In the wake of recent stock market downturns, the United States finds itself grappling with a host of questions and concerns. Market volatility has become the buzzword, sparking discussions on the impact on investors, the economy, and the future of the stock market. This article delves into the causes behind the stock market tumble and offers insights into how investors can navigate these uncertain times.

Causes of the Stock Market Tumble

Several factors have contributed to the recent stock market downturn. One of the primary reasons is inflation concerns. As the economy recovers from the COVID-19 pandemic, prices for goods and services have been rising, causing a spike in inflation. This has led to concerns about the future of the economy and, consequently, the stock market.

Another contributing factor is geopolitical tensions. Tensions between major world powers, such as the United States and China, have been escalating, causing uncertainty in the global markets. These tensions have raised concerns about trade and supply chain disruptions, which can negatively impact corporate earnings and, subsequently, stock prices.

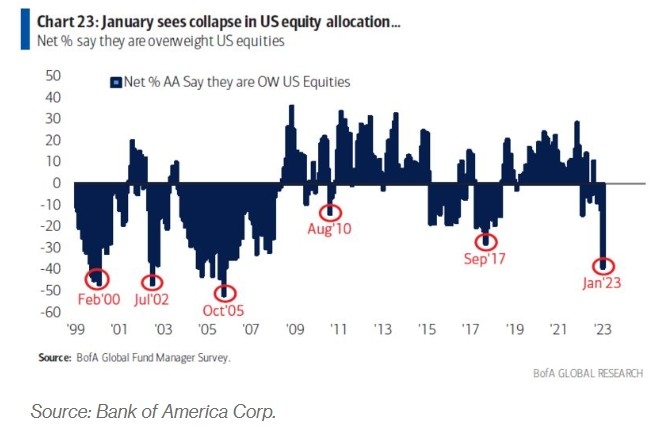

Impact on Investors

The stock market downturn has had a significant impact on investors. Many individuals and institutions have seen their portfolios decline in value, leading to increased anxiety and concern. However, it is crucial to remember that market volatility is a natural part of investing and that diversification is key to managing risk.

Navigating Market Volatility

So, how can investors navigate these turbulent times? Here are some strategies to consider:

Stay the Course: Market volatility is unpredictable, and panic selling can lead to significant losses. Instead, it is crucial to stay the course and maintain a long-term investment strategy.

Diversify Your Portfolio: Diversification can help reduce risk by spreading your investments across various asset classes, sectors, and geographical regions.

Review Your Portfolio: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Consider consulting with a financial advisor to make informed decisions.

Avoid Emotional Decisions: It is essential to avoid making impulsive decisions based on emotions. Instead, stick to a disciplined approach and avoid chasing performance.

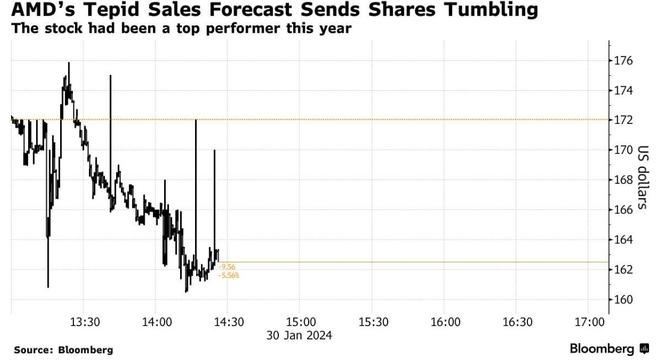

Case Study: The Tech Sector

One of the sectors most affected by the recent stock market downturn is the tech sector. Companies like Apple, Amazon, and Google have seen their stock prices decline significantly. However, history has shown that the tech sector tends to bounce back stronger after periods of downturn. This highlights the importance of maintaining a diversified portfolio and staying invested for the long term.

Conclusion

The stock market downturn has indeed been a cause for concern in the United States. However, by understanding the causes behind the downturn and adopting sound investment strategies, investors can navigate these turbulent times and achieve their financial goals. Remember, market volatility is a part of investing, and staying the course is key to long-term success.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....