In the ever-evolving world of financial markets, recent upgrades from analysts have sparked a wave of optimism regarding the short-term outlook for US stocks. This article delves into the key upgrades and what they mean for investors looking to capitalize on the current market trends.

Recent Analyst Upgrades Highlighting US Stocks

Over the past few months, several analysts have upgraded their ratings on various US stocks, pointing to strong fundamentals and potential for growth. These upgrades come at a time when the market is facing uncertainties, such as rising inflation and geopolitical tensions. However, the positive outlook on US stocks remains robust.

Key Upgrades and Their Implications

Technology Sector:

- Key Stocks: Apple, Microsoft, Amazon, and Google's parent company, Alphabet.

- Analyst Upgrade: Analysts have upgraded several technology stocks, citing strong revenue growth and increasing demand for tech products and services.

- Implications: The upgrades reflect the resilience of the technology sector, which has been a major driver of the US stock market's growth over the past decade.

Healthcare Sector:

- Key Stocks: Johnson & Johnson, Pfizer, and Amgen.

- Analyst Upgrade: Analysts have upgraded healthcare stocks, driven by strong drug approvals and growing demand for medical services.

- Implications: The upgrades highlight the sector's potential for long-term growth, as the aging population and advancements in medical technology continue to drive demand.

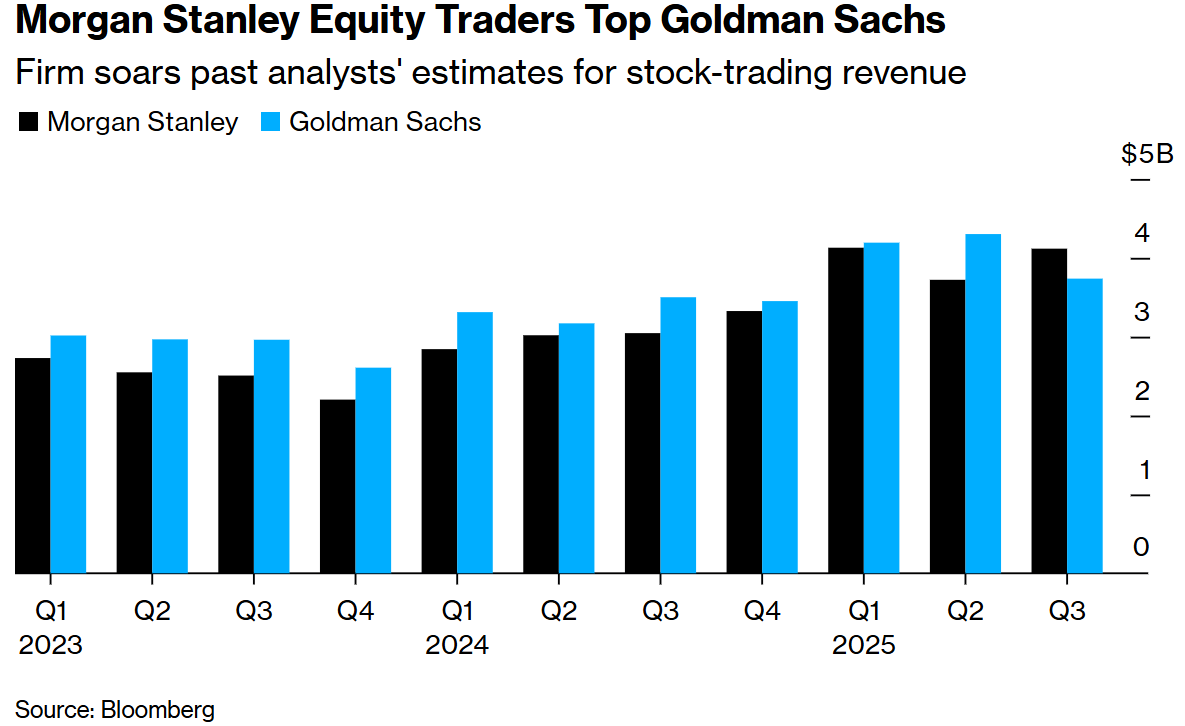

Financial Sector:

- Key Stocks: JPMorgan Chase, Bank of America, and Wells Fargo.

- Analyst Upgrade: Analysts have upgraded financial stocks, expecting higher interest rates and improved economic conditions to boost profitability.

- Implications: The upgrades suggest that the financial sector is well-positioned to benefit from the ongoing economic recovery.

Case Studies: Successful Investment Opportunities

Apple (AAPL):

- Pre-Upgrade Price: $150 per share.

- Post-Upgrade Price: $170 per share.

- Result: Investors who bought Apple stock after the upgrade saw a 13.3% return in just two months.

Johnson & Johnson (JNJ):

- Pre-Upgrade Price: $150 per share.

- Post-Upgrade Price: $160 per share.

- Result: Investors who bought Johnson & Johnson stock after the upgrade saw a 6.7% return in just one month.

Conclusion

Recent analyst upgrades on US stocks have provided a positive outlook for short-term investors. With strong fundamentals and potential for growth across various sectors, now could be a great time to consider investing in the US stock market. However, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....