In the ever-evolving landscape of the financial world, the U.S. stock market has always been a beacon for investors worldwide. As we delve into the year 2025, it is crucial to understand the current outlook and future trends of the US stock market. This article aims to provide a comprehensive analysis, highlighting key factors, potential risks, and opportunities that investors should be aware of.

Historical Performance and Current Trends

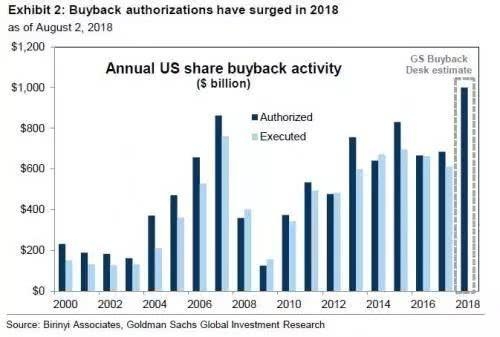

The US stock market has witnessed significant growth over the years. Since the turn of the century, the market has seen numerous ups and downs, but overall, it has managed to deliver impressive returns. In recent years, the market has been driven by factors such as technological advancements, globalization, and low-interest rates.

As of 2025, the market is characterized by several key trends:

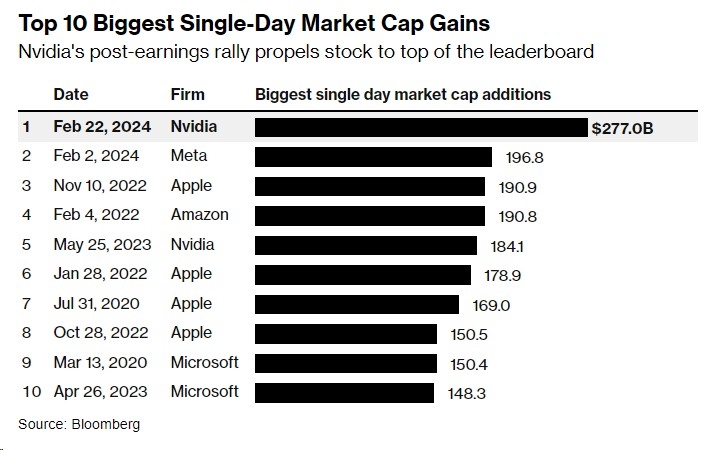

- Tech Stocks Dominate: Technology stocks have been a major driver of the market's growth. Companies like Apple, Google, and Amazon continue to dominate the landscape, attracting significant investment.

- Dividend-Paying Stocks Gain Popularity: With the increasing uncertainty in the global economy, investors are seeking safer investment options. Dividend-paying stocks have become a popular choice, offering consistent income and stability.

- Eco-Friendly Companies on the Rise: The growing focus on sustainability and environmental responsibility has led to a surge in investments in eco-friendly companies. This trend is expected to continue in the coming years.

Potential Risks and Challenges

While the US stock market appears promising, there are several risks and challenges that investors should be aware of:

- Global Economic Uncertainty: The global economy remains a major concern. Issues such as trade tensions, political instability, and economic downturns in key regions could impact the US stock market.

- High Valuations: Many stocks are currently trading at high valuations, which could lead to a market correction in the future.

- Technological Disruption: Rapid technological advancements can disrupt traditional industries, leading to significant market shifts.

Opportunities for Investors

Despite the risks, there are several opportunities for investors in the US stock market:

- Emerging Markets: Investing in emerging markets can offer high growth potential. However, it is crucial to conduct thorough research and understand the associated risks.

- Sector Rotation: Investors can benefit from sector rotation strategies by identifying and investing in sectors that are expected to perform well in the future.

- Dividend Growth Stocks: Investing in dividend growth stocks can provide consistent income and capital appreciation over the long term.

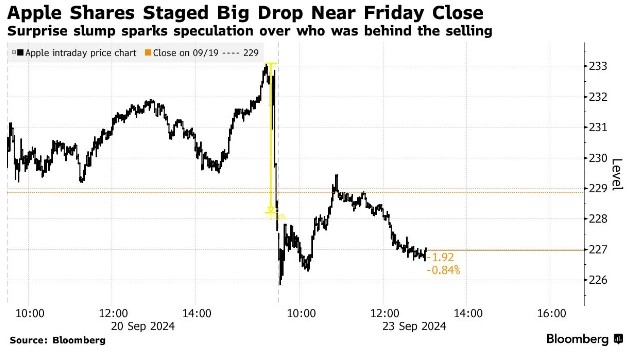

Case Study: Apple Inc.

To illustrate the potential of the US stock market, let's take a look at Apple Inc. Over the past decade, Apple has consistently delivered impressive growth, becoming one of the most valuable companies in the world. The company's focus on innovation, strong brand loyalty, and global market presence have been key factors in its success.

In 2025, Apple continues to dominate the technology sector, with its products and services enjoying high demand worldwide. The company's commitment to sustainability and its efforts to expand its product portfolio further enhance its prospects.

Conclusion

The US stock market in 2025 presents a mix of opportunities and challenges. Investors need to stay informed and be prepared to adapt to changing market conditions. By focusing on key trends, potential risks, and strategic opportunities, investors can navigate the market successfully and achieve their financial goals.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....