In the vast landscape of the United States stock market, US small caps stocks often fly under the radar of many investors. These companies, with a market capitalization ranging from

Understanding Small Caps

Small caps are companies that are not as well-known as their larger counterparts. They often operate in niche markets or are in the early stages of growth. This can make them riskier, but also more rewarding. According to a study by the National Bureau of Economic Research, small cap stocks have historically outperformed large cap stocks over the long term.

Advantages of Investing in Small Caps

Higher Growth Potential: Small cap companies are often in the early stages of growth, which means they have more room to expand. This can lead to significant increases in revenue and earnings.

Attractive Valuations: Due to their smaller size and lesser-known status, small cap stocks often trade at lower valuations compared to large cap stocks.

Innovation and Diversification: Many small cap companies are leaders in innovation, offering new products and services that can disrupt existing markets.

Risks Associated with Small Caps

Higher Volatility: Small cap stocks are generally more volatile than large cap stocks, which means their prices can fluctuate more dramatically.

Liquidity Issues: Smaller companies may have lower trading volumes, which can make it more difficult to buy or sell shares without significantly impacting the stock price.

Higher Risk of Failure: Many small cap companies do not survive in the long term, which means there is a higher risk of losing your investment.

Strategies for Investing in Small Caps

Conduct Thorough Research: Before investing in a small cap stock, it is crucial to conduct thorough research. Look for companies with strong fundamentals, a clear business model, and a solid management team.

Diversify Your Portfolio: Investing in a small number of small cap stocks can be risky. Diversifying your portfolio can help mitigate this risk.

Stay Informed: Stay up-to-date with the latest news and developments in the companies you are considering investing in. This will help you make informed decisions.

Case Studies

Tesla Inc. (TSLA): Once a small cap stock, Tesla has grown into one of the most valuable companies in the world. Investing in Tesla early on could have yielded significant returns.

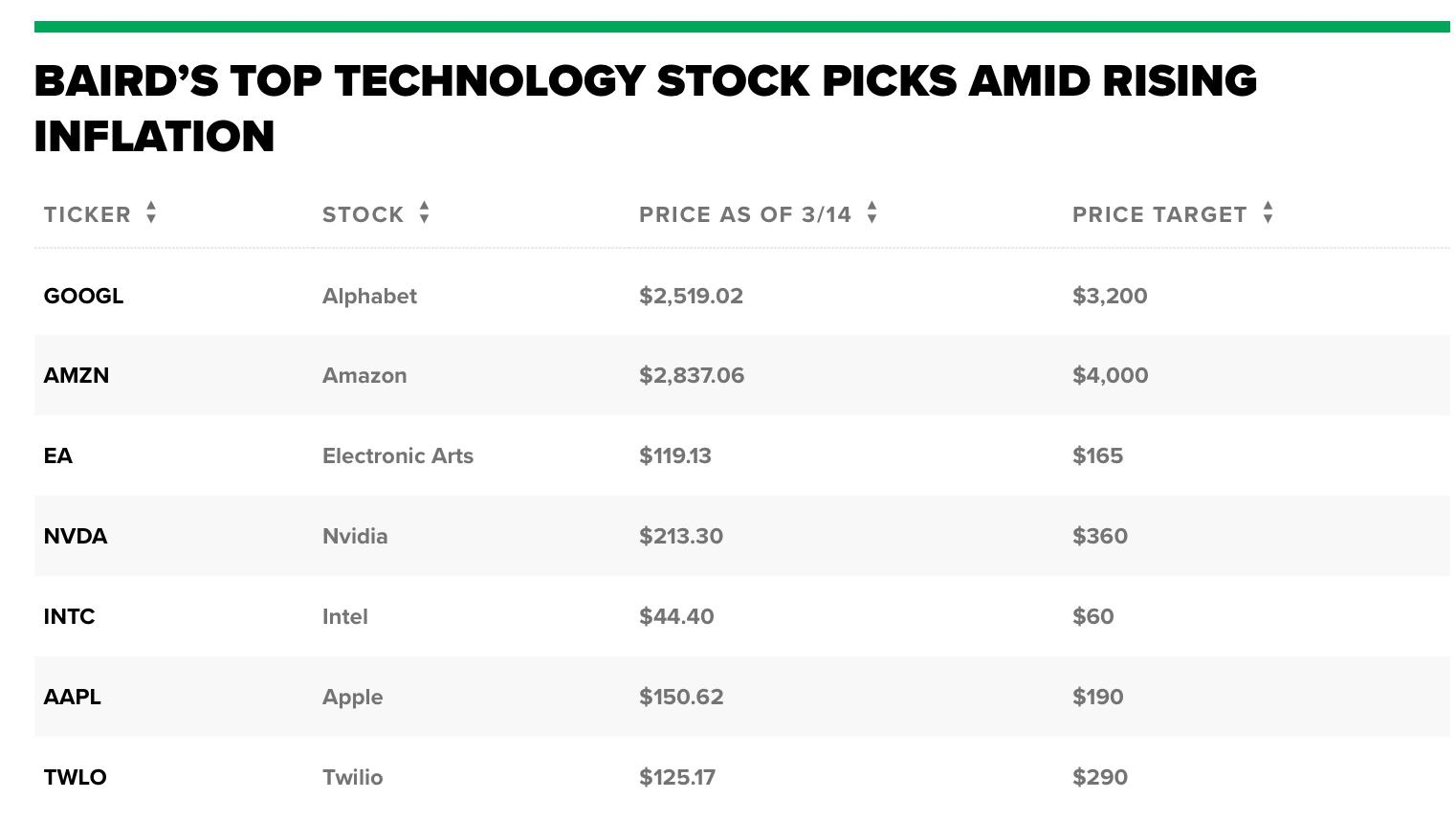

Amazon.com Inc. (AMZN): Similar to Tesla, Amazon started as a small cap stock before becoming a market leader. Early investors in Amazon have seen substantial gains.

In conclusion, US small caps stocks offer a unique opportunity for investors looking to capitalize on growth potential. However, they come with their own set of risks. By conducting thorough research and adopting a disciplined investment strategy, investors can unlock the potential of small caps and potentially reap the rewards.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....