The US stock market agenda is a critical component for investors looking to navigate the complex landscape of the financial markets. In this guide, we delve into the key aspects that shape the US stock market agenda, providing you with the knowledge to make informed decisions.

Market Trends and Analysis

One of the primary focuses of the US stock market agenda is to analyze and predict market trends. This involves examining economic indicators, corporate earnings reports, and global events that can impact stock prices. By understanding these trends, investors can position themselves to capitalize on opportunities and mitigate risks.

For instance, the Federal Reserve's monetary policy decisions have a significant impact on the stock market. When the Fed raises interest rates, it can lead to a decrease in stock prices as borrowing costs increase. Conversely, lower interest rates can stimulate economic growth and drive stock prices higher.

Sector Performance

The US stock market agenda also involves analyzing the performance of different sectors. Each sector, such as technology, healthcare, and finance, has its own unique set of factors that influence its performance. By understanding these factors, investors can identify sectors that are poised for growth or those that may face challenges.

For example, the technology sector has been a major driver of the stock market's growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen significant gains, making the tech sector a key area of focus for many investors.

Company Earnings Reports

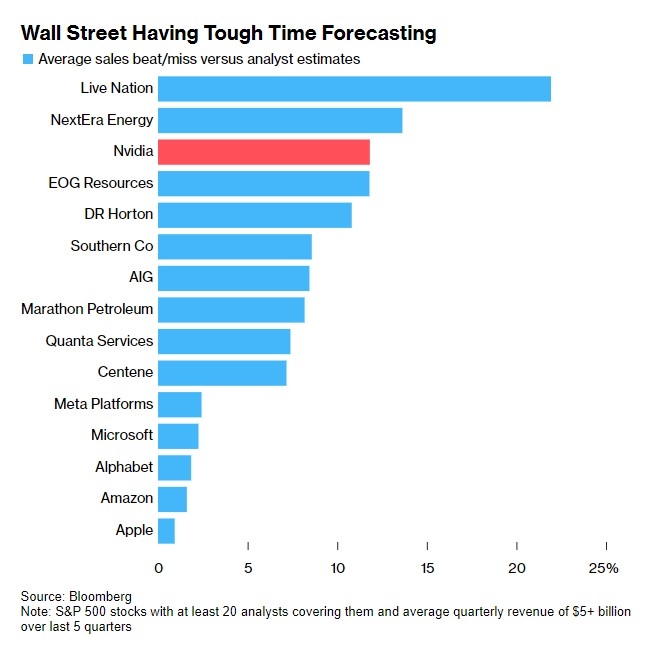

Another crucial aspect of the US stock market agenda is monitoring company earnings reports. These reports provide insights into a company's financial performance, including revenue, earnings, and other key metrics. By analyzing these reports, investors can gauge a company's profitability and growth prospects.

For instance, when a company beats its earnings estimates, it can lead to a surge in its stock price. Conversely, if a company misses its estimates, it can result in a decline in its stock price. Therefore, keeping a close eye on earnings reports is essential for investors looking to stay ahead of the market.

Market Indices and Indicators

The US stock market agenda also includes tracking key market indices and indicators. These indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, provide a snapshot of the overall market's performance. By monitoring these indices, investors can get a sense of the market's direction and make informed decisions.

For example, when the S&P 500 reaches a new all-time high, it can be seen as a positive sign for the market. Conversely, when the index falls, it can indicate a bearish market sentiment.

Case Studies

To illustrate the importance of understanding the US stock market agenda, let's consider a few case studies:

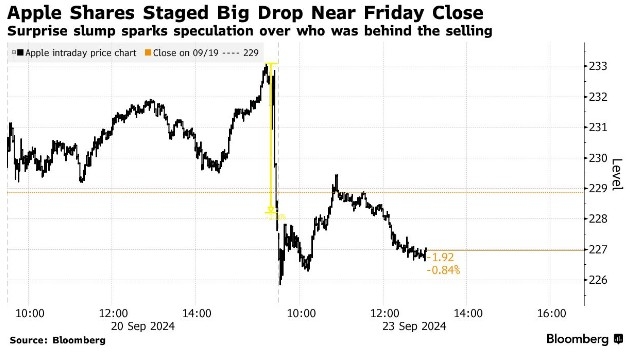

Apple's Stock Surge: In 2020, Apple's stock experienced a significant surge, reaching an all-time high. This was driven by strong earnings reports, increased demand for its products, and a positive outlook from analysts.

Tesla's Market Impact: Tesla has been a major force in the stock market, with its stock price skyrocketing in recent years. This has been attributed to the company's innovative electric vehicle technology and aggressive expansion plans.

Conclusion

Understanding the US stock market agenda is essential for investors looking to succeed in the financial markets. By analyzing market trends, sector performance, company earnings reports, and market indices, investors can make informed decisions and position themselves for success. Keep in mind the case studies mentioned above to better understand the impact of these factors on the market.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....