Understanding the Current Market Trends

In the ever-fluctuating world of finance, the question on everyone's mind is, "Is the market crashing right now?" The stock market is a complex entity, influenced by a myriad of factors, including economic data, geopolitical events, and investor sentiment. This article delves into the current market trends and analyzes whether the market is indeed experiencing a downturn.

Economic Indicators and Market Performance

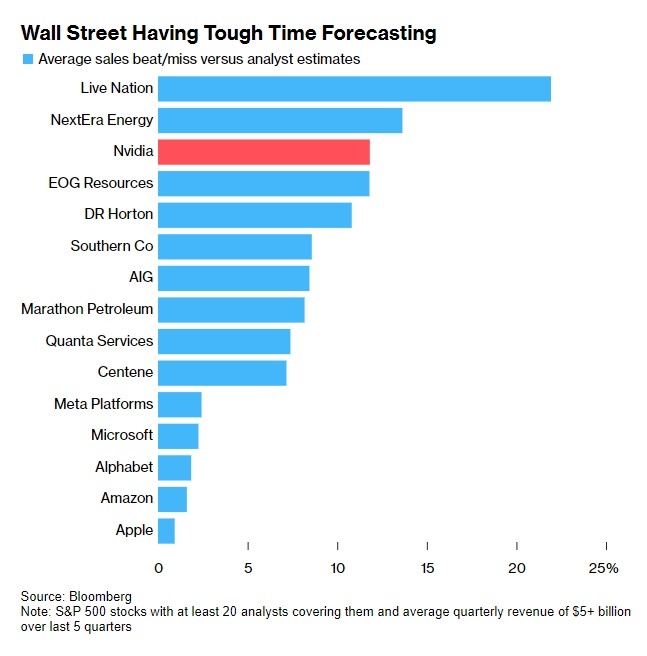

One of the primary indicators of a market crash is a sudden and significant drop in stock prices. According to the latest reports, the S&P 500 has experienced a decline of approximately 10% from its recent highs. This drop has sparked concerns among investors about a potential market crash.

However, it is essential to understand that a 10% decline does not necessarily indicate a market crash. Historically, the stock market has experienced multiple corrections, which are defined as a decline of 10% or more from the previous peak. These corrections are a normal part of the market cycle and often lead to buying opportunities for long-term investors.

Geopolitical Events and Market Volatility

Geopolitical events, such as trade tensions between the United States and China, have been a significant source of market volatility. The ongoing trade war has led to uncertainty and has had a negative impact on investor sentiment. As a result, the market has experienced periods of volatility, but it has not yet reached the level of a full-blown crash.

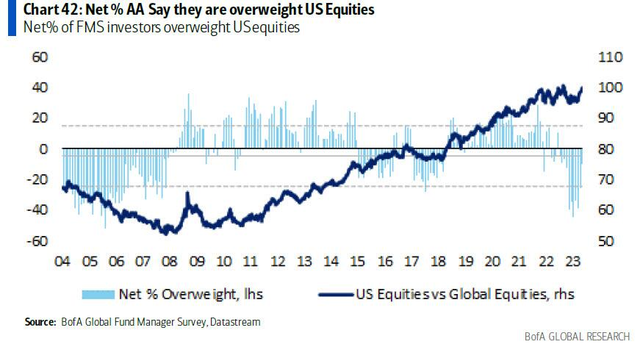

Investor Sentiment and Market Behavior

Investor sentiment plays a crucial role in determining market behavior. In recent months, there has been a shift from optimism to caution among investors. This shift has been driven by concerns about economic growth, inflation, and the potential for a recession. While this sentiment has contributed to market volatility, it has not yet led to a full-scale market crash.

Case Study: The 2008 Financial Crisis

To understand the potential for a market crash, it is helpful to look at historical precedents. The 2008 financial crisis serves as a stark reminder of the devastating impact that a market crash can have on the economy. However, it is essential to note that the current market conditions are not as dire as those in 2008.

In 2008, the market was driven by excessive leverage, risky mortgage lending, and a lack of regulatory oversight. Today, the market is better capitalized, and regulatory measures have been implemented to prevent a repeat of the 2008 crisis.

Conclusion: Is the Market Crashing Right Now?

In conclusion, while the stock market has experienced a decline in recent months, it is not yet indicative of a full-blown market crash. Economic indicators, geopolitical events, and investor sentiment all play a role in determining market behavior. As long-term investors, it is crucial to remain focused on the fundamentals and avoid making impulsive decisions based on short-term market movements.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....