In today's interconnected global economy, the stock markets worldwide have become a pivotal barometer of economic health and investor sentiment. From the bustling New York Stock Exchange to the dynamic Tokyo Stock Exchange, the impact of stock market movements can be felt across the globe. This article delves into the key factors influencing stock markets worldwide, the role of global events, and the strategies investors use to navigate these complex markets.

Global Economic Interdependence

The stock markets of the world are inextricably linked by the global economy. Economic indicators, trade policies, and geopolitical events in one region can have ripple effects on markets across the globe. For instance, the European Central Bank's monetary policy decisions can influence stock prices in the U.S. and vice versa.

Major Stock Exchanges and Their Influence

The major stock exchanges, such as the New York Stock Exchange (NYSE), the Tokyo Stock Exchange (TSE), the London Stock Exchange (LSE), and the Shanghai Stock Exchange (SSE), play a crucial role in shaping global markets. Each exchange reflects the economic and cultural nuances of its home country, yet all are interconnected through global financial networks.

Key Factors Influencing Stock Markets

Several factors can influence stock market performance worldwide:

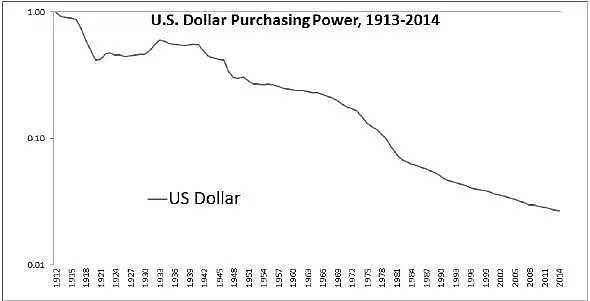

- Economic Indicators: Data such as GDP growth rates, unemployment rates, and inflation rates can significantly impact investor confidence and stock prices.

- Central Bank Policies: The actions of central banks, including interest rate decisions, can influence borrowing costs and, consequently, stock market valuations.

- Geopolitical Events: Conflicts, elections, and policy changes in major economies can create uncertainty and volatility in stock markets.

- Technological Advancements: Breakthroughs in technology can lead to new market opportunities and disrupt traditional industries, impacting stock prices.

Global Events and Their Impact

Global events can have a profound impact on stock markets. For example, the COVID-19 pandemic caused a significant downturn in global markets, leading to a sharp decline in stock prices. Similarly, the 2008 financial crisis had a lasting effect on the global economy and stock markets.

Investor Strategies

Investors use various strategies to navigate the complexities of the global stock markets:

- Diversification: Spreading investments across different asset classes, sectors, and geographical regions can help mitigate risks.

- Risk Management: Utilizing stop-loss orders, hedging, and diversification can help protect investments during market downturns.

- Technical and Fundamental Analysis: Investors use technical analysis to predict market movements based on price and volume patterns, while fundamental analysis focuses on the intrinsic value of a stock.

Case Study: The Tech Sector's Impact on Global Markets

The technology sector has been a significant driver of stock market growth worldwide. Companies like Apple, Microsoft, and Google have seen their share prices soar, reflecting the sector's importance. However, the tech sector is also subject to rapid innovation and regulatory changes, which can create both opportunities and risks for investors.

In conclusion, understanding the dynamics of stock markets worldwide is crucial for investors and market participants alike. By staying informed about global economic indicators, central bank policies, and geopolitical events, investors can better navigate the complexities of the global stock markets and make informed investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....