The stock market is a dynamic landscape, constantly changing with economic indicators, corporate earnings, and global events. One of the most significant stocks to watch is IBM (International Business Machines Corporation). This article delves into the current trends of IBM's US stock price, provides an analysis of its market performance, and offers insights into its future outlook.

Understanding IBM's Stock Price

IBM's US stock price, represented by the ticker symbol "IBM," has seen a rollercoaster ride over the years. The stock price is influenced by a variety of factors, including company earnings reports, market trends, and economic data. As of the latest available data, IBM's stock price is $142.56 per share.

Trends in IBM's Stock Price

In the past few years, IBM's stock price has shown a steady upward trend. This trend can be attributed to several factors:

- Strong Earnings Reports: IBM has consistently reported strong earnings, leading to increased investor confidence.

- Diversification: IBM has diversified its portfolio, expanding into areas such as cloud computing, artificial intelligence, and cybersecurity, which has helped stabilize its revenue streams.

- Dividend Yield: IBM offers a solid dividend yield of 4.48%, making it an attractive investment for income-seeking investors.

Analysis of IBM's Market Performance

IBM's market performance has been impressive, particularly when compared to its peers in the tech industry. Some key points to consider:

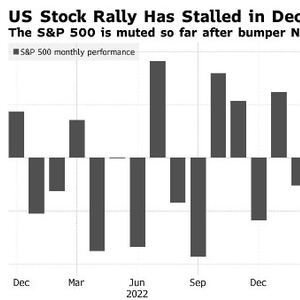

- Outperforming the S&P 500: Over the past five years, IBM's stock price has outperformed the S&P 500 index, indicating its strong market performance.

- Competitive Advantage: IBM's expertise in cloud computing, artificial intelligence, and cybersecurity gives it a competitive edge in the market.

- Robust Financials: IBM has demonstrated strong financial health, with low debt levels and a solid balance sheet.

Future Outlook for IBM's Stock Price

Looking ahead, the future outlook for IBM's stock price appears promising. Several factors contribute to this optimism:

- Continued Growth in Cloud Computing: Cloud computing is expected to continue growing at a rapid pace, and IBM is well-positioned to benefit from this trend.

- Artificial Intelligence and Cybersecurity: As the world becomes more digitized, the demand for AI and cybersecurity solutions will increase, providing further growth opportunities for IBM.

- Global Expansion: IBM is actively expanding its presence in emerging markets, which will help drive revenue growth and support its stock price.

Case Study: IBM's Acquisition of Red Hat

One notable case study in IBM's recent history is its acquisition of Red Hat, a leading provider of open-source software. This acquisition has had a significant impact on IBM's stock price:

- Increased Market Confidence: The acquisition demonstrated IBM's commitment to innovation and growth, leading to increased market confidence.

- Positive Impact on Stock Price: The announcement of the acquisition led to a significant spike in IBM's stock price, indicating investor optimism.

In conclusion, IBM's US stock price has shown strong performance in recent years, driven by factors such as strong earnings reports, diversification, and a competitive advantage in key markets. With a promising future outlook and continued growth opportunities, IBM remains a compelling investment option for investors.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....