In the world of investing, large cap stocks often take center stage due to their stability and potential for long-term growth. These stocks belong to companies with a market capitalization of over $10 billion, making them the backbone of the U.S. stock market. This article delves into the world of large cap stocks in the U.S., highlighting their benefits, risks, and top-performing companies.

Understanding Large Cap Stocks

Large cap stocks are characterized by their size and stability. These companies have a proven track record of profitability and growth, making them attractive to investors looking for a balance between risk and reward. Market capitalization is a key indicator of a company's size, calculated by multiplying its current share price by the total number of shares outstanding.

Benefits of Investing in Large Cap Stocks

Stability and Low Volatility: Large cap stocks are typically less volatile than their smaller counterparts, providing a sense of security for investors. This stability is often attributed to the diversified revenue streams and well-established market positions of these companies.

Dividend Yields: Many large cap companies have a history of paying dividends, which can provide investors with a steady income stream. Dividends are often more consistent and reliable compared to those of smaller companies.

Long-term Growth Potential: Despite their size, large cap stocks can still offer significant growth potential. As these companies continue to expand their market share and invest in new ventures, their stock prices can appreciate over time.

Risks of Investing in Large Cap Stocks

While large cap stocks offer numerous benefits, they are not without risks. Some of the risks include:

Market Risk: Large cap stocks can still be affected by market downturns, although they tend to be less volatile than smaller companies.

Low Growth Rate: As these companies grow larger, their growth rates may slow down compared to smaller companies, which are often in more rapid expansion phases.

Inflation Risk: If inflation rises, large cap stocks may not provide the same level of protection as smaller companies, which can benefit from higher prices due to their more flexible operations.

Top Large Cap Stocks in the US

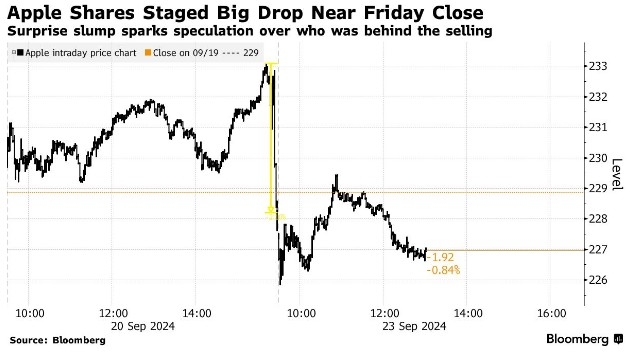

Apple Inc. (AAPL): As the world's largest technology company, Apple has a market capitalization of over $2 trillion. Its products, including the iPhone, iPad, and Mac, have made it a staple in the tech industry.

Microsoft Corporation (MSFT): Microsoft is another tech giant with a market capitalization of over $2 trillion. Its software and cloud services have contributed to its success.

Amazon.com, Inc. (AMZN): As the largest online retailer, Amazon has a market capitalization of over $1.5 trillion. Its expansion into various sectors, including cloud computing and streaming, has propelled its growth.

Johnson & Johnson (JNJ): This healthcare giant has a market capitalization of over $400 billion. Its diverse product portfolio, including pharmaceuticals and consumer goods, has made it a reliable investment.

Exxon Mobil Corporation (XOM): As the world's largest publicly traded oil and gas company, Exxon Mobil has a market capitalization of over $350 billion. Its global presence and strong oil reserves have contributed to its success.

Conclusion

Investing in large cap stocks in the U.S. can be a wise decision for investors looking for stability and long-term growth. While there are risks involved, the potential benefits, such as low volatility and consistent dividends, make them an attractive option. By understanding the market and staying informed, investors can make informed decisions about their investments in large cap stocks.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....