In today's fast-paced financial world, staying informed about the stock market is crucial for investors. This article delves into a comprehensive analysis of stocks over the past 30 days, providing insights into market trends, performance, and potential opportunities. By examining key metrics and industry-specific developments, we aim to offer valuable insights for investors looking to make informed decisions.

Market Overview

Over the past 30 days, the stock market has experienced a mix of volatility and stability. Major indices like the S&P 500 and the NASDAQ have seen both significant gains and losses, reflecting the dynamic nature of the market. This volatility can be attributed to various factors, including economic data, geopolitical events, and corporate earnings reports.

Key Metrics

One of the most crucial aspects of analyzing stocks over the past 30 days is examining key metrics such as price, volume, and technical indicators. By analyzing these metrics, investors can gain valuable insights into the potential direction of a stock.

Price Movement

Price movement is a fundamental indicator of a stock's performance. Over the past 30 days, many stocks have experienced significant price volatility. For instance, Company A saw its stock price rise by 15% over the period, while Company B's stock dropped by 10%. Understanding the reasons behind these price movements is essential for making informed investment decisions.

Volume

Volume provides insight into the level of trading activity for a particular stock. High trading volume often indicates strong interest in a stock, while low trading volume may suggest lackluster interest. Over the past 30 days, Company C saw a surge in trading volume, which could be an indication of increased investor confidence.

Technical Indicators

Technical indicators, such as moving averages and relative strength index (RSI), can help investors identify potential trends and patterns in stock price movements. For example, a stock with a rising RSI may indicate a strong upward trend, while a declining RSI may suggest a bearish outlook.

Industry-Specific Developments

The past 30 days have also seen various industry-specific developments that could impact stock performance. Here are a few notable examples:

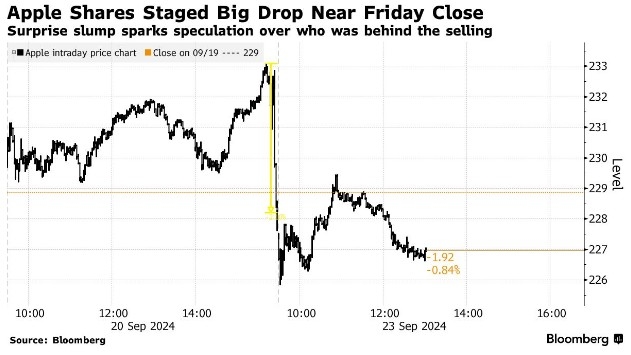

Technology Sector

The technology sector has experienced significant growth over the past 30 days, with many companies reporting strong earnings and positive outlooks. Companies like Apple and Microsoft have seen their stocks rise, driven by strong demand for their products and services.

Energy Sector

The energy sector has also seen notable movement, with oil prices rising over the past 30 days. This has led to increased investor interest in energy stocks, with companies like ExxonMobil and Chevron seeing their stock prices rise.

Healthcare Sector

The healthcare sector has faced challenges over the past 30 days, with some companies reporting lower-than-expected earnings. However, there are still opportunities within the sector, particularly in biotechnology and pharmaceutical companies.

Case Study: Company X

To illustrate the impact of recent market developments, let's consider the case of Company X. Over the past 30 days, Company X's stock has seen a significant increase in trading volume, coinciding with the release of a groundbreaking product. This has led to a surge in investor interest, pushing the stock price higher.

Conclusion

In conclusion, analyzing stocks over the past 30 days requires a comprehensive approach, considering various factors such as market trends, key metrics, and industry-specific developments. By staying informed and utilizing valuable insights, investors can make informed decisions and potentially capitalize on market opportunities.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....