As the year 2018 came to a close, investors around the world were keen to know how the US stock market fared during the final months of the year. The year was marked by a rollercoaster of events, including trade tensions, political uncertainties, and economic data releases. In this article, we will delve into the key factors that influenced the US stock market in 2018 and how it ended the year.

Trade Tensions and Global Uncertainties

One of the major factors that impacted the US stock market in 2018 was the escalating trade tensions between the United States and its major trading partners, particularly China. The imposition of tariffs on goods imported from China and retaliatory measures by the Chinese government created uncertainty and volatility in the markets.

The uncertainty surrounding trade negotiations between the two countries led to a sell-off in the stock market, particularly in sectors that were heavily reliant on international trade. Technology and automotive stocks were among the hardest hit, as they are particularly sensitive to global supply chains.

Political Uncertainties and Market Volatility

Another significant factor that influenced the US stock market in 2018 was the political uncertainties at home and abroad. The US midterm elections, Brexit negotiations, and the Italian government's budget dispute all added to the market's volatility.

Economic Data and Corporate Earnings

Despite the challenges, the US economy showed resilience in 2018. Economic data releases, such as job creation, consumer spending, and industrial production, remained strong throughout the year. Additionally, corporate earnings reports were generally positive, with many companies exceeding analyst expectations.

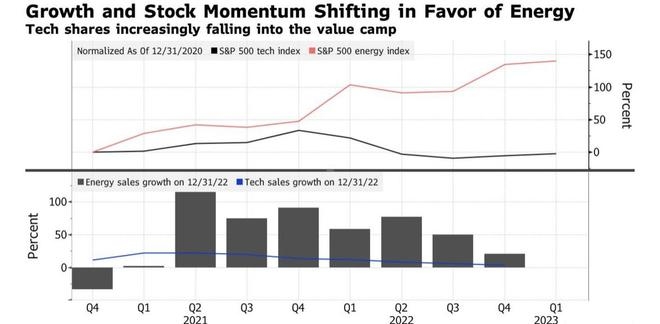

However, some sectors, such as energy and financials, struggled due to various factors, including low oil prices and rising interest rates. Technology stocks, on the other hand, continued to dominate the market, with companies like Apple, Microsoft, and Amazon leading the charge.

The Year-End Market Performance

As the year 2018 came to a close, the US stock market ended the year with mixed results. The S&P 500, a widely followed benchmark index, closed the year with a negative return of approximately -6.2%. This was a stark contrast to the strong performance of the market in the previous year.

However, it's important to note that the stock market is cyclical, and the end of a year doesn't necessarily reflect the long-term trend. For instance, the NASDAQ Composite index, which tracks technology stocks, ended the year with a positive return of approximately 3.9%.

Conclusion

In summary, the US stock market in 2018 was influenced by a combination of trade tensions, political uncertainties, and economic factors. While the market ended the year with mixed results, it's important for investors to focus on the long-term trend and not be overly concerned with short-term fluctuations. As always, a well-diversified investment strategy is key to navigating the complexities of the stock market.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....