In the ever-evolving world of technology and finance, staying informed about the stock market is crucial. One of the key players in the tech industry, Tencent, has made a significant impact on the global stage. This article delves into the details of Tencent’s US stock ticker, TCEHY, providing investors with essential insights and information.

Understanding TCEHY: The Tencent US Stock Ticker

Tencent, a Chinese multinational technology company, has a stock ticker symbol TCEHY on the New York Stock Exchange (NYSE). This ticker represents Tencent’s American Depositary Shares (ADS), which are US-listed shares that represent ownership in the company’s Hong Kong-listed shares.

Why Invest in TCEHY?

1. Strong Market Presence: Tencent is one of the largest technology companies in the world, with a diverse portfolio of businesses, including social media, gaming, e-commerce, and digital payments. This extensive presence makes it an attractive investment for those looking to capitalize on the global tech industry’s growth.

2. Diversification: By investing in TCEHY, investors can gain exposure to the fast-growing Chinese market, which is home to a significant portion of the world’s internet users. This diversification can help reduce risk in their investment portfolio.

3. High Revenue Growth: Tencent has consistently demonstrated strong revenue growth over the years, driven by its successful business models and innovative products. This has made it an appealing investment for long-term growth potential.

How to Invest in TCEHY

Investing in TCEHY is relatively straightforward. Here’s a step-by-step guide to help you get started:

Open a Brokerage Account: To buy TCEHY, you’ll need a brokerage account. Choose a reputable brokerage firm that offers access to the NYSE and supports trading in US-listed stocks.

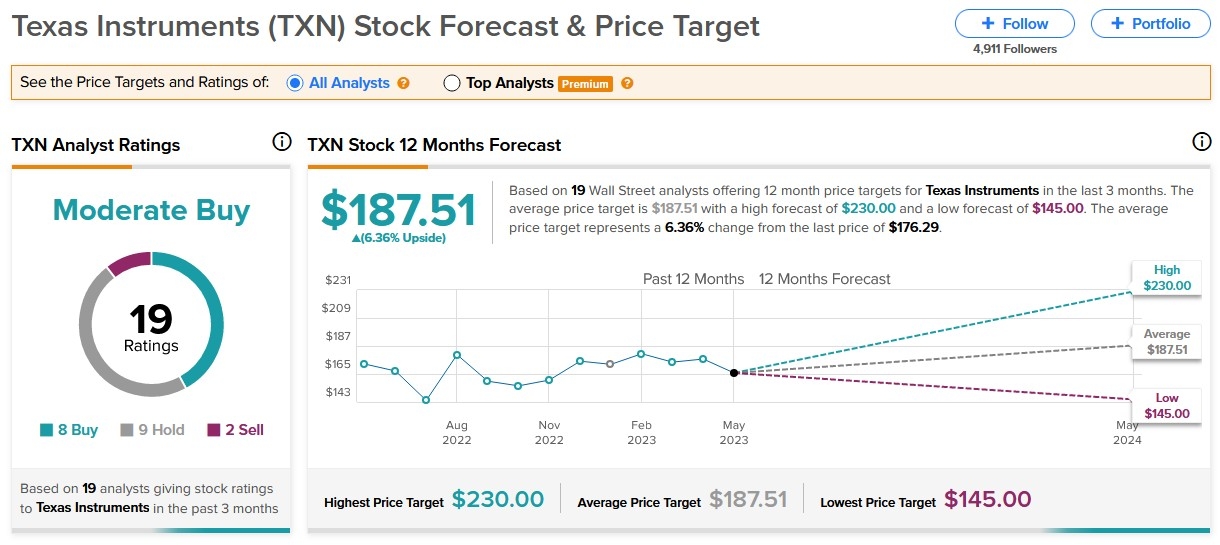

Research and Analyze: Before investing, it’s essential to research and analyze Tencent’s financials, market trends, and competitive landscape. This will help you make an informed decision.

