In the ever-evolving world of finance, staying updated with the latest news about the US stock market is crucial for investors and traders alike. The stock market is a reflection of the economic health of a country, and understanding its trends can provide valuable insights into investment opportunities. In this article, we delve into the latest developments in the US stock market, analyzing key trends and providing a snapshot of the current landscape.

Stock Market Indexes

The Dow Jones Industrial Average, S&P 500, and NASDAQ Composite are three of the most closely watched indexes in the US stock market. As of the latest updates, the Dow Jones has been fluctuating, with investors weighing various factors such as inflation, interest rates, and corporate earnings. The S&P 500 has shown resilience, largely driven by strong performance from technology and healthcare sectors. Meanwhile, the NASDAQ Composite has experienced significant growth, particularly in the tech sector, which has been fueling the overall market's upward trend.

Tech Sector Leading the Charge

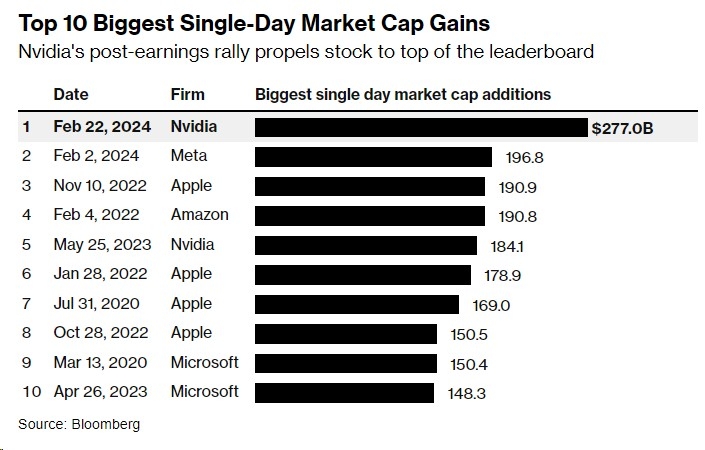

The tech sector has been a major driver of the US stock market's recent performance. Companies like Apple, Microsoft, and Amazon have seen their shares soar, contributing to the overall market's growth. The rise of remote work and digital transformation has further bolstered the tech sector, as businesses continue to invest in technology to adapt to the new normal. This trend is expected to continue, with tech companies likely to remain a key component of the US stock market's growth.

Economic Recovery and Corporate Earnings

The US economy has been gradually recovering from the impact of the COVID-19 pandemic. As businesses reopen and consumer confidence improves, corporate earnings have started to show positive trends. Many companies have reported better-than-expected earnings, which has helped to prop up the stock market. However, investors remain cautious about the potential for a second wave of infections and its impact on the economy.

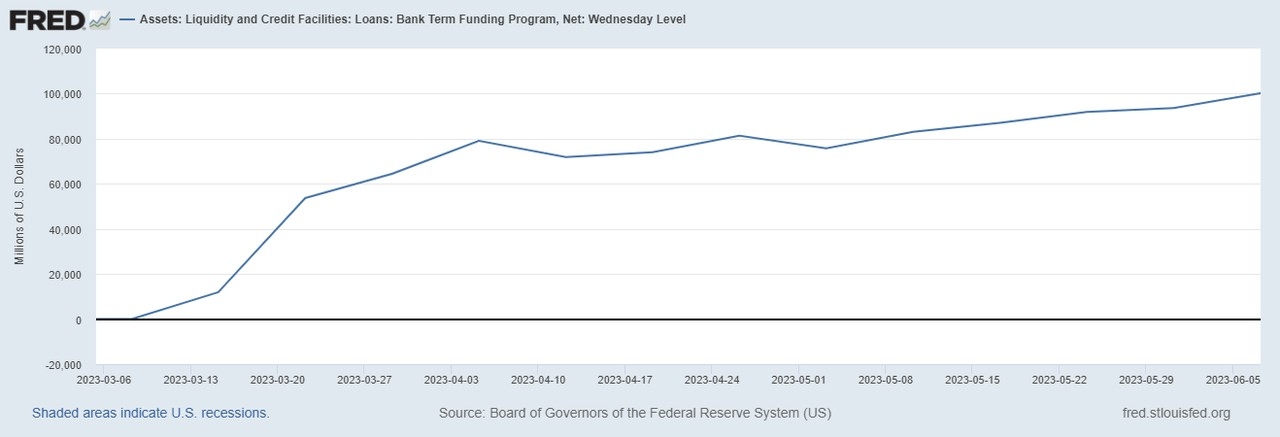

Inflation and Interest Rates

Inflation and interest rates remain key concerns for investors. The Federal Reserve has been closely monitoring inflation and has indicated that it will keep interest rates low to support the economy. However, rising inflation could pose challenges for the stock market, as it may lead to higher borrowing costs and reduce corporate profitability. Investors are closely watching the Fed's policy decisions and its impact on the stock market.

Case Study: Tesla's Stock Surge

One notable example of the stock market's volatility is the surge in Tesla's share price. The electric vehicle manufacturer has seen its stock soar in recent months, driven by strong demand for its products and positive news about its expansion plans. This case highlights the potential for high-growth companies to significantly impact the stock market.

Conclusion

The US stock market has been experiencing a mix of volatility and growth, with various factors influencing its performance. From the tech sector's dominance to economic recovery and inflation concerns, investors need to stay informed to make informed decisions. By keeping an eye on the latest news and trends, investors can navigate the complexities of the stock market and identify potential opportunities for growth.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....