In today's fast-paced financial world, mastering the art of financial management is crucial for both individuals and businesses. Whether you're a seasoned investor or a startup owner, understanding the ins and outs of finance is key to achieving your financial goals. This article delves into the essentials of finance management, offering valuable insights and practical tips to help you navigate the complex world of money.

Understanding Financial Management

What is Financial Management?

Financial management refers to the process of planning, organizing, directing, and controlling the financial resources of an organization. It involves making strategic decisions to ensure the efficient use of funds and the achievement of the organization's objectives. For individuals, financial management involves managing personal finances, including budgeting, saving, investing, and planning for the future.

Key Components of Financial Management

Budgeting: Budgeting is the foundation of financial management. It involves creating a plan to allocate income and manage expenses effectively. A well-planned budget helps you track your spending, identify areas for savings, and achieve your financial goals.

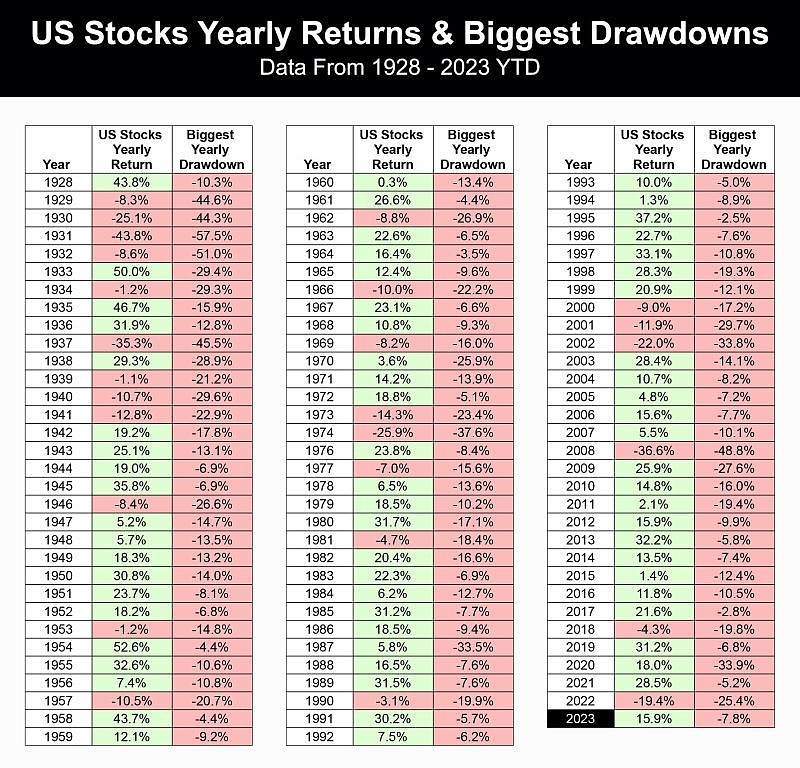

Investing: Investing is an essential aspect of financial management. It involves allocating funds to different investment vehicles to generate returns over time. Investing can help you grow your wealth and achieve long-term financial goals.

Risk Management: Risk management is the process of identifying, assessing, and mitigating potential risks to your financial well-being. This includes managing risks associated with investments, loans, and other financial commitments.

Financial Planning: Financial planning involves setting long-term financial goals and developing strategies to achieve them. This includes retirement planning, estate planning, and wealth management.

Best Practices for Effective Financial Management

Set Clear Financial Goals: Define your financial goals, whether they are short-term or long-term. This will help you stay focused and motivated.

Create a Budget: Develop a realistic budget that aligns with your financial goals. Track your expenses and make adjustments as needed.

Save Regularly: Establish an emergency fund to cover unexpected expenses. Additionally, set aside a portion of your income for savings and investments.

Diversify Your Investments: Diversify your investment portfolio to reduce risk and maximize returns. Consider different asset classes, such as stocks, bonds, and real estate.

Monitor Your Financial Health: Regularly review your financial statements and performance metrics to ensure you're on track to achieve your goals.

Case Study: The Smith Family

The Smith family recently experienced a financial setback when they lost their jobs. Despite the challenges, they had established a solid financial foundation. They followed these best practices:

Budgeting: The Smiths created a budget to manage their expenses and prioritize their needs.

Investing: They had a diversified investment portfolio, which helped mitigate the impact of the job loss.

Financial Planning: The Smiths had a solid financial plan in place, which included an emergency fund and a retirement plan.

As a result, they were able to navigate the financial crisis without significant stress or financial strain.

Conclusion

Mastering the art of financial management is essential for achieving your financial goals. By understanding the key components of financial management and following best practices, you can build a solid financial foundation and secure your future. Remember, financial management is an ongoing process, and it's important to stay informed and adapt to changing circumstances.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....