Investing in the stock market can be an exciting and potentially lucrative endeavor, but navigating the complexities of the U.S. stock market can be challenging. This comprehensive guide will provide you with the essential knowledge and strategies to master stock investments in the United States.

Understanding the U.S. Stock Market

The U.S. stock market is the largest and most diversified in the world. It includes two major exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges are home to thousands of companies across various industries, offering investors a wide range of opportunities.

Key Concepts to Know

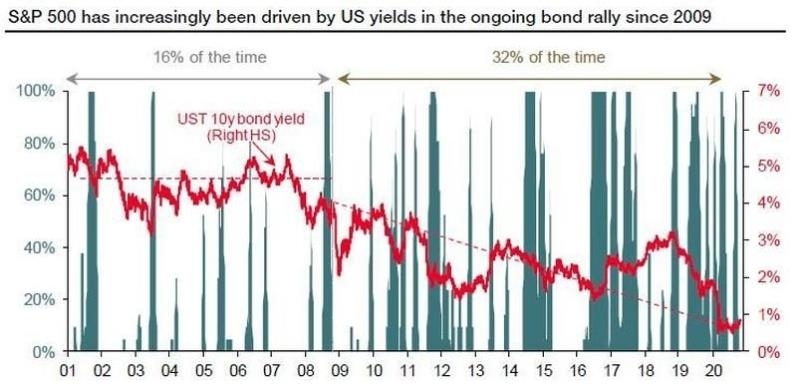

Stock Market Indexes: S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are popular indexes that represent a basket of stocks and are used as a benchmark for the overall performance of the stock market.

Stock Types: There are two main types of stocks: common and preferred. Common stocks provide voting rights, but preferred stocks offer higher dividends and a higher claim on assets in the event of bankruptcy.

Dividends: Dividends are payments made by a company to its shareholders, usually from its profits. They can be a significant source of income for investors.

Researching and Selecting Stocks

Before investing, it is crucial to conduct thorough research. Here are some key factors to consider:

Company Financials: Analyze the company's income statement, balance sheet, and cash flow statement to assess its financial health.

Industry Trends: Understand the industry in which the company operates and its potential growth prospects.

Management: Evaluate the company's management team and their track record.

Market Sentiment: Monitor the overall market sentiment to gauge potential market movements.

Diversification and Asset Allocation

Diversifying your portfolio is essential to mitigate risk. Allocate your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of market volatility.

Risk Management

Investing in the stock market involves risk, so it is important to manage your risks effectively:

Stop-Loss Orders: Set a stop-loss order to automatically sell a stock if its price falls below a certain level.

Diversification: As mentioned earlier, diversify your portfolio to reduce risk.

Regular Reviews: Review your portfolio regularly to ensure it aligns with your investment goals and risk tolerance.

Case Studies

Company A, a technology company, experienced rapid growth over the past few years. By conducting thorough research and analyzing the company's financials and industry trends, investors could have identified the potential for significant returns. However, they would have also recognized the risks associated with the technology industry and diversified their portfolio accordingly.

Company B, an energy company, faced challenges due to a decrease in oil prices. Investors who failed to diversify their portfolio and ignored market sentiment suffered significant losses.

Conclusion

Investing in the U.S. stock market can be a rewarding experience if you understand the key concepts, conduct thorough research, and manage your risks effectively. By following this comprehensive guide, you can master stock investments in the United States and achieve your financial goals.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....