The stock market in the US today is a dynamic and complex landscape, reflecting the economic and political climate of the nation. As investors and traders, it's crucial to stay informed about the latest trends and insights to make informed decisions. This article delves into the key aspects of the US stock market today, including market performance, major indices, and emerging trends.

Market Performance

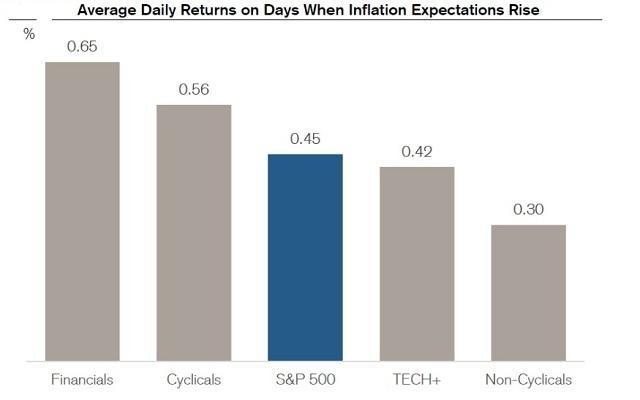

As of the latest data, the US stock market has shown a mixed performance. The S&P 500, a widely followed index, has experienced fluctuations, with some sectors outperforming while others lagging behind. The Dow Jones Industrial Average and the NASDAQ Composite have also seen varying levels of growth and decline.

Major Indices

The S&P 500 has been a key indicator of the overall health of the US stock market. It includes the top 500 companies by market capitalization and represents a broad range of sectors. The Dow Jones Industrial Average, on the other hand, tracks the performance of 30 large companies and is often seen as a gauge of the broader market.

The NASDAQ Composite is another important index, particularly for technology stocks. It includes more than 3,000 companies and has seen significant growth in recent years, driven by the rise of tech giants like Apple, Amazon, and Microsoft.

Emerging Trends

Several trends have emerged in the US stock market today, shaping the investment landscape:

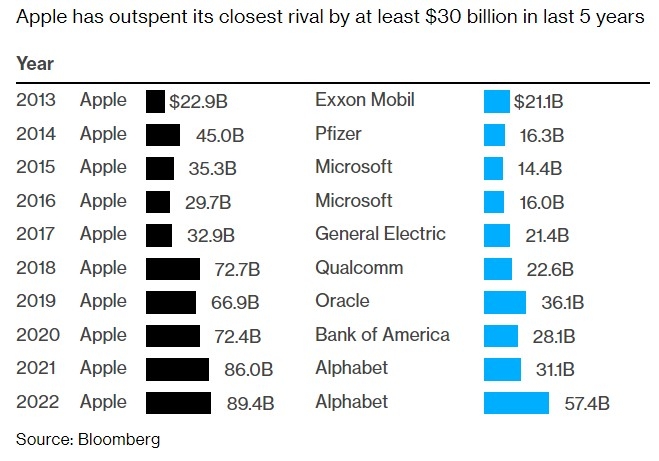

- Tech Stocks: The technology sector has been a major driver of stock market growth, with companies like Apple, Microsoft, and Google leading the way. However, concerns about valuation and potential regulatory changes have led to some volatility.

- Growth Stocks: Growth stocks, which are companies with high growth potential, have also been popular among investors. These stocks often trade at higher valuations and can offer significant returns, but they come with higher risk.

- Value Stocks: In contrast, value stocks, which are companies trading at lower valuations than their peers, have also seen increased interest. These stocks are often seen as undervalued and can offer attractive long-term returns.

Case Studies

To illustrate these trends, consider the following examples:

- Apple: As a leading technology company, Apple has seen significant growth in its stock price, driven by strong demand for its products and services. However, concerns about valuation and potential regulatory changes have led to some volatility in its stock price.

- Tesla: Tesla, another major player in the technology sector, has experienced rapid growth in its stock price, driven by its electric vehicles and renewable energy products. However, the company has also faced challenges, including production issues and regulatory concerns.

- Johnson & Johnson: As a large pharmaceutical company, Johnson & Johnson has been seen as a value stock, trading at a lower valuation than its peers. The company has a strong track record and a diverse product portfolio, making it an attractive investment for many investors.

Conclusion

The stock market in the US today is a complex and ever-evolving landscape, with a variety of factors influencing its performance. Staying informed about the latest trends and insights is crucial for investors and traders looking to make informed decisions. By understanding the key aspects of the market, including market performance, major indices, and emerging trends, investors can navigate the market with confidence.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....