In the fast-paced world of finance, staying ahead of market trends is crucial for investors. Among the various tools and resources available, US stock futures play a pivotal role. This CNN Money guide will delve into the intricacies of US stock futures, their significance, and how they can be utilized to make informed investment decisions.

Understanding US Stock Futures

Firstly, it's essential to understand what US stock futures are. These are agreements to buy or sell a stock at a predetermined price on a specified future date. Unlike stocks, which represent ownership in a company, futures are contracts that allow investors to speculate on the future price of a stock without owning the actual stock.

The Importance of Stock Futures

Stock futures are vital for several reasons. They provide a preview of market sentiment, allowing investors to gauge potential movements in the stock market. Additionally, they offer hedge opportunities against potential losses in a portfolio. By locking in a price today, investors can mitigate the risk of a stock's value declining in the future.

How to Trade Stock Futures

Trading US stock futures is similar to trading stocks, but with a few key differences. Here's a step-by-step guide:

Choose a Broker: Select a reputable broker that offers futures trading. Ensure they have a user-friendly platform and provide access to the necessary tools for analysis.

Open an Account: Once you've chosen a broker, open an account by providing the required personal and financial information.

Fund Your Account: Transfer funds to your account to start trading. It's crucial to only invest what you can afford to lose.

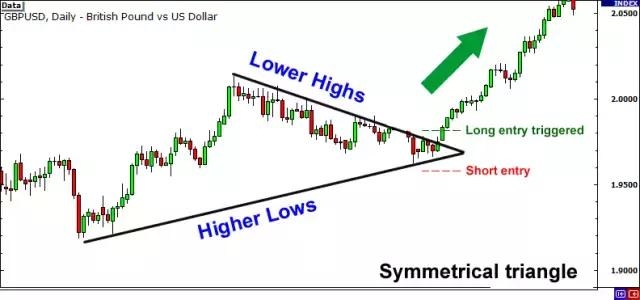

Research and Analyze: Conduct thorough research and analysis before placing a trade. Utilize technical and fundamental analysis to make informed decisions.

Place a Trade: Decide whether to go long (buy) or short (sell) a stock future. Set a stop-loss and take-profit order to manage your risk.

Monitor Your Positions: Keep a close eye on your positions and be prepared to exit if the market moves against you.

Case Studies

Let's consider two hypothetical case studies to illustrate the potential of US stock futures:

Long Position: An investor believes that a particular tech stock will rise in value. By purchasing a futures contract at

100, they can profit from the price increase without owning the stock. If the stock price rises to 120, the investor will make a $20 profit per contract.Short Position: An investor expects a stock to decline in value. By selling a futures contract at

100, they can profit from the price decrease. If the stock price falls to 80, the investor will make a $20 profit per contract.

Conclusion

US stock futures are a powerful tool for investors looking to gain exposure to the stock market without owning actual stocks. By understanding the intricacies of futures trading and employing proper risk management strategies, investors can potentially profit from market movements. Remember to always conduct thorough research and analysis before placing any trades.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....