In recent years, the allure of the US stock market has grown significantly among investors worldwide, including those in India. The US market is renowned for its robust economy, diverse sectors, and potentially high returns. But how can Indian investors tap into this lucrative opportunity? This article will guide you through the process of investing in the US stock market from India.

Understanding the Basics

Before diving into investments, it's crucial to understand the basics. The US stock market consists of two primary exchanges: the New York Stock Exchange (NYSE) and the Nasdaq. These exchanges list stocks of companies from various industries, including technology, healthcare, finance, and more.

Steps to Invest in the US Stock Market from India

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker. Many brokers offer services specifically tailored for international investors. Some popular options for Indian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Fund Your Account: Once your brokerage account is set up, you need to fund it. You can transfer funds from your Indian bank account to your US brokerage account using various methods like wire transfers, credit/debit cards, or electronic bank transfers.

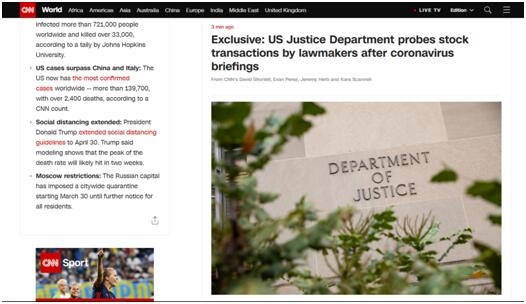

Understand Risk and Tax Implications: It's essential to be aware of the risks involved in investing in foreign markets. While the US stock market offers high potential returns, it also comes with higher volatility and risks. Additionally, Indian investors must consider tax implications when investing in the US market. The Foreign Account Tax Compliance Act (FATCA) requires US brokers to report the financial information of foreign clients to the IRS.

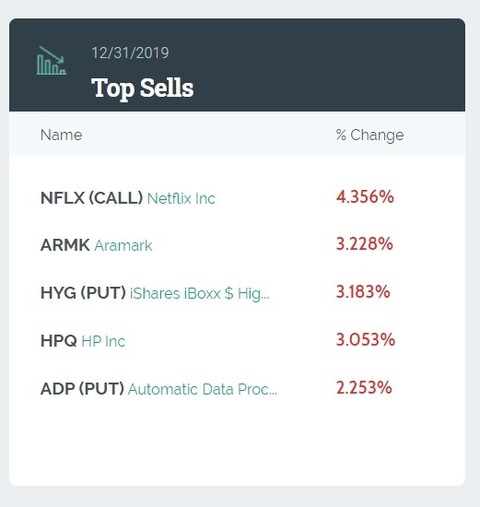

Research and Analyze: Like any investment, thorough research and analysis are crucial before investing in the US stock market. You can use financial news websites, stock analysis tools, and fundamental analysis techniques to identify promising stocks.

Invest: Once you've done your research, you can start investing. You can buy individual stocks or consider investing in a diversified portfolio through mutual funds or ETFs (Exchange-Traded Funds).

Case Study: Investing in Apple Inc.

Consider an Indian investor, Mr. Patel, who wants to invest in Apple Inc., a highly successful US tech company. Here's how he could do it:

- Open a Brokerage Account: Mr. Patel opens an account with a broker that offers access to the US stock market.

- Fund the Account: He transfers funds from his Indian bank account to his US brokerage account.

- Research and Analyze: Mr. Patel researches Apple Inc. and analyzes its financials, market position, and future growth prospects.

- Invest: Based on his analysis, Mr. Patel decides to buy Apple Inc. shares and places an order through his brokerage account.

By following these steps, Mr. Patel successfully invests in Apple Inc., potentially benefiting from its growth and success.

Conclusion

Investing in the US stock market from India is a viable and potentially lucrative option. By following the outlined steps, Indian investors can access this global market and potentially benefit from its growth. However, it's crucial to conduct thorough research, understand the risks, and consult with a financial advisor before making any investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....