Recent Developments and Their Impact on the Markets

In a surprising turn of events, the stock markets have experienced a steep decline, primarily attributed to the confusion surrounding the trade relationship between the United States and Canada. The uncertainty has sparked fears among investors, leading to a sell-off in various sectors. This article delves into the details of this situation, examining the key factors contributing to the market plunge and their potential long-term implications.

Trade Negotiations and the Underlying Issues

The trade confusion between the United States and Canada stems from ongoing negotiations over trade agreements. President Biden and Prime Minister Trudeau have been working tirelessly to resolve the issues at hand, but the process has been fraught with challenges. Key sticking points include concerns over agricultural tariffs and intellectual property rights.

The United States has imposed tariffs on Canadian dairy products, a move that has significantly impacted the agricultural sector in Canada. Canadian farmers are now facing difficulties in accessing the US market, leading to a surplus of dairy products within the country. This situation has raised concerns about the sustainability of the Canadian agricultural industry and its impact on the overall economy.

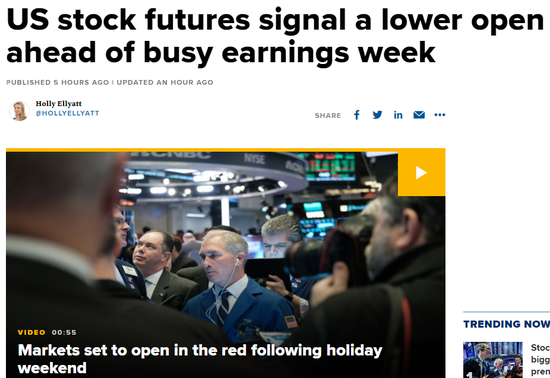

Impact on the Stock Markets

The uncertainty surrounding the trade negotiations has had a profound impact on the stock markets. Investors are worried about the potential for a trade war, which could lead to higher prices for goods and services and a decrease in corporate profits. The Dow Jones Industrial Average, S&P 500, and NASDAQ Composite have all experienced significant declines in recent weeks, reflecting the growing concerns among investors.

Key Factors Contributing to the Market Plunge

Several factors have contributed to the market plunge due to the trade confusion:

- Uncertainty: The lack of clarity in the trade negotiations has created uncertainty, making it difficult for investors to make informed decisions.

- Economic Impact: The potential for a trade war and the resulting economic implications have led to concerns about the overall health of the economy.

- Sector-Specific Impact: Certain sectors, such as agriculture and manufacturing, have been hit particularly hard due to the trade disputes.

Case Studies

To illustrate the impact of the trade confusion on the stock markets, let's look at a couple of case studies:

- Dairy Sector: The dairy sector has been one of the hardest-hit sectors. Canadian dairy companies such as AgriMarine Corporation and Agropur Inc. have seen their stocks decline significantly in recent weeks due to the trade disputes.

- Automotive Industry: The automotive industry, which is heavily reliant on trade between the United States and Canada, has also been affected. General Motors and Ford Motor Company, for example, have seen their stocks decline as concerns about the trade negotiations have grown.

Conclusion

The trade confusion between the United States and Canada has caused significant disruptions in the stock markets. While the situation remains fluid, investors are closely monitoring the developments and their potential impact on the economy. As negotiations continue, it remains to be seen whether a resolution can be reached to stabilize the markets and restore investor confidence.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....