, but investors should consider the impact of global energy policies and geopolitical tensions.

Healthcare: The healthcare sector has been a consistent performer, with pharmaceutical companies and biotech firms leading the way. Pfizer and Moderna have gained significant attention for their role in the COVID-19 vaccine development. However, investors should monitor the potential for increased healthcare costs and insurance premiums.

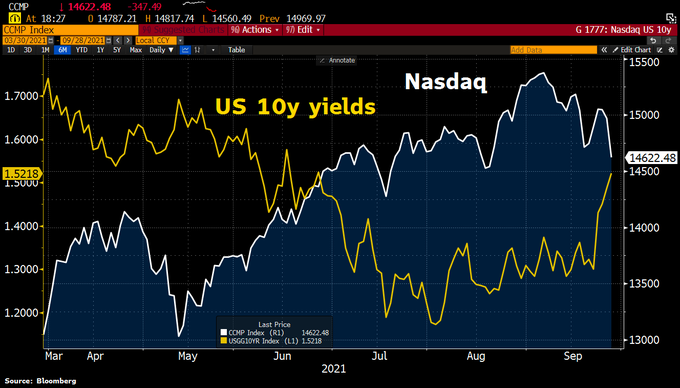

Bond Market Trends

The bond market has also seen its share of volatility, with yields fluctuating due to changing interest rates and economic outlooks. Treasury bonds and corporate bonds have remained popular among investors, but the potential for rising inflation and interest rates has raised concerns.

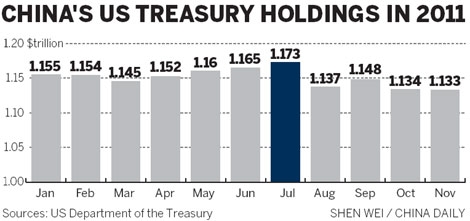

Commodities and Currencies

The commodities market has been influenced by a variety of factors, including global supply chains and geopolitical tensions. Gold and oil have seen significant price movements, while bitcoin and other cryptocurrencies continue to attract attention.

The U.S. dollar remains a major global currency, with its value often influenced by economic data and geopolitical events. The USD has experienced some volatility, but remains a stable currency for investors seeking to diversify their portfolios.

Case Studies

Tesla's Stock Performance: Tesla, an electric vehicle manufacturer, has seen its stock soar over the past few years. The company's innovative approach to sustainable transportation and strong revenue growth have contributed to its success. However, investors should consider the potential risks associated with the company's high debt levels and dependence on battery technology.

Bitcoin's Market Volatility: Bitcoin, the world's largest cryptocurrency, has experienced significant volatility since its inception. While some investors have seen substantial gains, others have faced substantial losses. It's important for investors to understand the risks associated with cryptocurrency markets before investing.

Conclusion

The U.S. markets today present a complex mix of opportunities and challenges. Staying informed and making informed decisions is crucial for investors and traders. As the market continues to evolve, it's important to remain flexible and adapt to changing conditions.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....