In the fast-paced world of finance, staying informed about the US stock market is crucial for investors and traders alike. Today, we dive into the latest updates and analysis from CNBC, providing you with the insights you need to make informed decisions.

Stock Market Overview

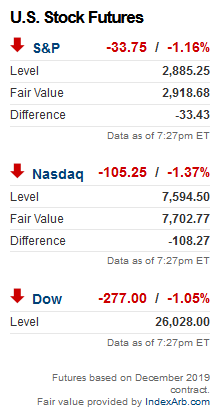

The US stock market opened on a positive note this morning, with the Dow Jones Industrial Average (^DJI) up by 0.5%, the S&P 500 (^GSPC) gaining 0.6%, and the NASDAQ Composite (^IXIC) rising by 0.7%. These gains were largely driven by strong earnings reports from major tech companies, including Apple (AAPL) and Microsoft (MSFT).

Key Earnings Reports

Apple reported its fourth fiscal quarter earnings, revealing a revenue of

Microsoft also reported its fiscal second quarter earnings, with revenue of $51.7 billion, a 19% increase from the same period last year. The company's cloud computing division, Azure, saw particularly strong growth, with revenue jumping 50% year-over-year.

Sector Performance

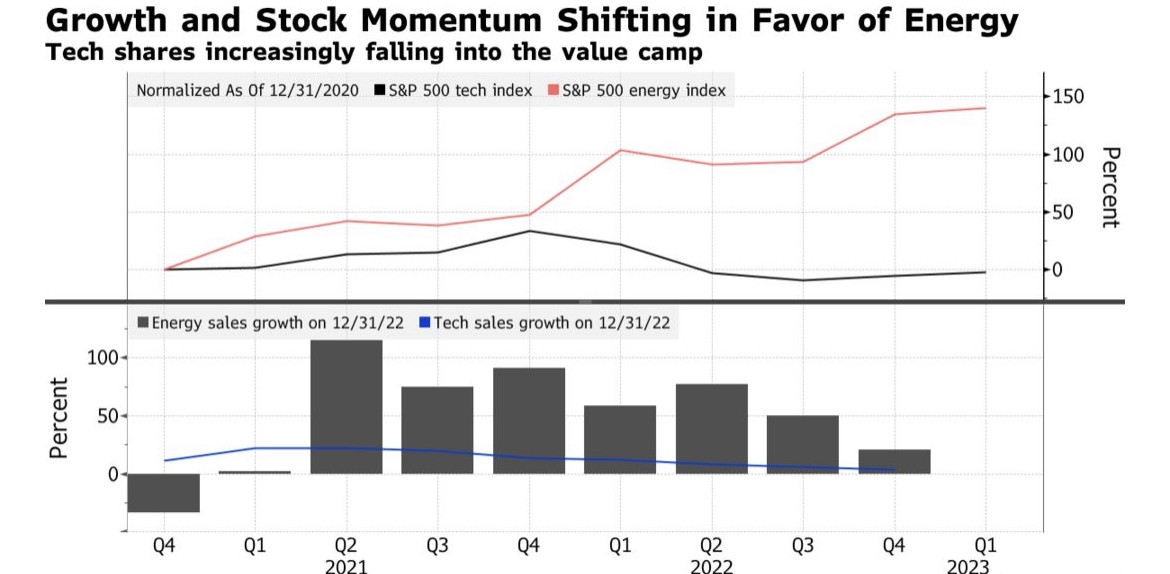

Technology stocks have been a major driver of the stock market's recent rally, with the Technology Select Sector SPDR Fund (XLK) up by 1.2% today. This sector has seen significant growth, largely due to the strong performance of companies like Apple, Microsoft, and Amazon (AMZN).

On the other hand, energy stocks have been under pressure, with the Energy Select Sector SPDR Fund (XLE) down by 0.8% today. This decline can be attributed to falling oil prices and concerns about rising production from OPEC+.

Market Outlook

Analysts are optimistic about the near-term outlook for the US stock market, citing strong economic data and corporate earnings. However, they also warn of potential risks, including rising inflation and geopolitical tensions.

Case Study: Tesla (TSLA)

Tesla (TSLA) has been a major mover in the stock market in recent months, with its share price skyrocketing. This surge can be attributed to several factors, including strong sales of its electric vehicles and positive reception of its new models, such as the Cybertruck.

Despite the company's rapid growth, some investors remain cautious, pointing to high valuations and potential regulatory hurdles. However, the overall outlook for Tesla remains bullish, with analysts forecasting continued growth in the coming years.

Conclusion

Today's US stock market saw a strong start, driven by strong earnings reports and positive economic data. While there are potential risks on the horizon, the overall outlook remains optimistic. As always, it's important for investors to stay informed and make decisions based on thorough analysis. Stay tuned to CNBC for the latest updates and insights.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....