In the ever-evolving world of technology and innovation, SK Innovation has emerged as a significant player. With its US stock market presence, investors are keen to explore the potential of this South Korean giant. This article delves into the key aspects of SK Innovation US stock, providing a comprehensive overview for investors looking to capitalize on this promising opportunity.

Understanding SK Innovation

What is SK Innovation?

SK Innovation is a South Korean multinational company known for its cutting-edge research and development in various sectors, including energy, chemicals, and telecommunications. The company operates through four business units: SK Energy, SK E&S, SK Global Chemical, and SK Telecom. Its diverse portfolio has earned it a reputation as a leader in innovation and technology.

The Importance of SK Innovation US Stock

Investing in SK Innovation US stock offers several advantages. Firstly, it provides exposure to a global market, allowing investors to diversify their portfolios. Secondly, SK Innovation's strong financial performance and commitment to innovation make it an attractive investment option. Lastly, the company's strategic investments in renewable energy and other emerging technologies position it for long-term growth.

Key Factors Influencing SK Innovation US Stock

Several factors influence the performance of SK Innovation US stock. These include:

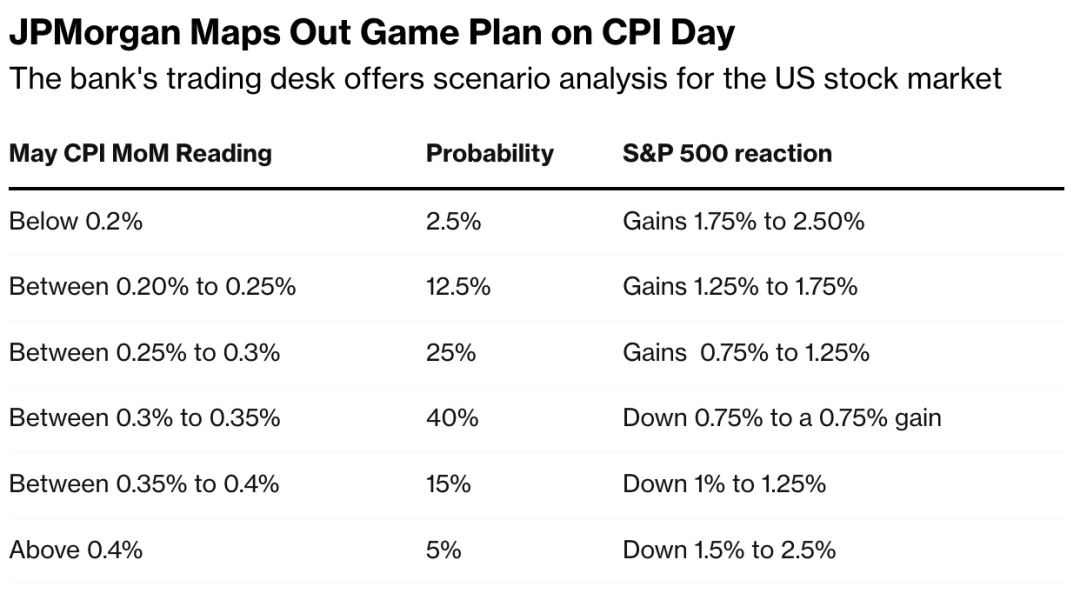

- Market Conditions: Economic factors such as interest rates, inflation, and political instability can impact the stock's value.

- Company Performance: SK Innovation's financial results, including revenue, earnings, and growth prospects, play a crucial role in determining the stock's value.

- Industry Trends: The company's success is closely tied to the performance of the energy, chemicals, and telecommunications industries.

Analyzing SK Innovation's Financial Performance

SK Innovation has demonstrated strong financial performance over the years. Here are some key highlights:

- Revenue Growth: The company has experienced consistent revenue growth, driven by its diverse business units and strategic investments.

- Profitability: SK Innovation has maintained a robust profit margin, showcasing its ability to generate significant returns for investors.

- Dividend Yield: The company offers a competitive dividend yield, providing investors with a steady stream of income.

Case Studies: SK Innovation's Strategic Investments

SK Innovation has made several strategic investments that have contributed to its growth and success. Here are a few notable examples:

- Renewable Energy: The company has invested heavily in renewable energy projects, including solar and wind power. These investments position SK Innovation as a leader in the transition to clean energy.

- Chemical Industry: SK Innovation has made significant investments in the chemical industry, expanding its production capacity and diversifying its product portfolio.

- Telecommunications: SK Telecom, a subsidiary of SK Innovation, has invested in advanced telecommunications technologies, providing high-speed internet and mobile services to millions of customers.

Conclusion

Investing in SK Innovation US stock offers a promising opportunity for investors seeking exposure to a global leader in innovation and technology. With its strong financial performance, strategic investments, and commitment to growth, SK Innovation is well-positioned to deliver long-term returns. As investors explore this exciting investment opportunity, it is crucial to consider the various factors that influence the stock's performance and stay informed about the company's latest developments.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....