As the sun dipped below the horizon on August 29, 2025, the US stock market closed another tumultuous trading day. The market saw a mix of ups and downs, with several key sectors and individual stocks making significant moves. Here's a comprehensive summary of the day's events.

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA) closed slightly higher on the day, ending at 30,845.75. The index was propelled by gains in tech and energy stocks, which offset losses in financials and consumer discretionary sectors.

NASDAQ Composite: The NASDAQ Composite index, which tracks technology stocks, ended the day lower at 11,895.23. The tech sector faced pressure from concerns about rising inflation and a potential slowdown in economic growth.

S&P 500: The S&P 500 index, a broad measure of the US stock market, closed marginally lower at 3,795.12. The index was impacted by a sell-off in communication services and consumer discretionary stocks.

Key Sector Moves:

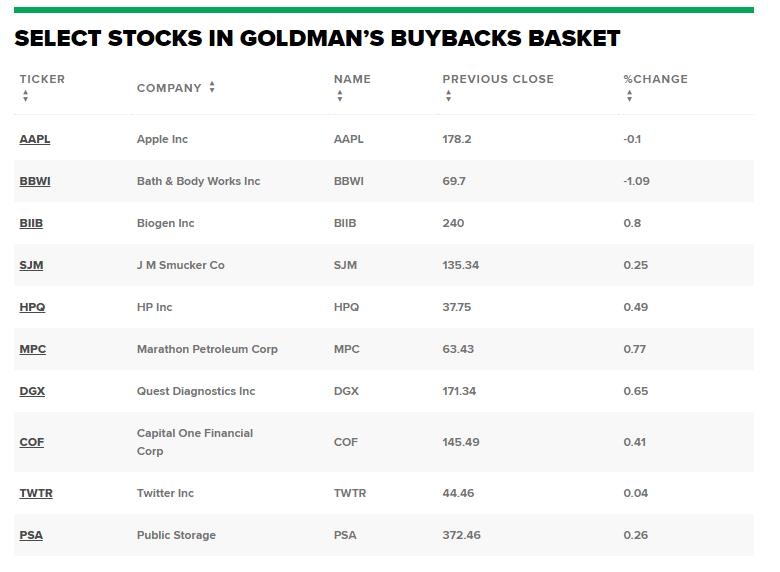

- Technology: The technology sector saw mixed results. Large-cap tech stocks like Apple (AAPL) and Microsoft (MSFT) closed higher, while semiconductor stocks like NVIDIA (NVDA) and AMD (AMD) ended the day lower.

- Energy: The energy sector was a bright spot, with oil and gas stocks leading the charge. Exxon Mobil (XOM) and Chevron (CVX) closed higher on the day.

- Financials: The financial sector struggled, with banks and insurance companies leading the decline. JPMorgan Chase (JPM) and Wells Fargo (WFC) closed lower.

Individual Stock Highlights:

- Apple (AAPL): The tech giant closed higher, benefiting from strong iPhone sales and a rise in its stock price.

- Exxon Mobil (XOM): The oil and gas giant closed higher, driven by rising oil prices.

- NVIDIA (NVDA): The semiconductor stock closed lower, as concerns about supply chain disruptions weighed on the sector.

Market Analysis:

The US stock market faced a challenging day as investors grappled with rising inflation, slowing economic growth, and geopolitical tensions. Despite the volatility, the market managed to end the day with modest gains.

Rising Inflation: The latest inflation data showed that consumer prices rose at an annual rate of 5.4% in July, the highest level since 2008. This has raised concerns about the Federal Reserve's ability to control inflation without causing a recession.

Slowing Economic Growth: There are growing concerns that the US economy may be slowing down. Recent economic data, including retail sales and manufacturing activity, has shown signs of weakness.

Geopolitical Tensions: Tensions between the US and China continue to escalate, with trade disputes and technology restrictions at the forefront. These tensions have raised concerns about global economic stability.

Conclusion:

The US stock market closed the day with a mix of ups and downs, reflecting the complex economic environment. Investors will continue to monitor key economic indicators and geopolitical developments in the coming weeks.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....