The year 2025 is shaping up to be a pivotal one for the US stock market. With the global economy gradually recovering from the pandemic, investors are keen to understand the current market outlook for US stocks. This article delves into the key trends, factors, and predictions that are likely to influence the US stock market in the coming years.

Economic Recovery and Growth

One of the primary factors shaping the current market outlook is the ongoing economic recovery. The US economy is expected to grow at a moderate pace, driven by factors such as increased consumer spending, business investment, and technological advancements. According to the US Treasury Department, the GDP growth rate is projected to be around 2.5% in 2025.

Sector Performance

Different sectors are expected to perform differently in the coming years. The technology sector, which has been a major driver of the US stock market, is likely to continue its strong performance. Companies like Apple, Microsoft, and Google are expected to benefit from increased demand for their products and services. Additionally, the healthcare sector is expected to see significant growth, driven by advancements in medical technology and the aging population.

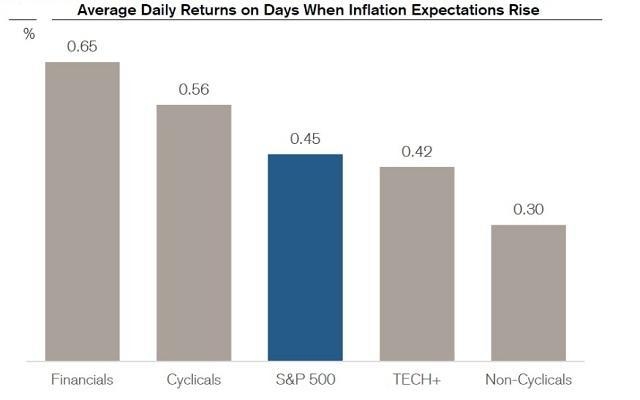

Impact of Inflation

Inflation remains a key concern for investors. While the Federal Reserve has taken steps to control inflation, it is still a factor that could impact the stock market. High inflation can lead to lower corporate profits and higher interest rates, which can negatively impact stocks. However, some sectors, such as energy and consumer discretionary, may benefit from higher prices.

Regulatory Changes

Regulatory changes are also likely to play a significant role in shaping the current market outlook. The US government has been increasingly focused on regulating tech giants and other large companies. These changes could impact the performance of companies in the technology and healthcare sectors.

Global Factors

Global factors, such as trade tensions and geopolitical events, can also impact the US stock market. While the US and China have been engaged in a trade war, there are signs that the two countries may be moving towards a resolution. This could have a positive impact on the stock market, particularly for companies that have a significant presence in both countries.

Case Study: Tesla

A notable case study is Tesla, the electric vehicle manufacturer. Despite facing challenges such as production delays and regulatory hurdles, Tesla has remained a strong performer in the stock market. This is due to its innovative technology and strong brand presence. As the world moves towards sustainable energy, Tesla is well-positioned to benefit from this trend.

Conclusion

The current market outlook for US stocks in 2025 is shaped by a combination of economic recovery, sector performance, inflation, regulatory changes, and global factors. While there are risks and uncertainties, the overall outlook remains positive. Investors should stay informed and be prepared to adapt to changing market conditions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....