Are you an investor in Europe looking to diversify your portfolio with US stocks? If so, you've come to the right place. Investing in US stocks from Europe can be a lucrative opportunity, but it's essential to understand the process and potential challenges. This guide will provide you with everything you need to know about buying US stocks from Europe, including the benefits, risks, and step-by-step instructions.

Understanding the Benefits

1. Diversification: Investing in US stocks allows you to diversify your portfolio and reduce your exposure to the European market. The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities.

2. Access to Top Companies: The US stock market is home to many of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon. Investing in these companies can provide you with exposure to some of the most innovative and profitable businesses globally.

3. Strong Regulatory Framework: The US has a strong regulatory framework that protects investors and ensures fair and transparent markets. This can provide you with peace of mind when investing in US stocks.

Understanding the Risks

1. Currency Fluctuations: Investing in US stocks from Europe means you'll be exposed to currency fluctuations. If the US dollar strengthens against the Euro, your returns in Euros may be reduced.

2. Tax Implications: Tax laws vary between countries, so it's essential to understand the tax implications of investing in US stocks from Europe. You may need to pay taxes in both the US and your home country.

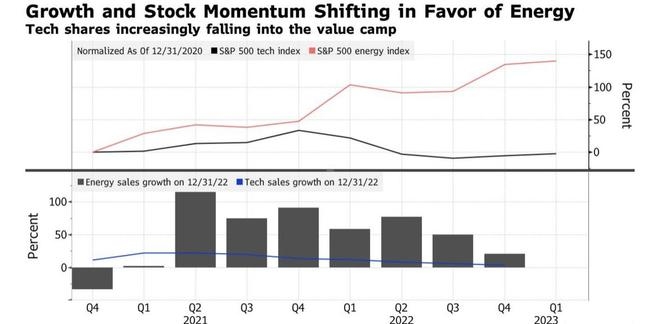

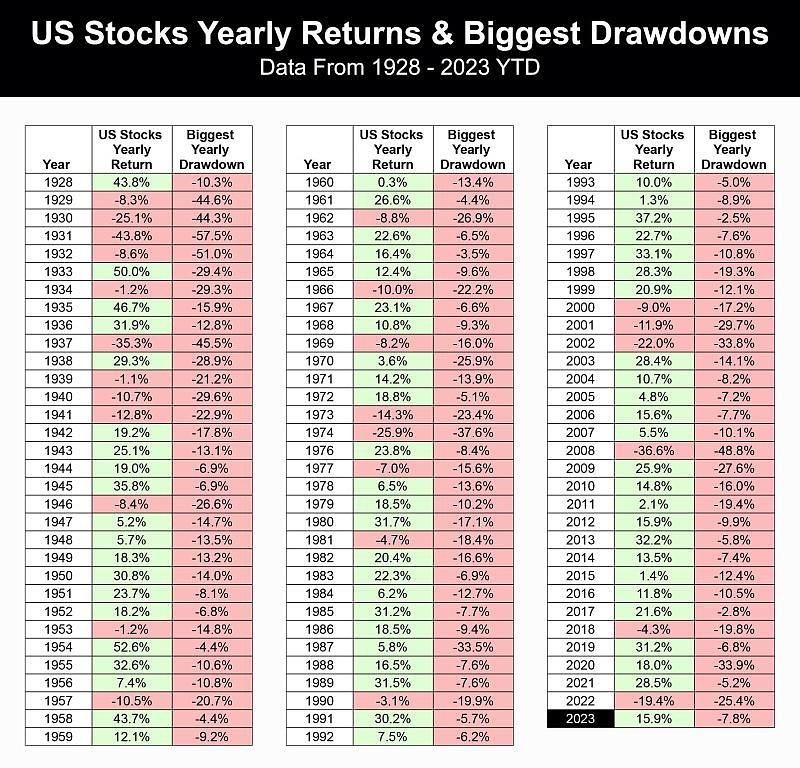

3. Market Volatility: The US stock market can be volatile, and investing in individual stocks carries inherent risks. It's crucial to do thorough research and understand the risks associated with each investment.

Step-by-Step Guide to Buying US Stocks from Europe

1. Open a Brokerage Account: The first step is to open a brokerage account with a US-based brokerage firm. Many online brokers, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer accounts for international investors.

2. Fund Your Account: Once your account is open, you'll need to fund it with US dollars. You can do this by transferring funds from your European bank account or using a wire transfer.

3. Research and Select Stocks: Research the companies you're interested in and select the ones that align with your investment goals and risk tolerance. You can use financial websites, news outlets, and stock market analysis tools to gather information.

4. Place Your Order: Once you've selected your stocks, you can place your order through your brokerage account. You can choose to buy shares of individual companies or invest in a mutual fund or ETF that tracks a specific index.

5. Monitor Your Investments: After placing your order, it's essential to monitor your investments regularly. Keep an eye on the market, company news, and economic indicators that may affect your investments.

Case Study: Investing in Apple from Europe

Let's say you're an investor in Europe looking to invest in Apple (AAPL). You open a brokerage account with a US-based broker, fund your account, and research Apple's financials and market trends. After analyzing the information, you decide to purchase 100 shares of Apple at

Conclusion

Buying US stocks from Europe can be a rewarding investment opportunity, but it's essential to understand the process and potential risks. By following this guide, you can successfully invest in US stocks from Europe and diversify your portfolio. Remember to do thorough research, understand the risks, and monitor your investments regularly.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....