In the fast-paced world of finance, the US stock exchange graph serves as a critical tool for investors, traders, and financial analysts to gauge market trends and make informed decisions. This article delves into the intricacies of stock exchange graphs, their significance, and how they can be utilized to understand the financial landscape of the United States.

Understanding the Stock Exchange Graph

The US stock exchange graph is a visual representation of stock market performance over a specified period. It typically features a series of data points, which are connected to form a line or a series of lines. The horizontal axis represents time, while the vertical axis denotes the value of the stock price or index.

Stock Price Graph: This graph displays the price of a single stock over a specified period. It's essential for investors to analyze the trend and volatility of the stock to make strategic investment decisions.

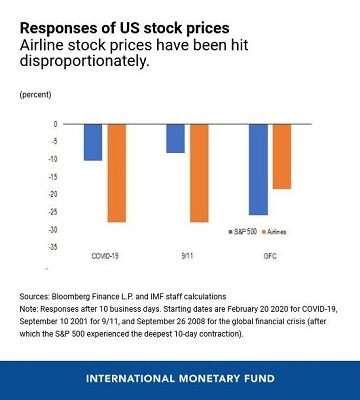

Index Graph: An index graph tracks the performance of a group of stocks, such as the S&P 500 or the NASDAQ 100. This provides a broader view of the market's health and direction.

Significance of Stock Exchange Graphs

Trend Analysis: US stock exchange graphs help investors identify the trend in the market. An upward trend indicates a bullish market, while a downward trend suggests a bearish market.

Volatility Analysis: By analyzing the US stock exchange graph, investors can gauge the volatility of a stock or the market. High volatility can be indicative of a high-risk investment.

Support and Resistance Levels: Stock exchange graphs can help identify key support and resistance levels, which are crucial for setting stop-loss and take-profit levels.

Historical Performance: Investors can use historical US stock exchange graphs to compare the performance of stocks or indices over different time frames.

How to Analyze the US Stock Exchange Graph

Identify the Trend: Look for patterns like uptrends, downtrends, and sideways trends. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows.

Volatility: Pay attention to the width of the price range on the graph. A wide range indicates high volatility, while a narrow range indicates low volatility.

Support and Resistance Levels: Identify these levels on the US stock exchange graph. These levels can be used to determine potential entry and exit points.

Case Studies

Let's take a look at a couple of US stock exchange graphs to understand how they can be analyzed:

Apple Inc. (AAPL): In the past few years, Apple has been on an upward trend. Investors can use this trend to identify potential entry points and set stop-loss levels below the recent lows.

Tesla Inc. (TSLA): Tesla's stock has been highly volatile, with significant price swings. Traders can use technical indicators like the Relative Strength Index (RSI) to gauge overbought or oversold conditions.

Conclusion

US stock exchange graphs are powerful tools that provide valuable insights into the financial market. By understanding and analyzing these graphs, investors and traders can make more informed decisions and better manage their portfolios. Whether you're a seasoned investor or just starting out, learning how to read and interpret stock exchange graphs is essential for success in the financial markets.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....