Introduction

The election of Donald Trump as the 45th President of the United States in 2016 marked a significant turning point for the US stock market. With his policies and economic agenda, investors were left pondering how the stock market would respond. This article aims to delve into the impact of Trump's presidency on the US stock market, offering a comprehensive analysis of the trends and developments that unfolded over the past four years.

Stock Market Performance During Trump's Presidency

Upon Trump's election, the US stock market experienced a surge in performance. The S&P 500, one of the most widely followed stock market indices, saw a substantial increase in value during his presidency. The index gained over 50% in value from the day Trump was elected to the day he left office, outperforming many other global stock markets.

Tax Cuts and Business Confidence

One of the key policies Trump pushed for was significant tax cuts. In December 2017, Congress passed the Tax Cuts and Jobs Act, which cut corporate tax rates from 35% to 21%. This move was aimed at boosting business confidence and encouraging investment. As a result, the stock market responded positively, with many large companies reporting increased earnings and share prices rising.

Trade Wars and Market Volatility

One of the most notable aspects of Trump's presidency was his aggressive approach to trade. He initiated trade wars with several countries, including China, Mexico, and the European Union. These trade tensions caused market volatility, with investors expressing concerns about the potential impact on the US economy and corporate profits.

Despite the volatility, the stock market ultimately weathered the trade wars. This resilience can be attributed to the strong fundamentals of the US economy, which continued to grow during Trump's presidency. The unemployment rate dropped to its lowest level in decades, and wages began to rise, suggesting a healthy labor market.

Impact of the Pandemic

The COVID-19 pandemic posed a significant challenge to the US stock market and the broader economy. However, the market's initial reaction was surprisingly strong. In the weeks following the pandemic's outbreak, the S&P 500 saw its worst daily decline since the 1987 crash, but it quickly recovered and eventually reached new record highs.

The Federal Reserve's aggressive monetary policy, including interest rate cuts and stimulus measures, played a crucial role in supporting the stock market during this period. Additionally, the government's fiscal response, including the passage of the CARES Act, helped to mitigate the economic impact of the pandemic.

Conclusion

Donald Trump's presidency had a profound impact on the US stock market. While trade tensions and market volatility were prevalent, the stock market ultimately delivered strong returns. This can be attributed to the strong fundamentals of the US economy, as well as the swift and aggressive action taken by policymakers to address the challenges posed by the COVID-19 pandemic.

Case Study: Apple Inc.

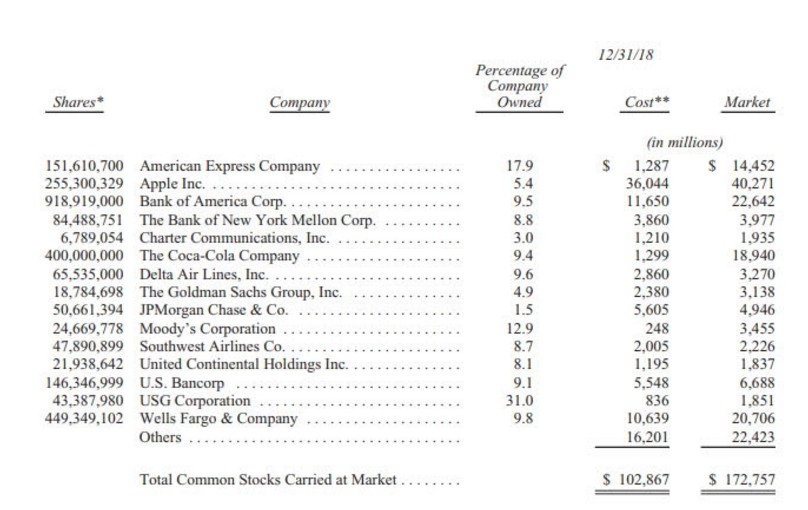

One of the most notable companies to benefit from Trump's presidency was Apple Inc. The tech giant's share price saw a significant increase during Trump's presidency, driven by strong revenue growth and the favorable tax environment. This highlights the broader impact of Trump's policies on the US stock market, as many large companies enjoyed similar benefits.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....