In the era of globalization, investors around the world are seeking opportunities to diversify their portfolios. For Indian investors, investing in US stocks has become an attractive option due to the strong economic performance and market stability of the United States. This article provides a comprehensive guide on how to invest in US stocks from India, including the process, risks, and potential benefits.

Understanding the Process

Investing in US stocks from India involves several steps. Here's a breakdown:

Open a Trading Account: The first step is to open a trading account with a brokerage firm that offers international trading services. Many Indian brokerage firms provide this service, allowing you to trade US stocks directly.

Fund Your Account: Once your account is set up, you'll need to fund it with Indian rupees. The brokerage firm will convert these funds into US dollars, which will be used to purchase stocks.

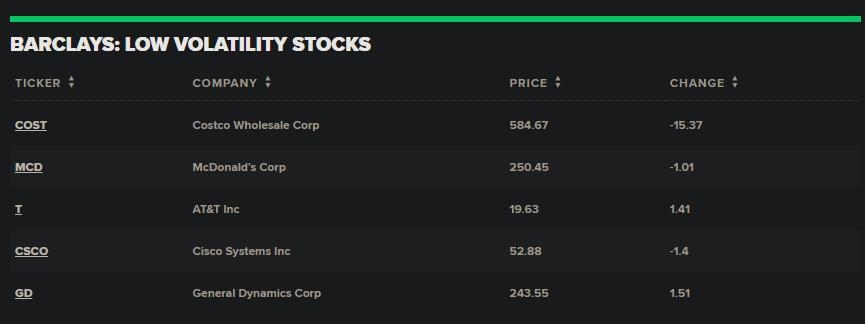

Research and Analyze: Before investing, it's crucial to research and analyze the US stock market. This includes understanding market trends, individual company performance, and economic indicators.

Place Your Order: Once you've selected a stock, you can place an order through your brokerage platform. You can choose from various order types, such as market orders, limit orders, and stop-loss orders.

Risks to Consider

Investing in US stocks from India comes with its own set of risks. Here are some key risks to consider:

Currency Risk: Fluctuations in the exchange rate between the Indian rupee and the US dollar can impact your investment returns.

Market Risk: The US stock market is subject to volatility, which can affect the value of your investments.

Regulatory Risk: Different regulatory frameworks in India and the US can pose challenges for investors.

Benefits of Investing in US Stocks

Despite the risks, investing in US stocks from India offers several benefits:

Diversification: Investing in US stocks can help diversify your portfolio, reducing exposure to domestic market risks.

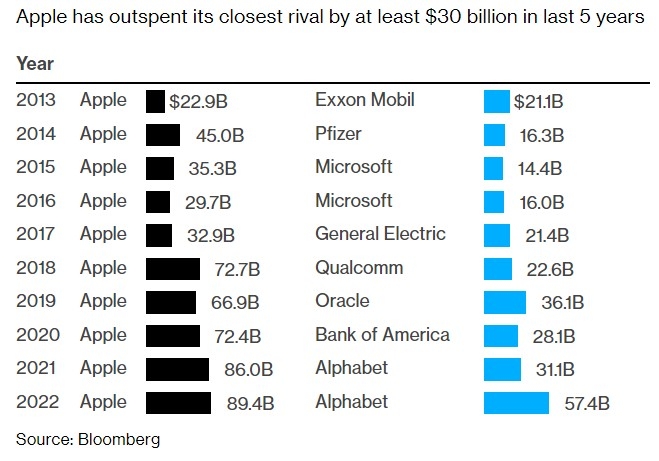

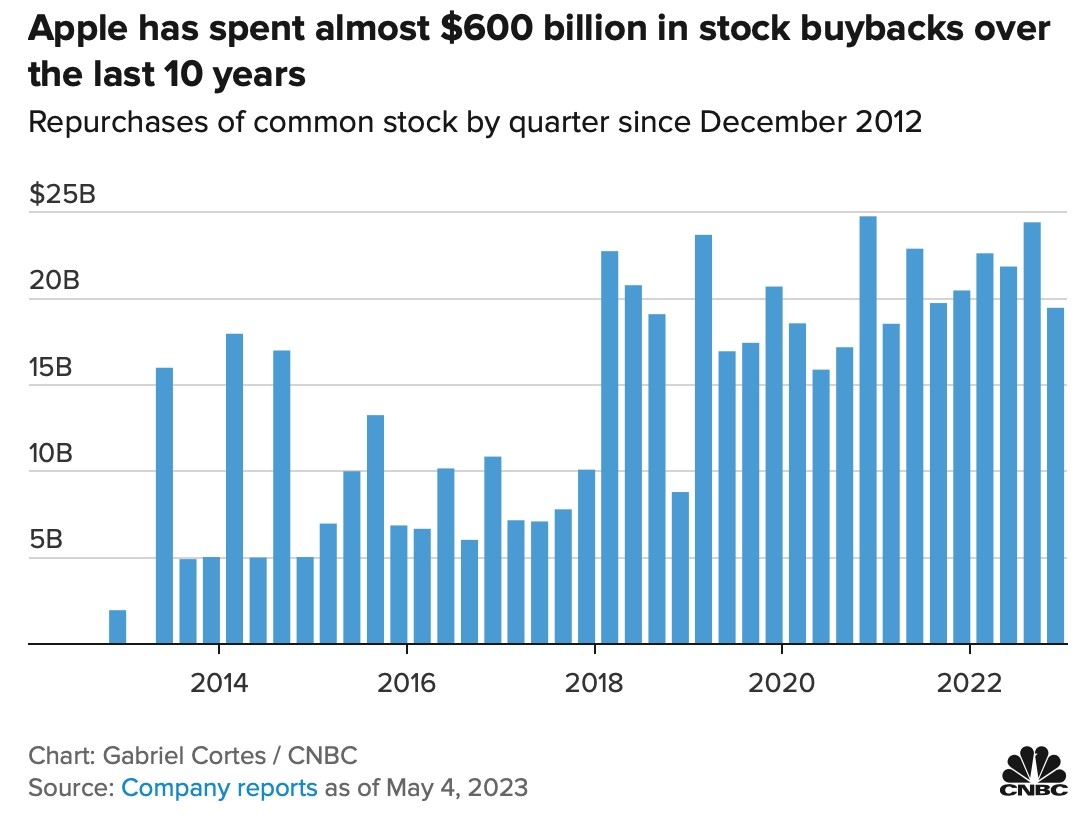

Potential for Higher Returns: The US stock market has historically offered higher returns compared to the Indian market.

Access to Blue-Chip Companies: The US stock market is home to many well-established and profitable companies, offering opportunities for long-term growth.

Case Study: Reliance Industries Limited

To illustrate the potential benefits of investing in US stocks from India, let's consider the case of Reliance Industries Limited (RIL). RIL is one of India's largest companies, with a diverse portfolio of businesses, including oil and gas, telecommunications, and retail.

In 2020, RIL raised $1.7 billion through a share sale in the US. This move allowed the company to diversify its funding sources and strengthen its balance sheet. For Indian investors, this provided an opportunity to invest in a well-established and profitable company, potentially benefiting from its long-term growth prospects.

Conclusion

Investing in US stocks from India can be a valuable addition to your investment portfolio. By understanding the process, risks, and benefits, you can make informed decisions and potentially achieve higher returns. Always remember to do thorough research and consult with a financial advisor before making any investment decisions.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....