Place Your Order: Once you’ve done your research, you can place your order to buy TCEHY through your brokerage account. You can choose to buy a specific number of shares or a specific dollar amount.

Monitor Your Investment: After purchasing TCEHY, it’s crucial to monitor your investment regularly. Stay updated on market trends, company news, and economic indicators that may impact the stock.

Key Risks of Investing in TCEHY

While investing in TCEHY offers numerous benefits, it’s important to be aware of the risks involved:

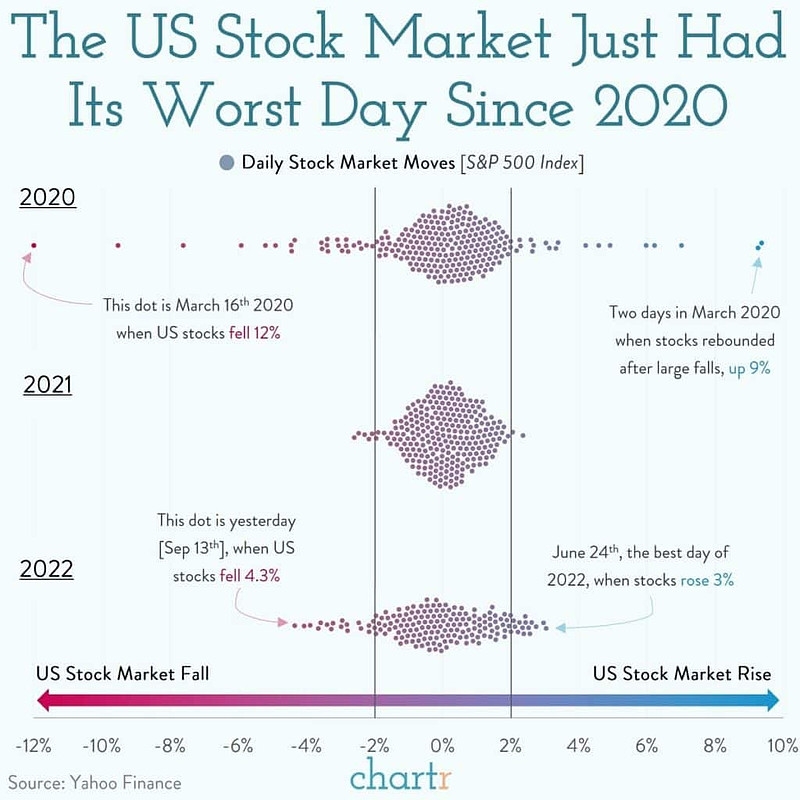

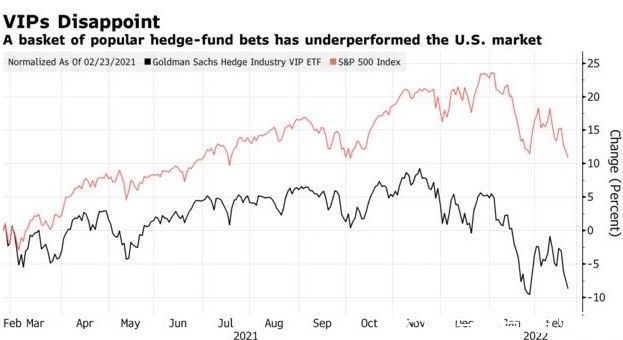

Market Volatility: The stock market can be unpredictable, and TCEHY is no exception. Its stock price can fluctuate significantly based on market conditions and company performance.

Regulatory Risks: As a Chinese company, Tencent is subject to regulatory risks and political tensions between the US and China. These factors can impact the company’s operations and stock price.

