In the intricate world of finance, one term that often confuses investors is the stock tax rate. The stock tax rate in the US refers to the percentage of taxes imposed on the capital gains or losses realized from the sale of stocks. This rate can significantly impact investors' returns and their overall financial strategy. In this article, we will delve into the details of the stock tax rate in the US, helping you understand how it works and its implications for investors.

What is the Stock Tax Rate in the US?

The stock tax rate in the US varies depending on the investor's income level and the holding period of the investment. Generally, short-term capital gains are taxed at a higher rate than long-term capital gains. Short-term capital gains are those realized from stocks held for less than a year, while long-term capital gains are those from stocks held for more than a year.

Short-term Capital Gains Tax Rate

For investors in the US, short-term capital gains are taxed as ordinary income. This means that the rate will depend on the investor's taxable income and filing status. For example, in 2021, single filers with taxable income up to $75,900 paid a rate of 0% on short-term capital gains. However, those with taxable income above this threshold faced a rate of 37%.

Long-term Capital Gains Tax Rate

Long-term capital gains are taxed at a lower rate than short-term gains. The rates for long-term capital gains in 2021 were as follows:

- 0% for single filers with taxable income up to $50,000

- 15% for single filers with taxable income between

50,001 and 450,000 - 20% for single filers with taxable income above $450,000

It's important to note that these rates are subject to change, and investors should consult with a tax professional for the most up-to-date information.

How the Stock Tax Rate Impacts Investors

Understanding the stock tax rate is crucial for investors, as it can significantly impact their returns. By knowing the tax rate, investors can make more informed decisions about when to buy and sell stocks. For example, investors may choose to hold onto stocks for longer periods to benefit from the lower long-term capital gains rate.

Case Study: John's Investment Strategy

Let's consider a hypothetical scenario involving John, a middle-aged investor. John has been investing in the stock market for several years and has accumulated a significant portfolio. In 2021, he decides to sell some of his stocks to reinvest in other assets. If he had held these stocks for less than a year, he would have paid a higher short-term capital gains rate. However, since he had held these stocks for more than a year, he would have paid a lower long-term capital gains rate, resulting in a more favorable tax outcome.

In conclusion, the stock tax rate in the US is a crucial factor that investors must consider when making investment decisions. By understanding the rates and their implications, investors can make more informed decisions and potentially maximize their returns. Always consult with a tax professional for personalized advice tailored to your specific financial situation.

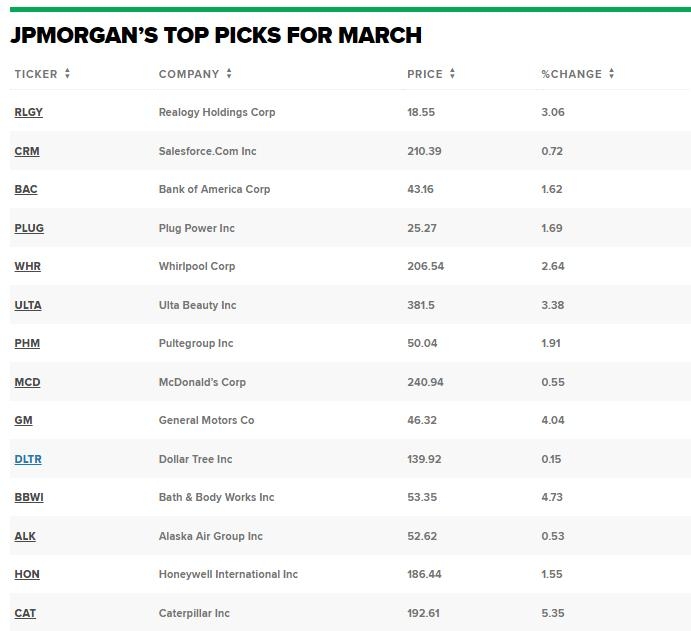

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....