In a surprising turn of events, a wave of analyst upgrades has swept through the US tech stock market, sending shares soaring and sparking optimism among investors. This surge in positive sentiment has been fueled by a combination of strong earnings reports, robust growth prospects, and favorable market conditions. Let's delve into the key factors driving this surge and examine some of the most notable upgrades.

Analyst Upgrades: A Sign of Confidence

Analyst upgrades are a clear sign that experts have high expectations for a company's future performance. These upgrades often come after a thorough analysis of a company's financials, market position, and growth prospects. In the case of US tech stocks, several key factors have contributed to this wave of upgrades:

- Strong Earnings Reports: Many tech companies have reported strong earnings in recent quarters, beating market expectations. This has led analysts to reassess their growth projections and become more bullish on these stocks.

- Robust Growth Prospects: The tech industry is known for its rapid growth and innovation. Many companies are investing heavily in research and development, which is expected to drive future growth and profitability.

- Favorable Market Conditions: The overall market conditions have been favorable for tech stocks, with low interest rates and strong economic growth. This has made it easier for tech companies to raise capital and expand their operations.

Notable Upgrades

Several tech stocks have received significant upgrades in recent months. Here are some of the most notable examples:

- Apple Inc. (AAPL): Analysts have upgraded Apple's stock multiple times, citing strong demand for its products and a robust services business. The company's recent earnings report showed that revenue from services grew by 18% year-over-year.

- Microsoft Corporation (MSFT): Microsoft has been a favorite among analysts, who have upgraded its stock on the back of strong cloud computing growth and a strong enterprise business. The company's recent earnings report showed that cloud services revenue grew by 25% year-over-year.

- Amazon.com, Inc. (AMZN): Amazon has been upgraded by several analysts, who are impressed with its strong growth in cloud computing and digital advertising. The company's recent earnings report showed that revenue from Amazon Web Services (AWS) grew by 29% year-over-year.

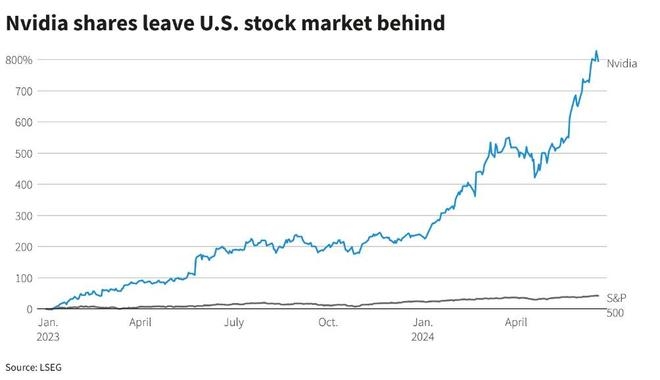

Case Study: NVIDIA Corporation (NVDA)

One of the most dramatic upgrades in recent months came from NVIDIA Corporation (NVDA). The company, which specializes in graphics processing units (GPUs), was upgraded from "hold" to "buy" by several analysts. This upgrade was driven by strong demand for GPUs in the gaming and data center markets, as well as the company's expansion into new areas such as autonomous vehicles and artificial intelligence.

The upgrade came just weeks before NVIDIA's earnings report, which showed that revenue grew by 49% year-over-year. This report further validated the analysts' optimism, and NVIDIA's stock soared to new highs.

Conclusion

The recent wave of analyst upgrades for US tech stocks is a strong signal that investors should be optimistic about the future of this sector. With strong earnings, robust growth prospects, and favorable market conditions, these stocks are poised to continue their upward trajectory. As always, investors should conduct their own due diligence before making any investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....