Introduction

The S&P 500 Index, often referred to as the "Golden Standard" of the U.S. stock market, is a bellwether for the overall performance of the American economy. In this article, we delve into the performance of the S&P 500 Index, analyzing its trajectory over the years, and examining key factors that influence its ups and downs.

Historical Performance

Since its inception in 1957, the S&P 500 has grown to become one of the most widely followed stock market indices in the world. Over the past six decades, the index has delivered an average annual return of around 10%, making it a compelling investment vehicle for both individual investors and institutional investors alike.

In the 1980s and 1990s, the S&P 500 experienced a bull market, with its value more than tripling. This period was marked by significant technological advancements, low interest rates, and favorable economic policies. Notable peaks were reached in 1999 and 2000, just before the dot-com bubble burst.

The following decade, the index faced several challenges, including the 2008 financial crisis. Despite these challenges, the S&P 500 managed to recover and reach new highs by 2013. Since then, the index has continued to grow, with numerous all-time highs recorded.

Influential Factors

Several factors have contributed to the performance of the S&P 500 Index. Here are some of the key influencers:

- Economic Growth: A strong economy generally leads to higher corporate earnings, which in turn boosts the index's performance.

- Interest Rates: Low interest rates encourage borrowing and investment, which can drive stock prices higher.

- Technological Advancements: The rise of technology companies, such as Apple, Amazon, and Microsoft, has played a significant role in the index's growth.

- Monetary Policy: The Federal Reserve's monetary policy, including interest rate adjustments and quantitative easing, has had a profound impact on the stock market.

- Political Stability: A stable political environment fosters investor confidence and can lead to higher stock prices.

Case Studies

To illustrate the influence of these factors, let's examine a few case studies:

- The Tech Bubble (1999-2000): During this period, the S&P 500's tech-heavy composition, driven by companies like Cisco and Oracle, experienced explosive growth. However, the bubble burst in 2000, leading to significant declines in the index.

- The Financial Crisis (2008): The S&P 500 plummeted during the financial crisis, losing nearly half of its value. However, it quickly recovered and reached new highs by 2013.

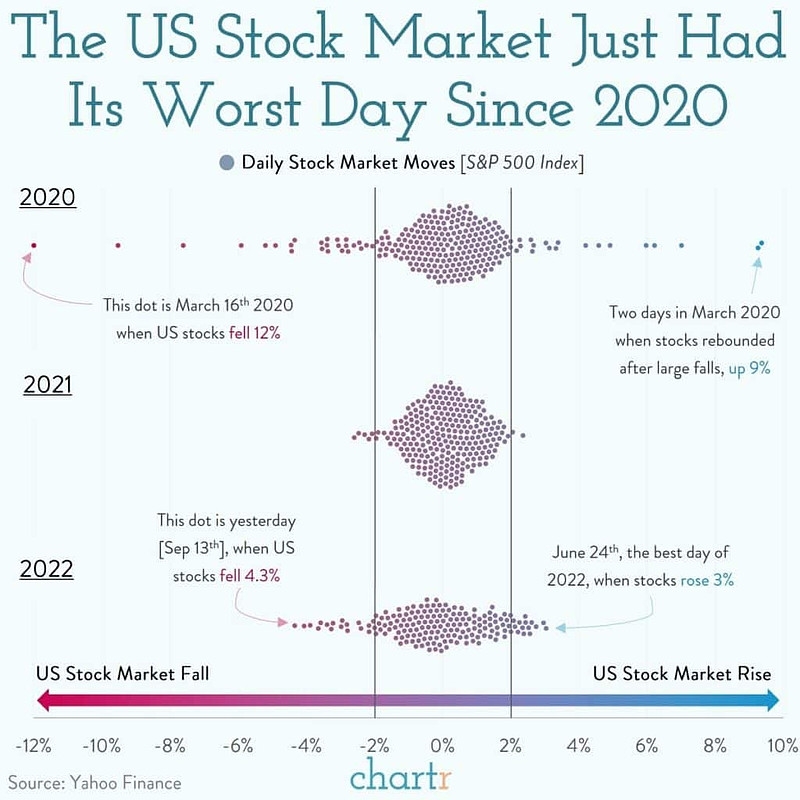

- The COVID-19 Pandemic (2020): Despite the global economic downturn caused by the pandemic, the S&P 500 managed to recover quickly, driven by strong performance from tech companies and other sectors.

Conclusion

The S&P 500 Index has been a reliable indicator of the U.S. stock market's performance over the years. Its growth has been influenced by a variety of factors, including economic growth, interest rates, and technological advancements. By understanding these factors, investors can better gauge the index's potential for future performance.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....