Introduction:

Understanding the Dynamics of Defence Stocks

Defence stocks refer to companies that are involved in the production, supply, and maintenance of military equipment, weapons, and services. These stocks are typically influenced by government spending on national security and defence programs. When war is declared, there is an increased demand for military equipment and services, which can lead to a surge in the value of these stocks.

Investment Opportunities

Increased Government Spending: During times of war, the government tends to allocate more funds towards national security. This increased spending can boost the revenue and profitability of defence companies.

Contract Awards: Defence companies often receive multi-year contracts from the government for the supply of military equipment. These contracts provide a steady revenue stream and can lead to significant growth in the company's financials.

Market Saturation: In times of war, there is limited competition in the defence sector. This can lead to higher profit margins for companies that secure contracts.

Risks Involved

Political Risk: The political environment can significantly impact the demand for military equipment. Changes in government policies or international relations can lead to reduced defence spending and, consequently, lower stock prices.

Economic Uncertainty: Times of war are often accompanied by economic uncertainty. This can lead to reduced consumer spending and a decline in the stock market, affecting defence stocks as well.

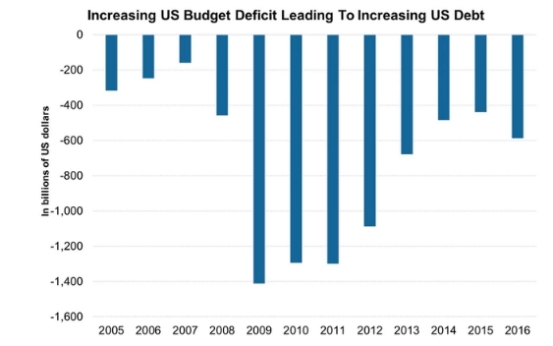

Long-Term Consequences: The long-term consequences of war, such as increased debt and social unrest, can negatively impact the overall economic environment and, subsequently, the performance of defence stocks.

Case Studies

Lockheed Martin: During the Gulf War in the early 1990s, Lockheed Martin, a major defence contractor, experienced a surge in orders for fighter jets and other military equipment. This led to a significant increase in the company's revenue and stock price.

Raytheon: During the Vietnam War, Raytheon, another leading defence company, saw a surge in orders for missiles and other military equipment. This increased demand helped the company achieve substantial growth in its financials.

Conclusion: Investing in US defence stocks during times of war can offer attractive investment opportunities. However, it is crucial to understand the risks involved and the potential long-term consequences of war. Conduct thorough research and consider seeking advice from a financial advisor before making any investment decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....