In the dynamic world of stocks, it's crucial for investors to stay ahead of the curve. One such stock that has been attracting significant attention is HD. In this article, we delve into the details of HD stock, providing you with a comprehensive overview to help you make informed investment decisions.

Understanding the HD Stock Symbol

The symbol "HD" stands for "Home Depot," a leading retail home improvement company in the United States. As a Fortune 500 company, Home Depot has a strong market presence and a well-established reputation for providing high-quality products and exceptional customer service.

Key Factors Influencing HD Stock

Several factors contribute to the performance of HD stock, making it an attractive investment opportunity:

- Revenue Growth: Over the years, Home Depot has consistently demonstrated revenue growth, driven by its expansive product range and strong market demand for home improvement services.

- Profitability: The company has maintained high profitability, with impressive earnings per share growth. This profitability can be attributed to efficient operations and effective cost management strategies.

- Dividend Yield: Home Depot offers a solid dividend yield, making it an attractive option for income-oriented investors.

- Market Position: As a market leader in the home improvement sector, Home Depot has a competitive edge over its rivals. The company's strategic expansion into international markets further enhances its growth potential.

Case Study: Home Depot's Expansion into Mexico

A notable example of Home Depot's expansion strategy is its entry into the Mexican market. In 2019, the company opened its first store in Mexico City, marking a significant milestone in its international growth journey. The decision to enter the Mexican market was driven by the strong demand for home improvement services and the potential for growth in the region.

How to Analyze HD Stock

When analyzing HD stock, it's important to consider the following metrics:

- Price-to-Earnings (P/E) Ratio: The P/E ratio provides a measure of the company's valuation. A lower P/E ratio may indicate that the stock is undervalued.

- Earnings Per Share (EPS) Growth: Consistent EPS growth is a positive sign, indicating that the company's profitability is on an upward trajectory.

- Dividend Yield: As mentioned earlier, the dividend yield is an important factor for income-oriented investors.

Conclusion

In conclusion, HD stock presents a compelling investment opportunity for investors looking to gain exposure to the home improvement sector. With a strong market position, impressive revenue growth, and a solid dividend yield, Home Depot has the potential to deliver long-term returns. As with any investment, it's crucial to conduct thorough research and consider your investment goals before making any decisions.

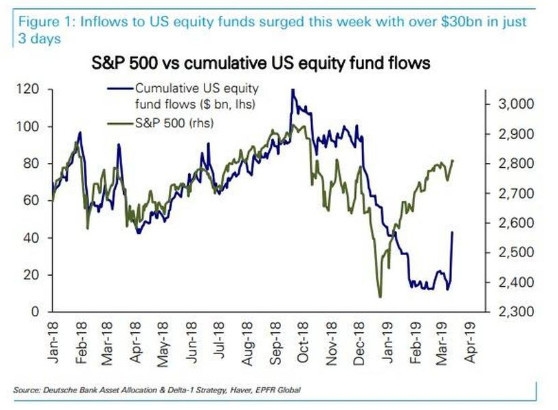

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....