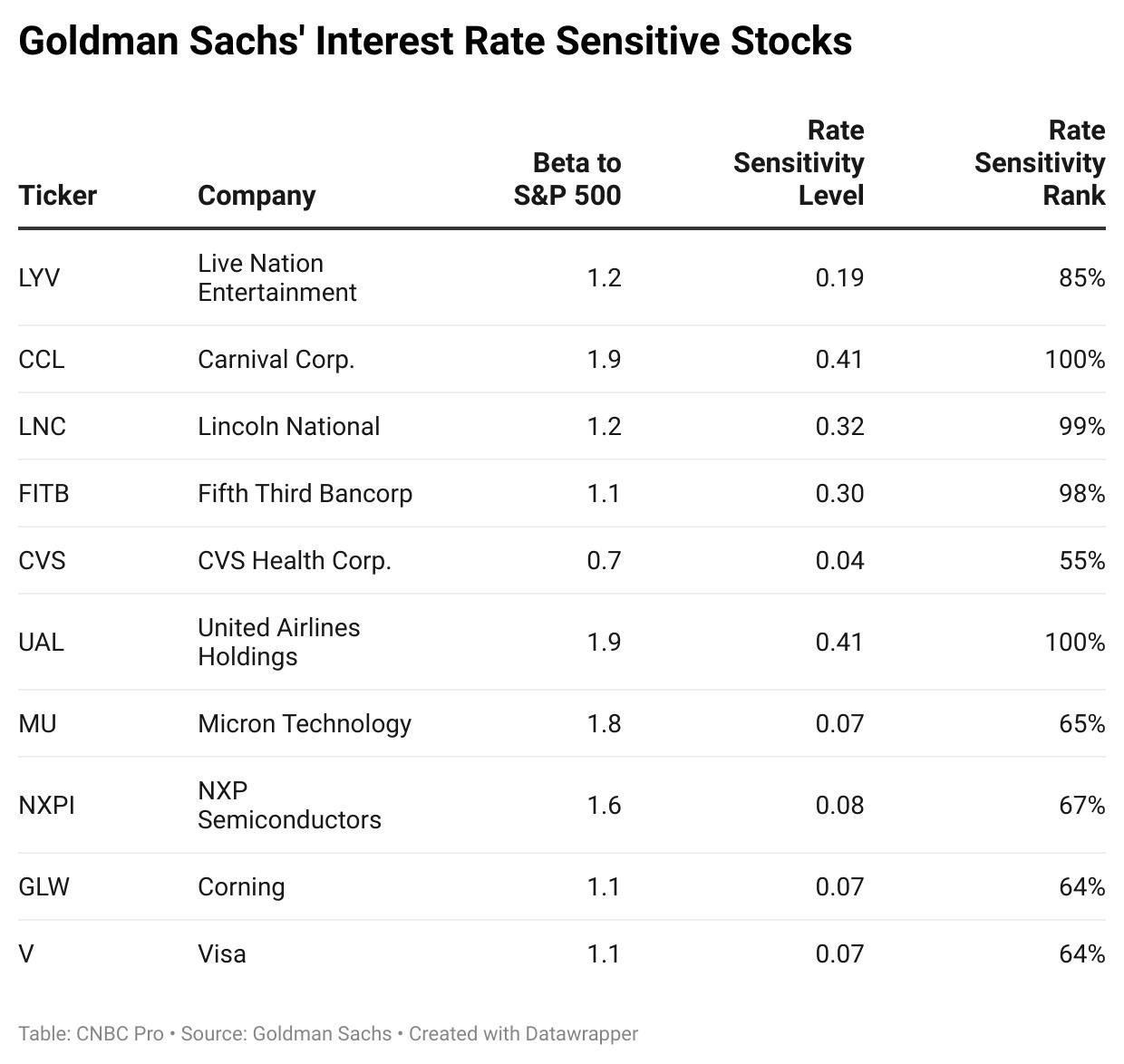

Economic Factors: Economic downturns, currency fluctuations, and other global economic factors can also affect TCEHY’s performance.

Conclusion

Tencent’s US stock ticker, TCEHY, offers investors a unique opportunity to invest in one of the world’s leading technology companies. By understanding the risks and rewards associated with TCEHY, investors can make informed decisions and potentially capitalize on the company’s strong market presence and growth potential.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....