In today's fast-paced world, managing your finances effectively is crucial for achieving financial stability and security. Understanding your financial needs is the first step towards creating a solid financial foundation. This article delves into the essential aspects of financial needs, providing you with actionable insights to help you navigate the complexities of managing your money.

What Are Financial Needs?

Financial needs refer to the specific monetary requirements that individuals or businesses have at a given time. These needs can vary widely and include expenses such as rent, utilities, groceries, healthcare, education, and more. Understanding your financial needs involves identifying your current and future obligations, as well as your goals and aspirations.

Identifying Your Financial Needs

Assess Your Current Financial Situation

- Start by reviewing your income, expenses, and savings. This will give you a clear picture of your financial standing.

- Example: John, a 30-year-old software engineer, recently assessed his financial situation and discovered that he spends more on dining out than he anticipated.

Determine Your Short-Term and Long-Term Goals

- Short-term goals may include paying off credit card debt or saving for a vacation.

- Long-term goals may include buying a house, planning for retirement, or starting a business.

- Example: Sarah, a 25-year-old teacher, aims to save

10,000 for her wedding in two years and 50,000 for her retirement in 30 years.

Calculate Your Expenses

- Track your monthly expenses, categorizing them into fixed and variable costs.

- Example: Mark, a 40-year-old lawyer, found that his monthly expenses include

1,200 for rent, 400 for utilities, and $300 for groceries.

Create a Budget

- Based on your income, expenses, and goals, create a realistic budget that allocates funds to your financial needs.

- Example: Emily, a 35-year-old nurse, created a budget that allocates

1,200 for rent, 400 for utilities,300 for groceries, and 200 for savings each month.

Strategies for Managing Your Financial Needs

Prioritize Your Expenses

- Tackle high-priority expenses first, such as rent, utilities, and groceries.

- Example: Instead of spending $50 on a new outfit, prioritize paying off your credit card debt.

Save Regularly

- Establish an emergency fund to cover unexpected expenses.

- Example: Tom, a 45-year-old accountant, saved $5,000 for his emergency fund.

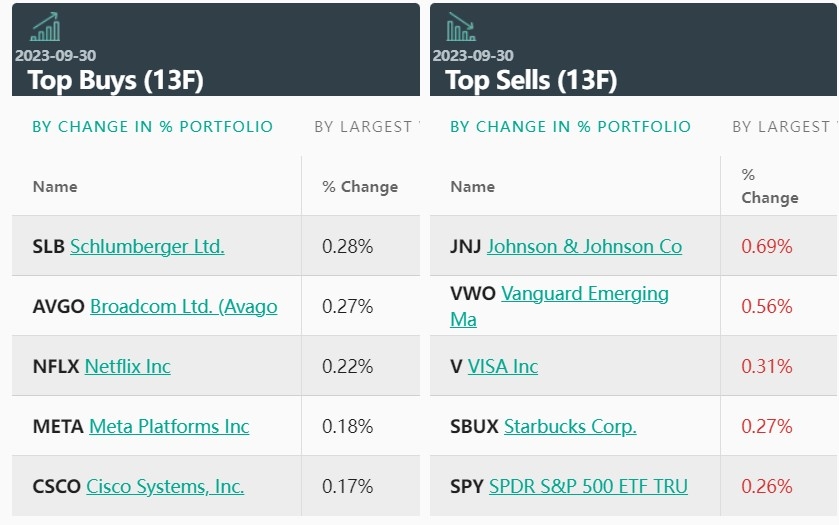

Invest Wisely

- Consider investing in stocks, bonds, or real estate to grow your wealth.

- Example: Jane, a 50-year-old financial advisor, invested a portion of her savings in a diversified portfolio.

Seek Professional Advice

- Consult with a financial advisor to gain insights on managing your financial needs effectively.

- Example: Michael, a 55-year-old retiree, sought advice from a financial advisor to ensure his retirement savings were on track.

In conclusion, understanding your financial needs is crucial for achieving financial stability and security. By assessing your current financial situation, setting goals, creating a budget, and implementing strategies to manage your expenses and investments, you can take control of your financial future. Remember, the key to financial success lies in taking informed and proactive steps to meet your financial needs.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....